3 reasons why Xero (ASX:XRO) still has significant upside right now

![]() Nick Sundich, December 30, 2024

Nick Sundich, December 30, 2024

Xero (ASX:XRO) is one of the ASX’s best-performing tech stocks over the last decade, offering accounting software helping SMEs do business. Although the company was caught up in the Tech Wreck of 2022, shedding half of its value across that calendar year, it has bounced back with a vengeance in the last 18 months.

Xero (ASX:XRO) share price chart, log scale (Source: TradingView)

Just look at its results and you’ll see why. In FY24 – the 12 months to March 31, 2024 – the company recorded:

- NZ$1.7bn in revenue (up 22%),

- 4.16m subscribers (up 11% and 419,000 from 12 months prior),

- $39.29 in average revenue per user (up 14%)

- An 88% gross margin

- A $174.6m profit (compared to a $113m loss in the year before).

And we think it has significant potential to grow further, and there are good reasons why.

1. Xero is useful and loved by its customers

Xero is all about helping small & medium sized businesses do business. The company, which has over 3 million subscribers, primarily sells accounting software that helps businesses keep books, pay bills and send invoices. But it has gradually developed features useful beyond book-keeping, such as storing files, converting currencies, keeping track of inventories and creating professional quotes.

Clearly, Xero is an essential service to its customers….it’s very hard to switch it off just to save a few bucks. And what incentive is there to switch to another solution like an MYOB? Very little. Whatever few bucks would be saved, would be lost in the long-run. Xero’s tools are estimated to save its customers on average 5.5 hours of manual work per week. We guess that is why its churn is less than 1% and the total lifetime value of subscribers is NZ$15.5bn, even amidst inflation.

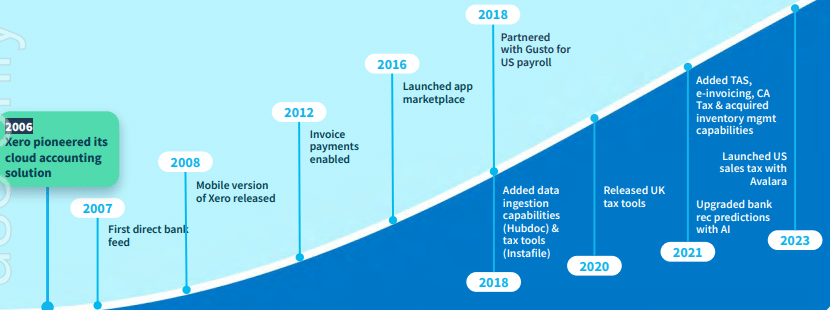

2. Xero keeps innovating and expanding

We touched on this above, but the innovation of the company ensures it remains ahead of its competitors. This is a testament to the company’s leadership.

Source: Company

The company went through a pivotal period with Rod Drury retiring after over 15 years leading the company and the CEO’s seat being taken by Sukhinder Singh Cassidy, who started in February 2023. Clearly investors have had little issue with her so far. One telling sign that the company is moving forward is that Ms Cassidy is based in San Francisco rather than Wellington or Sydney, a sign that it is becoming a truly global player.

Consider that in recent years, its non-ANZ revenues have grown stronger than its ANZ revenues and the average revenue per user has been higher.

