The Big Four Banks: Which is the best one for investors in 2024?

![]() Nick Sundich, May 6, 2024

Nick Sundich, May 6, 2024

The so-called Big Four Banks on the ASX are among the ASX’s most prominent companies.

They are capitalised at nearly $400bn collectively, record among the largest profits of any listed company and are renowned for being the most significant dividend payers.

At the same time, they are among the most highly-regulated and scrutinised Australian companies.

So of all the big four banks, which one is the best? Ultimately, we think the answer comes down to an individual investors’ objectives.

First published March 16, 2023. Last updated May 6 2023.

What are the Big Four Banks?

The term ‘Big Four Banks’ alludes to the Commonwealth Bank of Australia (ASX:CBA), Westpac Banking Corporation (ASX:WBC), Australia and New Zealand Banking Group – or ANZ Bank for short – (ASX:ANZ) and National Australia Bank (ASX:NAB).

These banks hold the largest majority of loans and deposits in Australia and all have an ‘oligopoly’ market position. As a result, Australian consumers have a love-hate relationship with them.

There is a lot of debate as to where Macquarie (ASX:MQG) sits. Some argue the term ‘Big 5’ should be used with Macquarie included, especially given it is growing its retail banking business. Others argue its legacy of being an institutional investor first means it belongs in a different class, and for now we’d lean towards the former view.

Which of the Big Four Banks is the biggest?

CBA is the biggest of the Big Four Banks by market capitalisation with ~$190bn as at early May 2024. None of the other Big Banks come close. CBA also has the highest market share in payment terminals and business transaction accounts.

However, NAB is the largest lender with $288bn in loans vs CBA’s $254bn. Furthermore, even where CBA has the largest market share, it faces significant competition.

Although CBA has the largest mortgage lending market, at 25.9%, Westpac is not far behind with 22.5%. ANZ and NAB have just over 14% each.

Conversely, even though NAB is a laggard in home loans, it is easily the largest business lender (hence explaining why it has the largest amount of total loans), notwithstanding it has only a 20% share versus CBA’s 17.7% share.

The state of the market

For the sake of investors that have been living on Planet Mars for the past three years, let’s recap how the big four banks.

The COVID-19 pandemic, and fears that it would cause an economic depression, led to the RBA, the big four banks and their smaller peers cutting interest rates to record lows.

Since May 2022, however, the RBA has delivered more than a dozen consecutive interest rate increases, all passed on by CBA and its peers.

At first glance you might think this will be positive for the big four banks, given higher interest payments as fixed-rate loans revert to the new rates, therefore generating higher earnings.

However, three things should be borne in mind.

First the big four banks are still having to compete for home loan customers as they look for the best deal – potentially offering discounts to incentivise them to refinance with them or just stay.

Second, banks are also hiking deposit rates and this will eat into their profits as well.

And third, it remains to be seen how many of these customers who took out loans at record low rates can cope with such high interest rates.

Remember that the RBA’s cash rate has grown by more than 3%, 50% more than the typical serviceability buffer banks use when considering new applicants. Many banks have gone even further.

The Silicon Valley Bank (SVB) collapse has added a further spanner into the works.

In our view, none of the Big Four Banks are unlikely to be impacted by the direct collapse of the company.

However, if there is a broader economic fallout this could impact the banks.

As of the time we wrote this article, a few days after the collapse and the guarantee of all SVB customers’ money by the Federal Reserve, the impact is uncertain.

The state of each of the Big Four Banks

In the last couple of years, NAB and CBA have been performing better than Westpac and ANZ from many perspectives, especially the share price.

