Australian uranium stocks: Here is why they are set for growth and our 4 favourites

![]() Marc Kennis, February 21, 2024

Marc Kennis, February 21, 2024

Investors should seriously look into Australian uranium stocks. And we’re not just talking all ASX stocks involved in yellowcake, we’re talking about those with projects in Australia.

The uranium pricing upswing is good news for all stocks…

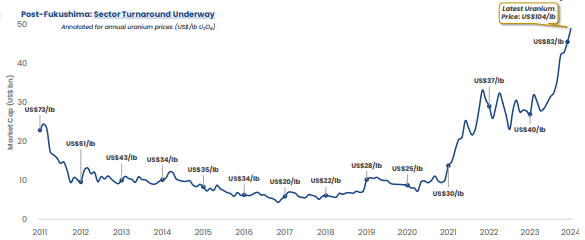

Uranium is a unique commodity with an eclectic range of applications and it seems marketplaces across the globe are catching on. Uranium’s spot price has now surpassed US $100/lb ($153.30) up from $24.60/lb ($37.62) in 2019. Not quite close to its record high of $136/lb ($207.97) in 2007 but potentially getting there.

Source: Deep Yellow Company Presentation

Uranium’s recent upward spiral has primarily occurred as the world becomes cognisant of nuclear energy as a very viable alternative to fossil fuels in the wake of the internationally coordinated effort to reach net zero emissions by 2050.

Nuclear is also becoming more and more promising as a means of bridging the stark divide between advocates for both renewables and fossil fuels and it’s easy to see why. It’s a non-intermittent energy source with low carbon emissions. What’s not to love?

In fact, last year’s COP 28 conference was a historic moment for nuclear energy with an official pledge by 22 countries to triple production by 2050.

…but Australian uranium stocks will particularly benefit

This is because Australia is unique amongst countries with uranium reserves in being geopolitically stable and not having global supply-chain bottlenecks.

Australia’s known uranium reserves are among the world’s largest, almost one third in total according to the World Nuclear Association. It is not however the largest producer, only accounting for 8% in 2022, with 4,087 tonnes. Although Australia has no nuclear power, it all gets exported and all from 2 operating mines: Beverley Four Mile and Olympic Dam in SA. The NT’s Ranger mine closed in 2021.

Australia’s industry has been hit by the pricing downtown but also by the historical negative sentiment around nuclear power. We know those headwinds are gradually becoming tailwinds, as we noted above.

There’s also the reality that uranium mining is considerably more difficult than that of other commodities for a number of reasons.

There are of course the stringent regulatory requirements imposed because of the commodity’s radioactive nature. Deposits also usually have lower concentrations of uranium itself meaning a substantial amount of ore must be mined before enough of the good stuff can be extracted.

But, analysts are already tipping yellowcake to steeply appreciate this year. In January, Citi claimed uranium prices will average US $110/lb ($168.21) in 2025 whilst brokerage firm Shaw and Partners tipped the metal to reach US $150/lb ($229.38) in 2025.

Fund manager Tribeca Investment Partners’ nuclear energy portfolio manager Guy Keller believes these calls are too conservative, predicting uranium prices to jump by around 70% to US $175/lb this year.

Yes, Australian-focused stocks will benefit

But Australia specifically is set to benefit in the way that other major uranium players won’t. Remember that most of the world’s supply is endowed in very geopolitically sensitive areas like Kazakhstan (43%), Russia (5%), Namibia (11%), South Africa (5%) and Niger (4%).

Take the latter of that list for starters.

Niger is the world’s seventh-largest producer of uranium but last year was upset by a coup d’état surrounding the nation’s supply of the stuff.

Then you’ve got the plethora of Western sanctions placed on Russian exports as a result of Vladimir Putin’s Ukrainian crusade. That’s another supplier down.

Kazakhstan’s state-owned uranium producer Kazatomprom has also warned it will likely face serious production issues throughout 2024 and 2025. And another one bites the dust.

Exciting sentiments indeed.

4 Australian uranium stocks to look at

Now let’s have a look at some of who we believe may be the largest potential winners from a continual uranium price hike.

Boss Energy (ASX:BOE) is one to chuck on your radar.

They’ve got their premier initiative—The Honeymoon Project in South Australia—that recommenced in October 2023. In 2013, the project was placed into care and maintenance by the previous owner due to low uranium prices but has kickstarted again under Boss’s watch.

In December 2023, they gave investors another reason to cheer by announcing a contract to supply an unnamed major US publicly-listed power and utility provider over a seven-year period starting in 2025.

Analysts at brokerage firm Bell Potter Securities have forecasted the company to make a net profit of $67.4 million on sales of $152.2 million for the 12 months to June 30, 2025, based on current assumptions of uranium prices in that timeframe.

Boss Energy has also purchased a 30% interest in the Alta Mesa Project from American nuclear power company enCore Energy. The project consists of a mine and nearby processing facility both situated in Alta Mesa, Texas.

The acquisition cements the company’s status as a multi-mine uranium producer.

Alligator Energy (ASX:AGE) is another one we think is worth looking out for. Situated near Whyalla, South Australia, the numbers run on its Samphire Project are solid.

A scoping study for the project uncovered a post-tax NPV of $152m, an IRR of 29% and a payback of 3.5 years. All-in sustaining costs are $US 30.2/lb which will make for very good margins assuming continually appreciating uranium prices.

The company also has a quality leader in Greg Hall, a mining engineer with 24 years experience in uranium mining exploration under his belt.

Third on our list is Toro Energy (ASX:TOE) which also has gold, nickel and base metal tenements, not to mention vanadium at its Wiluna Uranium Project in WA. Wiluna has a JORC Resource of 52MT @ 548ppm for 62.7M pounds. The Lake Maitland deposit alone, just part of the project, has a pre-tax NPV of $610m.

The project has received all federal and state approvals and promises a 17.5 year mine life.

Finally, we have Deep Yellow (ASX:DYL). This company has 2 projects in Namibia, but a couple of others in Australia – the 33Mlb Alligator River project in the NT and the 90Mlb Mulga Rock project in WA. The latter was acquired after it merged with Vimy in 2022, and is the only uranium project in WA to reach ‘substantial commencement’.

We hope we’ve demonstrated that even though all uranium stocks will benefit from the bull market that is only just getting started, there is reason for investors to specifically consider ASX uranium stocks focused on Australia.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

Anthropic Draws a Line With the Pentagon

The AI-First Military Agenda with Anthropic The Pentagon is moving aggressively to bring cutting-edge commercial AI into defence work. A…

88 Energy (ASX:88E) Doubles on Alaska Upside, Here’s What’s Driving It

The Market Just Repriced Alaska Exploration Optionality 88 Energy surged 100% today on the back of a corporate presentation that…

Oil Jumps to US$111 as Hormuz Stays Shut, ASX Slides Hard

The Oil Chokepoint Shock Brent crude jumped 20% to US$111 per barrel, while the ASX 200 fell 3%, with companies…