ASX Palladium stocks: Here’s why you might want to consider them as a long-term investment

![]() Nick Sundich, January 25, 2024

Nick Sundich, January 25, 2024

The cohort of ASX Palladium stocks may not be as substantial as lithium stocks, but they just might be as important to the world’s decarbonisation push. There are not many stocks specialising in this metal, and few have a significant reputation amongst investors right now, but this might be the time to look into them.

What is palladium?

Palladium is a silvery-white transition metal belonging to the platinum group of elements. It was discovered in 1803 by English chemist William Hyde Wollaston and named after the asteroid Pallas, which itself was named after the Greek goddess Athena.

Palladium has numerous industrial applications due to its unique properties. It has a high melting point and is resistant to corrosion, making it ideal for use in catalytic converters, electronics, and dentistry. It is also used in jewellery, making as a cheaper alternative to platinum. In many applications, it is used in conjunction with platinum or is sometimes a competing metal, particularly in respect of catalytic converters.

Why is it worth considering as an investment?

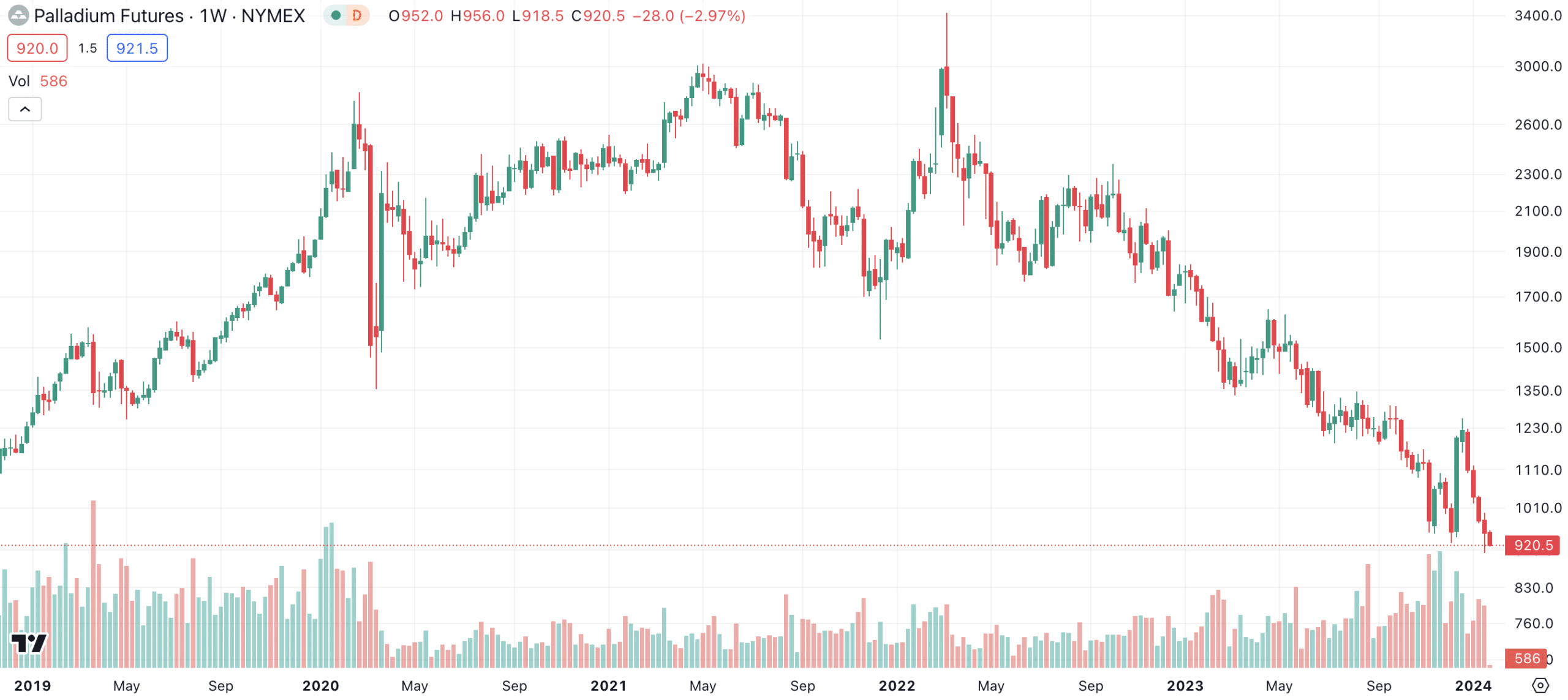

Due to its increasing demand and limited supply, palladium has become an attractive investment opportunity for investors. Prices of the metal have skyrocketed in recent years, with a peak of nearly $3,000 per ounce in March 2022, up from barely $500 just 6 years earlier.

Palladium pricing, log scale (Source: TradingView)

Investors may wish consider stocks exposed to palladium for the potential of high returns in their portfolio. With its diverse range of applications and growing demand, the outlook for this commodity remains strong.

In addition, investing in palladium can provide diversification benefits as it is not closely correlated with other precious metals like gold or silver. This means that even during times of market volatility, the value of this metal may not be affected in the same way as other investments.

Another advantage of investing in palladium stocks is that it allows for indirect exposure to the metal without physically owning it. This can be beneficial for those who do not want to deal with storage or insurance costs associated with owning physical metals.

Risks investors should know about

However, investors should also be aware of the risks associated with investing in this commodity. As with any commodity (or any investment for that matter), there is always a degree of uncertainty and volatility – The price can fluctuate rapidly due to various factors such as changes in supply and demand, economic conditions, and geopolitical events.

