Here are 5 ASX small caps with big name backers

![]() Nick Sundich, December 27, 2023

Nick Sundich, December 27, 2023

There’s nothing like ASX small caps with big name backers, especially when they first join the company. Whether they join as investors, as directors or even just as strategic advisors, they inspire confidence that a company has something special – be it a mineral deposit, a medtech device or a fine piece of technology. Stocks Down Under recaps 5 such companies:

5 ASX small caps with big name backers

Waratah Minerals (ASX:WM1) – Tim Goyder

We’ve written quite about Tim Goyder and his companies before. These include Liontown Resources (ASX:LTR) and Chalice Mining (ASX:CHN), which have been multi-baggers off the back of major discoveries and made him a billionaire – as all explorers dream of.

Goyder also has stakes in DevEx Resources (ASX:DEV) and Strike Energy (ASX:STX) as well as Minerals 260 (ASX:MI6) and Falcon Minerals (ASX:FAL), which are demergers from Liontown and Chalice respectively. You could say business runs in the Goyder family given his cousin Richard is the chairman of Qantas (ASX:QAN) and the AFL.

As we wrote about earlier this month, he has become involved in another company, in NSW-focused explorer Battery Minerals, soon to be Waratah Minerals (ASX:WM1). Goyder and Northern Star boss Stuart Tonkin participated in a $560,000 placement that gave him a 7.3% stake in he company. Tonkin owns 9.89% having already owned just over 5% prior to the deal.

His company recently acquired a project in NSW’s East Lachlan Ford Belt that lies just 14km from Newcrest’s Cadia Valley mine. This is a project that has had some exploration work while in private hands, although mostly for copper rather than gold, and the results do not go deep. An initial exploration campaign is set for January.

4D Medical (ASX:4DX) – Sam Hupert

Sam Hupert is the boss of Pro Medicus (ASX:PME), the company responsible for the Visage software that provides radiologists and clinicians with advanced visualisation capabilities to view multi-dimensional medical images. It has become a near $10bn company off the back of success in the US market.

4D Medical has similar technology, focused on lung imaging and it to is trying to break into the US market. Dr Hupert has actually been involved with this company since late 2019 when it was a pre-IPO company. He is a member of the Advisory Board. Whilst we don’t imagine he would be involved day to day when he has Pro Medicus to run, neither would we think he’d be much further than a phone call away from CEO Andreas Fouras & the board.

Delta Lithium (ASX:DL1) – Chris Ellison

Delta has the Mt Ida Lithium Province & Yinnetharra Lithium Project in Western Australia. The first of these has a resource of 12.7Mt @ 1.2% lithium. The second is at earlier exploration, but has recorded some solid hits of over 1% lithium.

Chris Ellison is involved with Delta in 2 ways. First, his company Mineral Resources is Delta’s largest shareholder with a stake of over 19%. Right behind him is Gina Rinehart with a 12% stake – talk about a good shareholder register. Second, he is on the board as a non-executive chairman.

Why is he interested? Because his company and Delta want to expand their footprint in the Pilbara region, both in respect of gold and lithium.

Lithium Universe (ASX:LU7) – Patrick Scallan

Lithium Universe is one of the Australian bourse’s newer lithium stocks. It has projects in the James Bay & Red Lake districts, including the Apollo lithium project that is less than 30km away from Patriot Battery Metals’ (ASX:PMT) 109.2Mt at 1.42% resource and Winsome Resources’ (ASX:WR1) Adina property.

Sitting on the board of the company is Patrick Scallan, whose resume includes 25 years of management experience in the lithium industry at Greenbushes, the world’s largest lithium hard rock mine. Over 25 years, it expanded from a 200kt annual output to 1.4Mt today.

‘I see a real opportunity for LU7 to develop a value-added strategy in Québec that meets the Canadian government’s likely requirement for the downstream processing of lithium minerals,’ he declared in August.

Tivan (ASX:TVN) – Guy Debelle

Guy Debelle is probably best known for his stint as an RBA Board member, although served on the board of Fortescue Future Industries for a while before departing at the end of August. He was one of three executives to depart in a matter of weeks and although he publicly denied it was unrelated, shareholders will have reasonable suspicions to the contrary for a while. We’re not making comments regarding our own personal views about those suspicions here about that here.

