The ASX 200: Here’s a guide with everything Australian investors need to know

Every stock market has a benchmark indice used to measure the performance of the entire market and the ASX 200 serves that purpose for the Australian bourse. We seek to answer some key questions many new (and some more experienced) investors would have about the ASX 200, including which stocks are in it, how it is determined, how it has performed and is it really a useful guide as to how the entire stock market is going.

What is the ASX 200?

The ASX 200 is Australia’s benchmark indice, measuring the performance of the top 200 stocks as measured by market capitalisation. It is important to note that it has not been a benchmark indice for that long – it only began in 2000 and started pegged to the All Ordinaries (which still exists but has become less prominant). America’s Dow Jones indice was founded in 1885, by way of comparison.

How does it work?

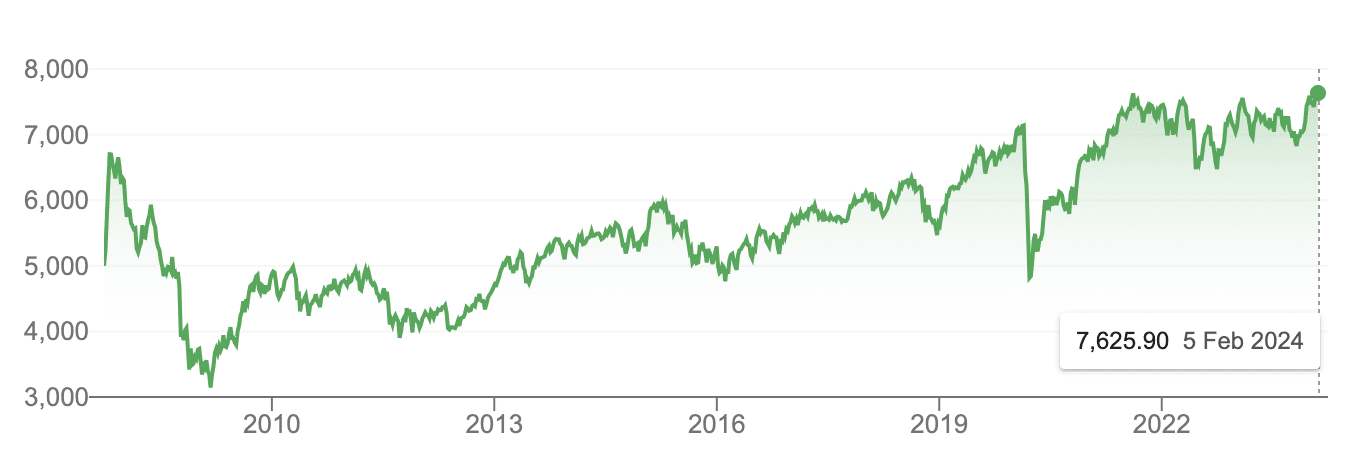

Like all indices, the ASX 200 will either go up or down as investors buy and sell shares in constituent companies and the share prices move accordingly. The movements are expressed in points and it began with 3,133.3 back in 2000. Because it tracks the top 200 companies, it can be used as a mechanism for viewing how the market is going.

There are also 15 sub-indices for each sector on the ASX that can be used as a more useful measure for how a sector is going – such as Banking stocks or Mining stocks. This is in addition to other indices such as the All Ords, Small Ords and ASX All Technology Index.

What stocks are in the ASX 200 and how are they determined?

The composition of the ASX 200 is determined by a complex methodology managed by Standard & Poor’s (S&P), which involves reviewing the company’s liquidity, market capitalization, and its listing on the ASX. Liquidity is measured by the volume and frequency of shares traded, ensuring that the index only includes companies with high investor engagement.

Market capitalization is reassessed to maintain a focus on the 200 largest and most influential companies. These constituents are reviewed quarterly to ensure the index remains up-to-date with the changing landscape of the Australian corporate sector.

All ASX indices, including the ASX 200, are rebalanced every quarter. There are several sites that can provide a full list, our favourite is Market Screener.

Although stocks get added to and taken out of the index each quarter, there are plenty of companies that are always there including the Big 4 Banks, the major miners (BHP, Rio and Fortescue), tech names including Seek and Carsales, property stocks like Dexus and even some health and industrial stocks.

How has the ASX 200 performed?

As of mid-February 2024, it has gained 1% in the past year and 26% in the last 5 years. Not bad in isolation, although paltry compared to other markets. The S&P 500 has gained 19% and 80% over 1 and 5 year time spans. What is also disappointing to note is that the ASX is barely higher than its pre-GFC peak, while many other markets have gone up multiple times since then – the S&P 500 is up over 500% in that time.

Is it really useful?

Given stocks in the ASX 200 account for the largest 200 companies and over three quarters of trading, of course it is useful as a measure of how the market is going. However, it is not a useful measure of how your stock might go on the day, especially if it is not a constituent of the indice. Whether or not it is a useful measure for how the Australian economy is going is up for debate – one that we would rather not give an opinion on here, except to note that there are other economic measures too such as GDP.

What are the Best ASX Stocks to invest in?

Check our buy/sell tips

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

ASX Lithium Stocks Surge as Prices Triple: Is It Too Late to Buy or Just the Beginning?

ASX lithium stocks rally as prices rebound ASX lithium stocks surged this week, with PLS Group (ASX: PLS) up 8%,…

Lynas (ASX:LYC) Posts 13x Profit Jump But Stock Fades. Is This a Buying Opportunity?

Lynas profits surge, but doubts remain Lynas Rare Earths (ASX: LYC) jumped as much as 5% on Thursday after reporting…

ASX 200 Reporting Season Wrap: 5 Earnings Surprises That Signal Buy Opportunities Heading Into March

ASX 200 reporting season- five stocks the market rewarded The ASX 200 touched a fresh record high of 9,202 this…