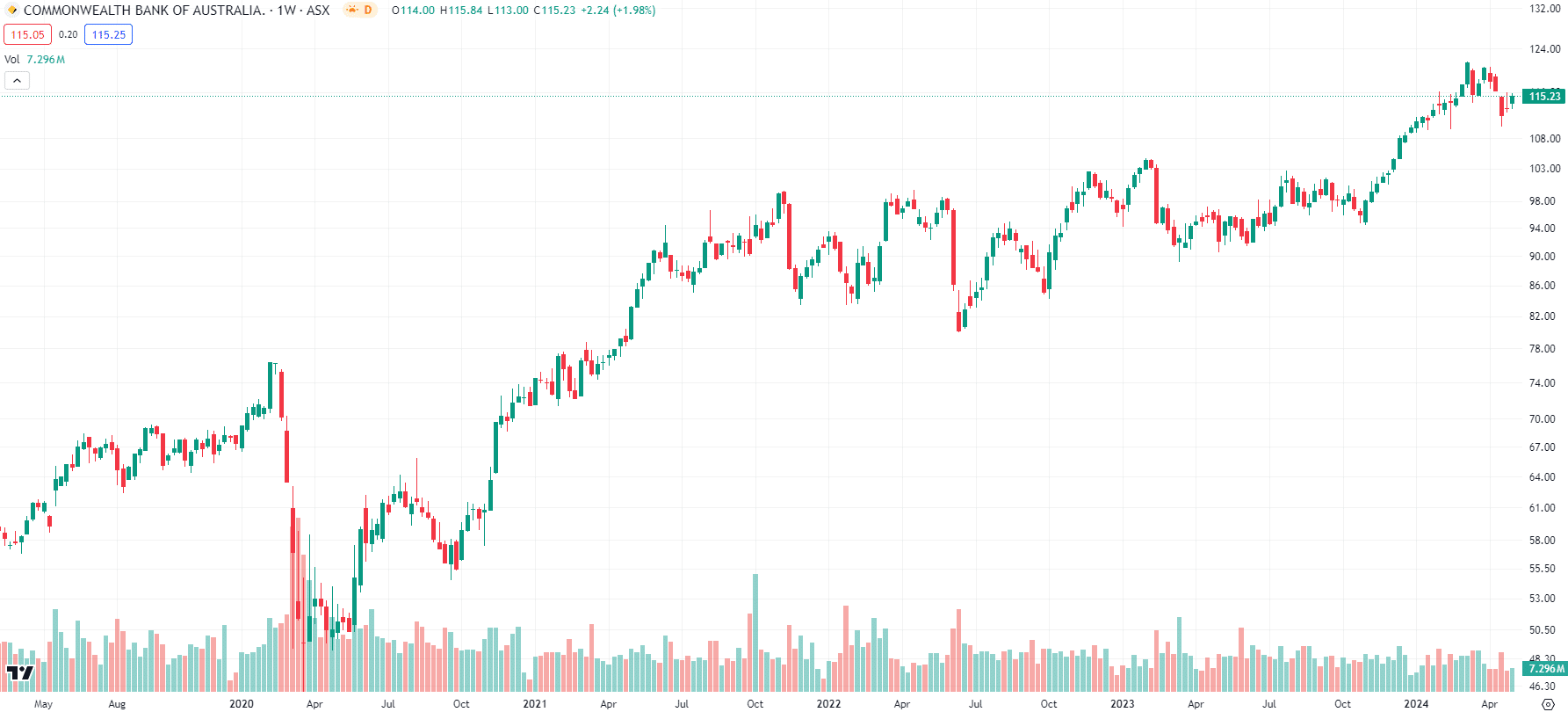

CBA has tended to outperform its peers and it has in the last five years, sitting on a 50%+ gain as of mid-May 2024. NAB is up 33%, ANZ is up 4.4% and Westpac is down 3%.

On a 12-month basis, it is a mixed picture. Westpac is up 21%, ANZ is up 20%, NAB is up 27% and CBA is up 19%. So, despite CBA being the best bank in 5 years and ANZ is the worst in 5 years, ANZ is the best in the last year.

CBA (ASX:CBA) share price chart, log scale (Source: TradingView)

