Wesfarmers (ASX:WES): Is it really a safe haven amidst 40-year high inflation?

![]() Nick Sundich, January 29, 2024

Nick Sundich, January 29, 2024

As retailers announced downgrades left right and centre during the cost of living crisis, Wesfarmers (ASX:WES) was an exception. Its shares gained 15% in CY25 and are up 75% in five years. This was no accident. It is has a very diverse revenue mix, with several non-discretionary categories, along with several growth opportunities down the track.

But is it completely immune from turbulence in the economy?

Who is Wesfarmers?

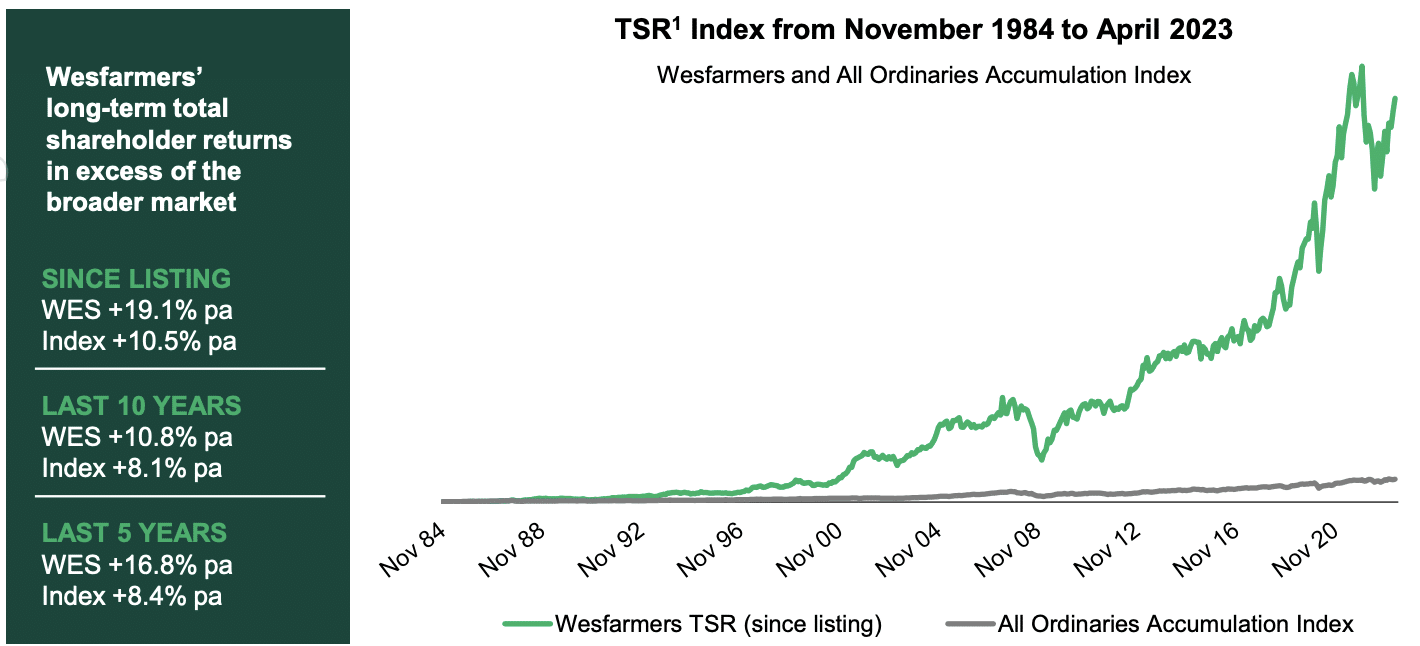

Wesfarmers is a $65bn conglomerate that has interests in retail, industrials, chemical and fertilisers. It was founded as a WA farmers co-op in 1914 and was ASX listed in 1984. Since then, it has an impressive track record of growth that speaks for itself.

Source: Company Investor Presentation May 2023

The company’s most famous holdings include Bunnings, Officeworks, Kmart and Target. But it also hosts a chemicals and fertilisers business, an industrial and safety products business, a joint-venture mining operation at the Mt Holland lithium project in WA, as well as other consumer facing businesses, buying Priceline owner Australian Pharmaceutical Industries (ASX:API) in 2022 and bidding for Silk Lasers (ASX:SLA) last year.

