Atturra (ASX:ATA): With a $53bn market opportunity, is this Australia’s next big tech star?

![]() Nick Sundich, April 10, 2025

Nick Sundich, April 10, 2025

As a company that listed in 2021, Atturra (ASX:ATA) has performed much better than many would have thought. While many other IPOs during that year (the last of low interest rates worldwide) have crashed and burned, the opposite has been true of this company that listed with an ~$100m IPO and has nearly tripled since then. And there are good reasons it has done so well.

Why Atturra is compelling

Atturra (ASX: ATA) is a provider of end-to-end IT solutions, including data and integration services, advisory and consulting, cloud services and business application services, such as Enterprise Resource Planning Solutions. And all these are delivered to clients as a single holistic solution that can be flexibly integrated into their digital environment. The solutions help clients ensure their IT systems are up to date and will get the job done.

Atturra came to be in 2015 as part of a ‘roll up’ of five individual IT services brands. Over the next few years, it completed further acquisitions and rebranded itself before listing on the ASX. It boasts many client segments including government, education, defence, financial planning and utilities. Many of these are sticky customers that need these services, and also have specific requirements that make them difficult for smaller players to serve.

IT services is a lucrative space to be in. Global spending on IT is expected to total US$5.6tn in 2025, according to Gartner, which would represent 9.8% growth from 2025. IT services specifically is forecast to be $1.73tn, 9% up from $1.59tn in 2024. Specifically in Australia, IT spending is expected to be A$147bn in 2025, up 8.7% from 2024, driven by increased spending in cybersecurity, cloud and generative AI. IT services spending is expected to be $53.4bn in 2025, up 7.2%.

Just look at the list of client wins during FY24: The Seventh-day Adventist Church, Alliance Partners, Edward River Council, VetPartners and Ascham School. Specific examples of products include an ePlanning portfal for councils to manage Development Applications (DA Online), a Student Information System (Scholarion) and a cloud platform (named Atturra).

Progress made, and more to come

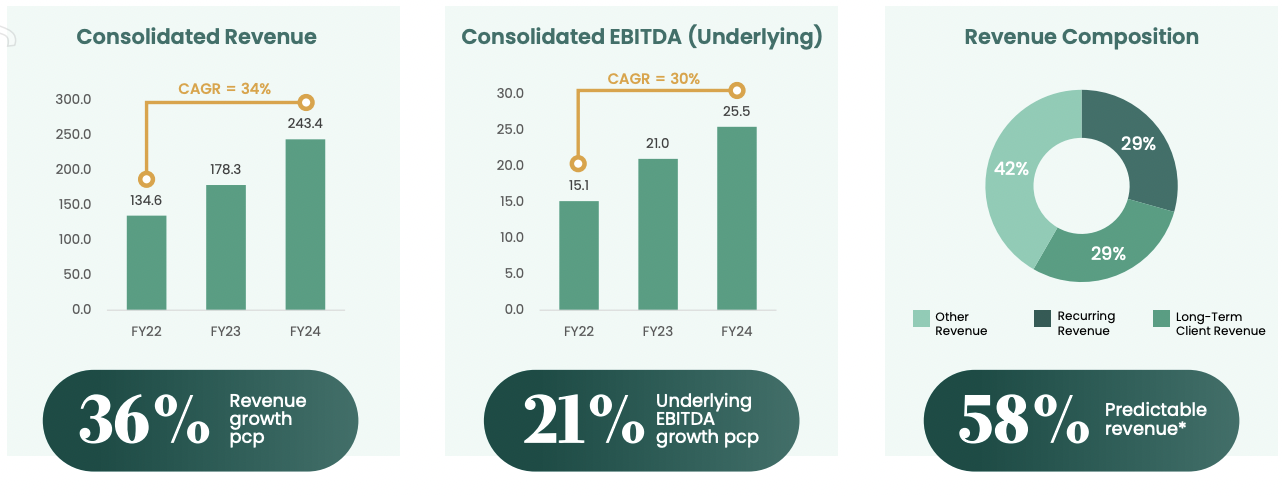

In FY21, Atturra made $98.3m in revenue, $8.4m EBIT and a $5.6m NPAT. 3 years later, in FY24, the company made $243.4m revenue, $25.5m EBITDA and a $16.3m profit. The company’s target is >20% revenue growth and >10.5% underlying EBITDA growth per annum and it has consistently exceeded its targets since it listed. To this end, it has guided to $292m revenue and $30m underlying EBITDA in FY25.

Source: Company

Since 2021, it has expanded both organically (in Australia and overseas) and through M&A activity. It has had particularly strong growth in education with a 121% CAGR since FY21. The challenge when pursuing an M&A-heavy strategy is still being able to grow organically and convincing investors of that. This is something not all companies can do, just ask DGL (ASX:DGL).

Where Atturra has succeeded is making takeovers that increased its capabilities and allowed it to offer complementary services. One of the most noteworthy since listing was the December 2023 takeover of former ASX-listee Cirrus Networks. In FY25, the company made a few purchases including ComActivity, a company that offers enterprise resource planning (ERP) solutions for the manufacturing industry.

The purchases have caused the company to update its guidance to $305-320m revenue and $31-34m EBITDA. Both are upgrades to previous guidance.

A chance to buy a good company at a discounted price

The market rout has spread to this company, but the rout could provide a chance to buy a good company. Analysts have mean target price of $1.09, well up from the $0.72 per share it closed at Black Monday. They believe they company can reach its guidance in FY25, then hit $371.2m in revenue and $38.5m in EBITDA for FY26, then hit $408.7m in revenue and $42.5m EBITDA in FY27.

If the company can achieve this, then we don’t imagine the current share price will last for long.

What are the Best ASX Stocks to invest in?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

ESG (Economic, Social and Governance) investing in 2025: Here’s an investor’s ultimate guide

ESG has become one of the most popular acronyms in the investing world, and a quickly growing trend. Few investors…

Its been 3 years since Block shares listed on the ASX: Can it boost to new heights in 2025?

The Afterpay acquisition was not just noteworthy because it was the biggest corporate takeover in Australian history, but also because…