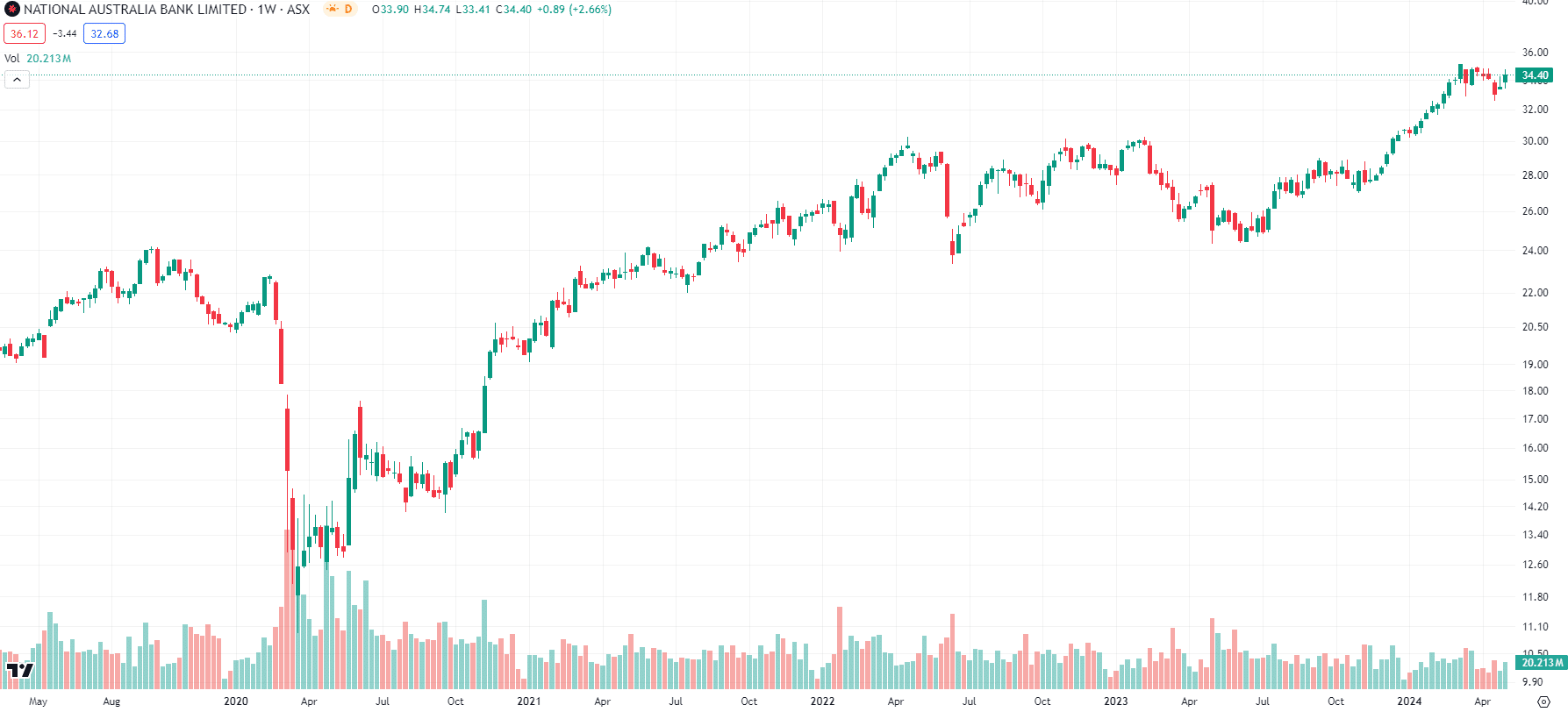

This being said, some of the big banks can have spectacular runs. As a point of example, NAB’s share price more than doubled between the Corona Crash and early February 2023.

NAB (ASX:NAB) share price chart, log scale (Source: TradingView)

Why was this? Because other than CBA, it has been the best performing Big Bank.

After being the most heavily scrutinised during the Royal Commission, it hired Ross McEwan as CEO and it has been able to grow its business banking unit stronger than the competition and returned its home loan unit to growth.

Since then, shares have underperformed, given its high exposure to the home loan lending market.

Meanwhile, Westpac and ANZ have lagged over much of the same time period. Westpac has struggled regain its mojo with investors since its $1bn AUSTRAC fine back in 2020. As for ANZ, it lost ground to its peers due to lagging technology, although things have improved in the last 18 months as it finally launched its ANZ Plus platform.

Which of the Big Four Banks offer the best prospects?

This is a difficult question to answer, because many of the measures we like to use all paint different pictures.

All the banks are expected to see a retreat in EPS and this would inevitably flow to its profit. The bank expected to see the smallest decline is NAB with 1.8% while Westpac is expected to see a 10% retreat.

CBA also boasts of having the highest long-term growth estimate (at 2.3%) as well as inevitably having the highest dividend per share (although not the highest yield).

Nonetheless, CBA is considered overvalued with the median share price a 16% discount to the current price. Only ANZ is considered undervalued by analysts, but even it has just a 4% premium. ANZ also boasts the highest yield – if we assume it will pay 80% of its EPS, this is a yield of 6.92%. Nonetheless, its peers are not far behind – Westpac has 6.34%, NAB has 5.92% and CBA as 4.38%.

So far as multiples are concerned, ANZ has the lowest P/E at 11.61x, followed by Westpac at 12x, NAB at 13.5x and CBA at 18.7x. All banks have high PEG multiples although there is some divergence between the companies – Westpac at 7.9x and ANZ has 13.7x.

It is hardest to say which is the best big bank stock, although it is worth noting that NAB and Westpac not lead any of its peers in any of the aforementioned categories, while CBA and ANZ are evenly split.

Conclusion about the Big Four Banks

In our view, investors looking for the best big bank stock in Australia should make the decision on what they are searching for – long-term growth, dividends or just short-term stability.

Investors wanting short-term stability might be best sticking with CBA, while long-term growth oriented investors might look to ANZ.

Dividend oriented investors may look to CBA because of its track record of paying out the highest dividends, although they may not be the highest yielding.

Ultimately, all investors should examine factors such as financial performance, risk profile, dividends yields and volatility over time. Considering all these factors will provide an indication of which of the Big Four Bank stocks could be most beneficial for you as an individual investor.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…