It’s almost a case of what Wesfarmers doesn’t own rather than what it does. A couple of instances include Coles, which was owned between 2007 and 2018 until it was demerged, and insurance broking. But of all these, Bunnings is the biggest earner.

Wesfarmers has a lot going for it

OK, not everything it holds is inflation-proof but plenty of it is. Companies like Baby Bunting (ASX:BBN) have reported that money-strapped consumers are moving to discount retailers. People want lower prices and value in a way they haven’t since the GFC and Wesfarmers may be able to provide it.

The company is continuing to invest in itself, modernising its supply chains with new fulfilment centres. There’s plenty of new initiatives including the rolling out a pets range in Bunnings, the integration of Silk Laser clinics as well as the first sales of lithium concentrate from Mt Holland in early CY24.

It is one of the few companies that was pandemic beneficiary that may not be a loser. It recorded 35% sales growth over the COVID years and has ended up with 13,000 more staff across its retail business alone.

FY23 was a pretty good year

It closed FY23 with $43.6bn in revenue, an impressive 18% higher than the year before. Granted, this was driven to some extent by Wesfarmers Health, although taking this out of the picture still shows 7% growth. The company’s profit came in at $2.5bn, up 5% from the year before, and it paid $1.91 per share in dividends.

ESG investors don’t fret, you’re accounted for too! The company employed nearly 100 more Aboriginal and Torres Strait Islander team members (with 3,689 of them), it reduced Scope 1 and 2 emissions from 1,225.7kt CO2 to 1,196.7kt, it increased the percentage of waste diverted from landfill from 69.6% to 71.6% and maintained having 48% of its board and leadership team as women.

Consensus estimates suggest more of the same in FY24 results with $43.7bn in revenue (up 0.3%) and a flat profit. It is true that few other businesses with exposure to retail will be recording growth this year so stagnation may not be a bad thing. At the same time, there are growth opportunities out there in the resources, tech, health and consumer discretionary sectors.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

But the goings might still get tough

Let’s look back at FY24, the year we are in now. This will be the time where consumers feeling the pinch and Wesfarmers will be too. Even if Wesfarmers doesn’t see a slowdown in sales, it might see falling margins. When the Fair Work handed down a 5.75% pay rise to workers on the minimum wage, CEO Rob Scott publicly warned that it would undermine investment.

Are Wesfarmers unfairly crying poor? We don’t think so. But it is inevitable that wages will rise and labour costs represent the highest cost to retailers. Indeed, it agreed to provide a 10.5% pay rise to its 40,000 Bunnings employees over 3 years including 4.5% in 2023.

And keep in mind that labour costs don’t begin and end with wages paid. Lower productivity since the pandemic – due to labour shortages, working from home and absenteeism – have been additional costs. Workplace regulations in Canberra and payroll taxes in Victoria will hurt too.

Turning to the non-consumer side of Wesfarmers, it may suffer from falling chemical and fertiliser prices. Ultimately, it may still be better off than many of its smaller peers because it is a price maker rather than a price taker. In other words, it has more pricing power given its market position.

Overpriced?