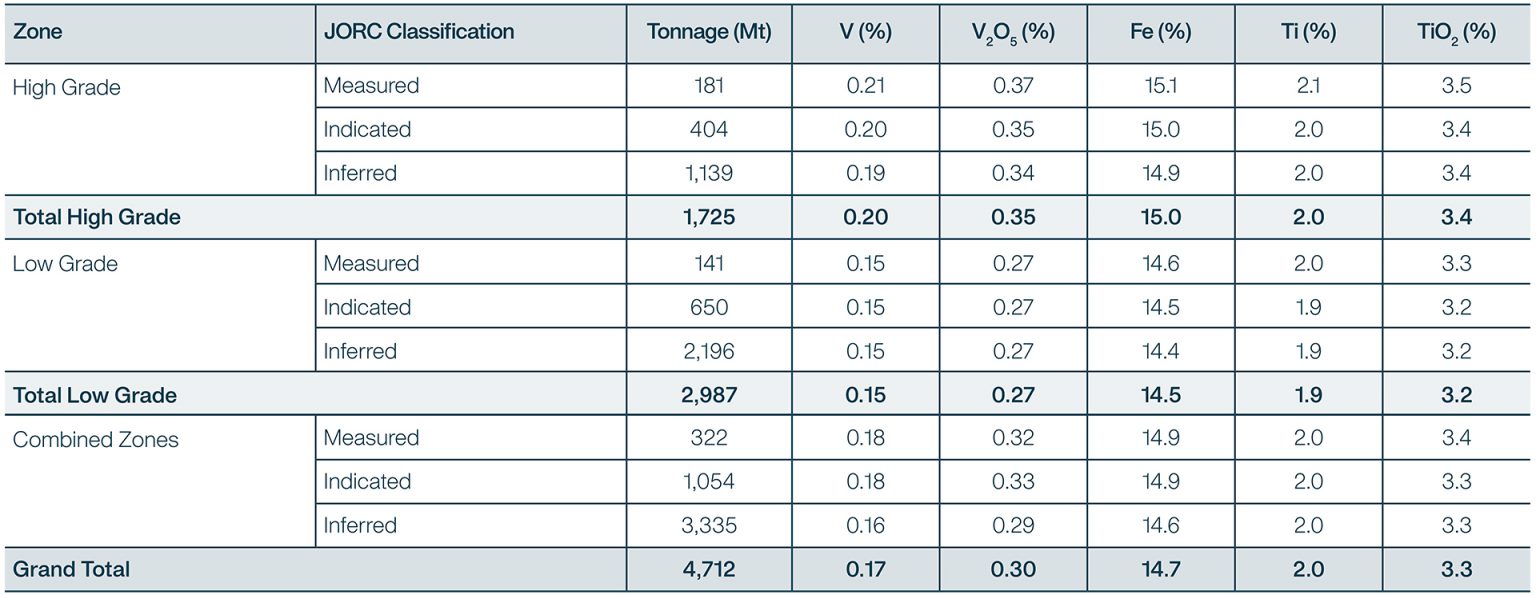

But what we will say is that Fortescue’s loss is Tivan’s gain. Debelle joined the board as a non-executive director and chipped A$25,000 into the company. Tivan’s flagship project is the Speewah project which is the largest, high grade vanadium in titanomagnetite resource on the planet.

Source: Company

Tivan remains a minnow compared to Fortescue, although the gap could ever so slowly begin to close if iron ore prices remain off their 2021 highs, and the company brings this project closer to production.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

The $3m super tax is coming! If you’re invested in equities, here is how it might impact you

It seems during the next 3 years, the $3m super tax will be officially a thing. Itwas blocked by the…

Northern Star Resources (ASX:NST): The $28bn gold miner that stands above them all

Northern Star Resources (ASX:NST) is by far the largest gold company on the ASX, capped at $28bn as of May…

6 ASX stocks you forgot were listed

Here are 6 ASX stocks you forgot were listed Brisbane Broncos (ASX:BBL) No it is not a mistake. This…