3. Still more potential for growth

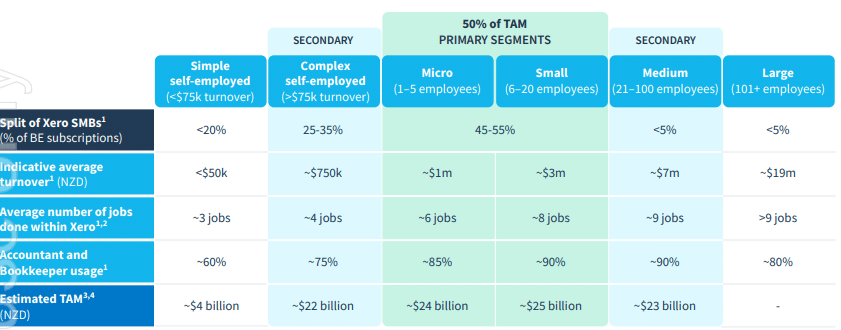

Xero uses the New Zealand financial year, which runs April to March and will be releasing its FY25 results in mid-May 2025. In advance of its previous results, the company held an Investor Day and revealed some more medium term goals. It told investors it believed it had the opportunity to double the size of ‘our business’, alluding to the company’s revenue which was $1.4bn in FY23. It told investors it is still underpenetrated in many markets, even its core segments.

Source: Company

The company believes the TAM (Total Addressable Market) is NZ$100bn and that is just the top 3 jobs its software is used for – Accounting, Payroll and Payments. Adjacent Tasks, including other tasks such as inventory, CRM and project management, could be another $39bn.

OK, so how much will it grow?

So far as specific guidance is concerned, it has only given these points:

- Keeping total operating expenses as a percentage of revenue to around 73%.

- Abiding by Rule of 40. This states that if a SaaS company’s revenue growth rate is added to its profit margin, the combined value should exceed 40%. This was achieved in FY24.

- The goal of doubling revenues by the end of FY27.

Let’s turn to consensus estimates, drawn from 16 analysts. In FY25, analysts expect the company to record NZ$2.0bn in revenue (up 18%) and a $261.5m profit (up 50%). In FY26, $2.36bn in revenue (up 18%) and a $367m profit (up 40%).

Still lots of upside

The mean share price is A$185.37 per share, a 10% premium to the $167.75 share price it closed at on December 24, 2024. Granted, the estimates range from $90.70 on one extreme and $219.38 on the other. The company is trading at 78.7x P/E and 33.6x EV/EBITDA for FY26…quite high.

And let’s look at one of Xero’s biggest bulls, Goldman Sachs. Its target of A$201 per share is drawn from 41x EV/EBITDA for FY26, relative to the 33.6x it is trading at right now. The 40x figure was drawn from a confidential list of peers, although we would observe that fellow WAAAX stock WiseTech (ASX:WTC) is trading at 63x EV/EBITDA right now.

Looking at Xero’s raw valuation, it is A$20bn on an equity value basis. This makes it very big for an ASX stock, particularly a tech one, although it is not irrelevant to note that Intuit in America is worth US$185bn.

Potential risks for Xero investors

We think the biggest potential risks are worsening economic conditions and investor sentiment towards companies that are only just profitable. We do not think competition is a significant risk given the superiority of the platform.

So far as investor sentiment is concerned, we think this problem will disappear as the company is expected to become profitable right about now. And even though a downturn in economic activity is a risk, we think the company will continue to prove itself resilient.

Some investors have been disappointed specifically with the company’s performance in the UK market and fear the poor state of the UK’s economy could mean that Xero continues to disappoint there. Although the UK is easily the company’s second-largest market, only behind Australia, it is responsible for only 26% of subscriber numbers and 27% of revenue. We don’t think this market alone should impact the entire company, barring some doomsday scenario.

Conclusion

In our view, Xero is one of the best companies on the ASX and has good growth potential in the months ahead. We think the next couple of months might present a good entry point, because if the recent reporting season is any guide, stocks that report good results can significantly re-rate – yes, even large caps.

What are the Best ASX Technology Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Apple’s iPhone Production in Focus: Is the Tariff Pause Enough to Ease the Pressure?

Apple, one of the largest and most influential tech companies in the world, is no stranger to the fluctuations of…

Why travel shares are getting slammed…and it is not for the reasons you may think

Just when ASX travel shares were out of the COVID-19 doldrums (in that some surpassed their pre-COVID highs), 2025 looks…

Capital Gains Tax on Stocks: Here’s what you need to know

Investors may be liable to pay Capital Gains Tax on Stocks, but may not know the nuances of how it…