Alterity Therapeutics (ASX:ATH) more than doubled after its Phase 2 results, but its still only $80m

![]() Nick Sundich, February 3, 2025

Nick Sundich, February 3, 2025

Alterity Therapeutics (ASX:ATH) hit the jackpot last week. Any clinical-stage biotech achieving a positive Phase 2 outcome is good news, because it depicts that the company’s drug is not just safe, but that it works too. But while some companies (like Paradigm (ASX:PAR)) are going after markets with existing drugs that need replacement, Alterity is going after a market where there are no competing drugs. And what’s more, is that it may not be as long a path to market as it would usually be for a company at this stage.

Alterity Therapeutics is on to something

Alterity’s drug is ATH434, an orally-administered drug that inhibits alpha-synuclein aggregation and reduces oxidative stress by reducing excess iron across membranes in the CNS – Central Nervous System. It has been in a Phase 2 clinical trial in patients with early-stage multiple system atrophy (MSA). MSA is a neurological disorder that causes people to lose coordination and balance or become slow and stiff as a consequence of detrioration in the brain. It is most likely to start in one’s 50s but can occur in anyone over 30, but occurs in every 3.4-4.9 per 100,000 people. Over 50% will need a wheelchair within 5 years and median survival is 7.5 years after the onset of symptoms.

It can only be definitively diagnosed after death, by analysing brain tissue in an autopsy. You can only suspect it based on symptoms, medical or family history and reasons to treatments. It can be commonly mistaken for Parkinson’s disease, which is similar. Worst of all – there are no approved treatments.

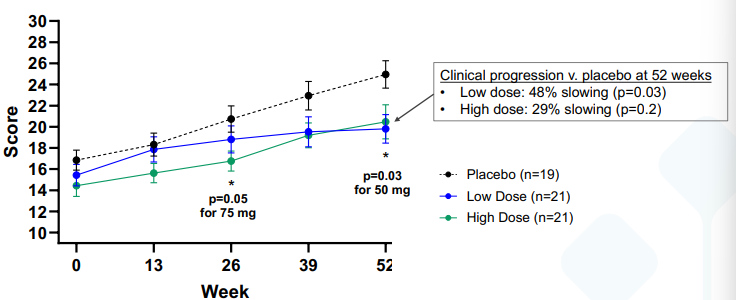

The trial of ATH434 was in 77 early-stage MSA patients over 12 months. Key endpoints were Activities of daily living (UMSARS), global measures, motor exam and autonomic function. Some patients received 75mg, others 50mg, others still a placebo. The UMSARS is a Unified MSA Rating Scale – between 0 and 48 (with the higher being worse). It assessed functional impairment in areas affected in MSA such as speech, swallowing, handwriting, walking, urinary function, hygiene and sexual function.

Alterity released the results and the outcomes were spectacular.

Source: Company

There was a statistically significant improvement with both doses – although the low dose showed a higher proportion of slowing. There was increased activity (as deduced by wearable sensors being worn) as deduced by step count, bouts of walking, total walking time and standing time. And there was also a positive impact on brain iron content and brain volume.

So now what?

Normally, Alterity would proceed to a Phase 3 trial – a step that could take 2-4 years to complete. But in this instance, the company may be able to get accelerated development. ‘Based on the strength of these Phase 2 data, we look forward to engaging with the FDA as quickly as possible to discuss the path forward for accelerating the development of ATH434 given the tremendous unmet need for treating MSA’, CEO David Stamler told investors last week. Although the company did not say it could get the drug approved without a further trial, we would be surprised if this was not part of the company’s discussions with the FDA.

Even if Alterity had to undertake a Phase 3 trial, we still think it is undervalued at a market cap of just A$80m. This is well below comparable companies in Phase 3 trials like Opthea (ASX:OPT) and Dimerix (ASX:DXB). And don’t get us started on the valuation of Neuren (ASX:NEU) – we are not saying Neuren is overvalued, but Alterity still has room to rerate if it makes further progress.

Last week’s news could be just the beginning for this company. Well done to all its shareholders.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Pfizer (NYSE:PFE) shares are still declining post-pandemic! Does the company have a future?

The dream run Pfizer had during the pandemic was not going to last forever. But while certain companies that derived…

The RBNZ is cutting rates again, and here are 5 ASX stocks (based in New Zealand) that could benefit

Last week, we heard that the RBNZ is cutting rates again. If you thought Australia’s economy was not doing well,…

China Stimulus Hope Fades: What It Means for ASX Iron Ore Giants

The Australian mining sector, particularly the iron ore giants, is undergoing a period of uncertainty, marked by the fading hopes…