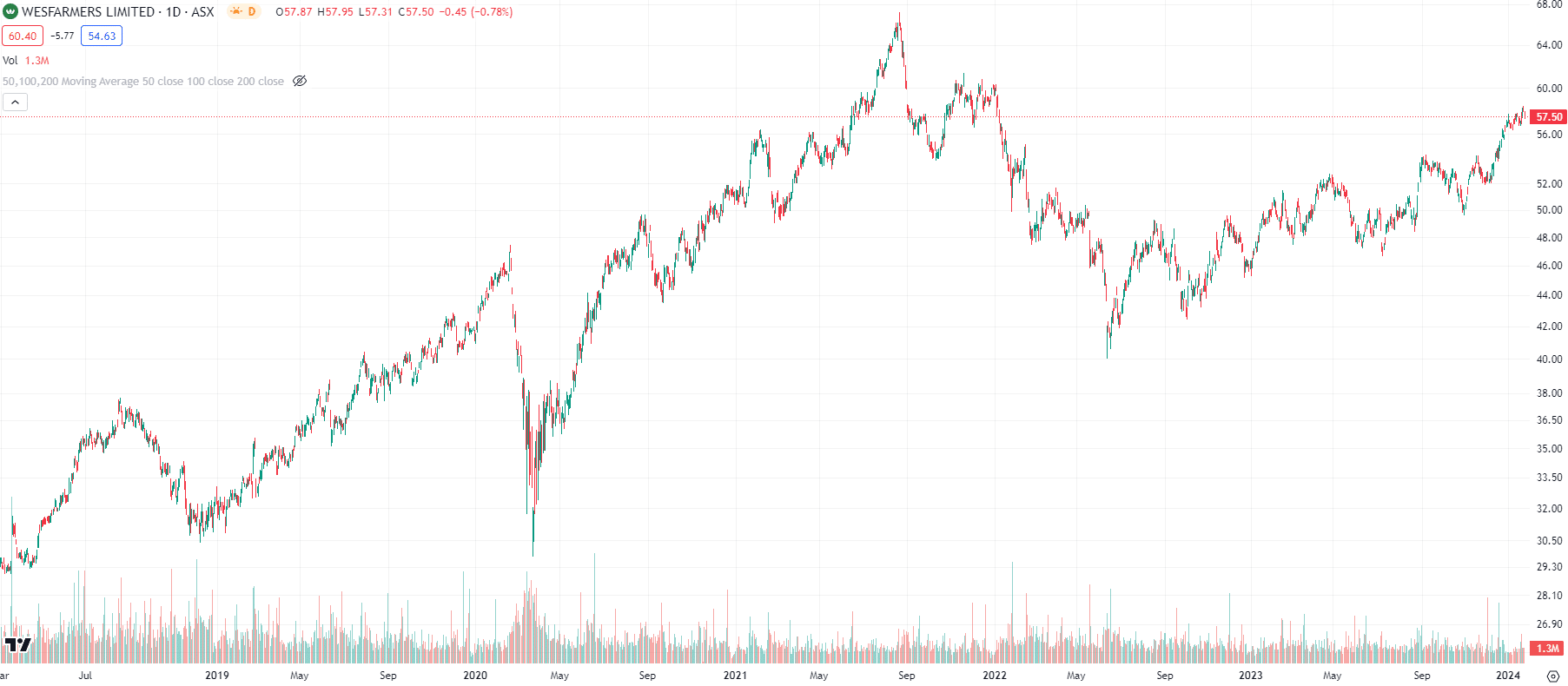

There are 14 analysts covering Wesfarmers and the mean target price is $52.34, 9% lower than the closing price on January 24, 2024.

Wesfarmers (ASX:WES) share price chart, log scale (Source: TradingView)

Granted, there is a significant divergence of opinions among the analysts – the lowest price is $42 but the highest is $62.90. Let’s turn to Wesfarmers’ multiples. For FY24, it is trading at an EV/EBITDA of 13.4x and a P/E of 26.4x. The company’s PEG multiple is 3.57 (using a 6.15% long-term growth rate) which suggests it is overpriced relative to its growth. The average ASX 200 P/E is 15.4x, which also suggests Wesfarmers is overpriced.

Maybe you’re getting what you pay for considering you’re clearly not going to get a 10-20% plunge in sales and/or profits.

So is Wesfarmers a safe haven?

If you’re looking for a retail stock where you won’t see a fall in sales, yes Wesfarmers is a safe haven. But if you are looking for a growth stock, this may not be the best option for you. There are better opportunities in the tech and resources spaces (yes even amongst large caps) that represent growth opportunities.

As with any stock, investors looking at Wesfarmers need to consider their personal circumstances, objectives as an investor as well as do further due diligence beyond this article. This being said, hopefully we have given you food for thought to conduct further research.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…

Here’s why drug reimbursement is so important for ASX healthcare stocks

Let’s take a look at the concept of drug reimbursement, something that is crucial for ASX healthcare stocks looking to…