As you might have noticed above, prices haven’t gone so well since their 2022 peak, eerily similar to many other battery metals including lithium, nickel and cobalt. The reason they have struggled is because EV sales have slowed compared to 2020-21 levels and as competition ramps up from producers in other countries.

Furthermore, the production of palladium (and other PGE metals) is highly concentrated in a few countries, namely Russia and South Africa. While many commodity supplies from Russia have been cut in the aftermath of the war with Ukraine, palladium has not been one of them. Any disruptions in production or export from these countries can have a significant impact on the commodity’s price.

ASX palladium stocks: What’s out there?

The most famous is Chalice Mining (ASX:CHN) which owns the Julimar deposit in WA. As of July 2023, its Julimar discovery has 560Mt @ 1.7g/t palladium equivalent, equating to 16MOZ of 3E (Palladium, platinum and gold combined). It is a few years away from a Final Investment Decision (FID) and production – expected in 2026 and 2029 respectively. We wouldn’t be surprised to see this project snapped up before that given it is such a monster deposit – the first major PGE-discovery in Australian history.

One company in production is Zimplats (ASX:ZIM) which has operations in Zimbabwe. It made US$1.2bn in 2022 and over 80% of this came from palladium, platinum and rhodium.

Then there’s a few explorers that are aspiring to build the mines of tomorrow. One is Podium Minerals (ASX:POD) with its Parks Reef Project in WA. It has a 6Moz combined resource including 2.9Moz of inferred Platinum. It is located in Western Australia and has a Mining License approved, Native Title granted and Environmental Survey complete.

Another is Southern Palladium (ASX:SPD) which has the Bengwenyama project in South Africa. As of December 2023, this project has an Indicated resource of 5.4Moz 4E (gold, palladium, platinum and rhodium). And this could just be the tip of the iceberg with a further Indicated resource at this mineralisation reef (UG2) and further resources at the other mineralisation reef (Merensky) – between these project as a whole is now 26.22Moz.

Why ASX palladium stocks are worth a look

In conclusion, investors should consider including stocks exposed to palladium in their investment portfolio for potential high returns and diversification benefits. The demand for palladium is expected to continue growing, making it a promising opportunity for investors in the long term. So, stocks specialising in it it can be a valuable addition to an investor’s portfolio.

What are the Best ASX Stocks to invest in?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…

Here’s why drug reimbursement is so important for ASX healthcare stocks

Let’s take a look at the concept of drug reimbursement, something that is crucial for ASX healthcare stocks looking to…