Australia’s Future Fund: What does Australia’s $290bn sovereign wealth fund invest in?

Let’s take a look at Australia’s Future Fund. Specifically how it grew to A$260bn in Funds Under Management (FUM) (not even counting for other funds the parent company operates other than its namesake flagship fund) and what it is investing in now.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

What are sovereign wealth funds?

First of all, it is important to understand what sovereign wealth funds are because the Future Fund is one of them.

Sovereign wealth funds (SWFs) are state-owned investment funds or entities that manage a country’s reserves for the purpose of generating wealth and financial returns. These funds typically invest in a wide range of assets, including stocks, bonds, real estate, and private equity.

The main goals of SWFs can include:

-

- Stabilisation: Providing a buffer against economic shocks by saving surplus revenues, especially from natural resources.

- Savings for Future Generations: Investing in funds to support future government spending, particularly when dealing with finite resources like oil.

- Diversification: Spreading investments to reduce reliance on domestic economies and to seek higher returns.

- Economic Development: Investing in domestic projects or industries to stimulate growth.

Some of the best known sovereign wealth funds include the Norway Government Pension Fund, the Abu Dhabi Investment Authority, and the China Investment Corporation. They tend not to be open to members of the public, and can be restrictive into what it invests in.

The story of Australia’s Future Fund

It began in 2006 with an initial $60bn injection from the then Howard government. No cash inflows or withdrawals have been made since then and none will be until at least 2026-27. There is a particular list of sectors it does not invest in – generally tobacco companies and those that make military weapons.

These days, there are actually multiple funds – one fund called the future fund that has $224.9bn and there are half a dozen or so funds for specific purposes.

- The Medical Research Future Fund

- Aboriginal and Torres Strait Islander Land and Sea Future Fund

- Future Drought Fund

- Disaster Ready Fund

- DisabilityCare Australia Fund

- Housing Australia Future Fund

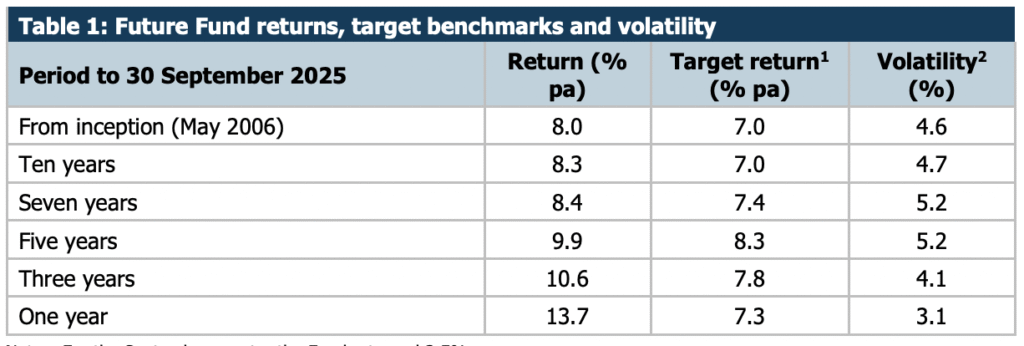

It reports its assets quarterly and these are put out on the ASX Market Announcements Platform even though it is not directly listed. Below are its returns over time.

Source: Future Fund

What does it invest in?

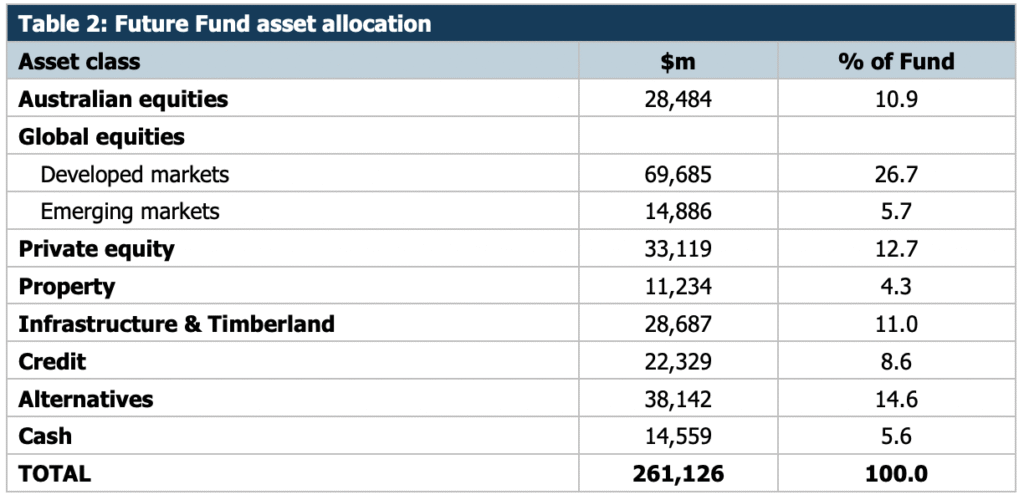

The Future fund invests in a variety of assets, although 43% of it (as of September 30, 2025) is in equities, split across Australian and global equities. A further 12.7% is in private equity. Below is a chart showing the full outline. A year ago, these figures were 37% and 14% respectively.

Source: Future Fund

What specific stocks does it invest in? It doesn’t specifically disclose it – the best way is to see if it votes at a company’s AGM. The most noteable of these was Woodside because it was among nearly 60% of investors who voted against its climate plan last year. According to the ABC, it voted against remuneration reports 18.9% of the time and these included Abacus, Fortescue, AVZ Minerals and Bank of Queensland. It was more protective of AMP, Cleanaway and AGL, having voted against board spill motions at these companies.

Each of the other funds have their own allocations. We would observe that the Medical Research Fund has more than a third $9bn of its $24bn in assets not spent (in other words in Cash). The Aboriginal and Torres Strait Islander Land and Sea Future Fund has ‘Credit’ has 28% in cash, and the next largest allocation is credit with 17.6%.

The fund is currently chaired by former Labor government minister Greg Combet, who recently succeeded Peter Costello. It delivered a 13.7% return in the last 12 months, impressive but small compared to its overall return. It started with A$60.5m in nominal terms and it just surpassed the milestone of $200bn being added over time.

Commenting specifically on the result, CEO Raphael Arndt put it down to the changes made to the portfolio in light of the emerging world. ‘Recent developments show we are continuing to move towards a more multipolar world marked by geostrategic competition, national capability building and technological ambition,’ he said.

‘These conditions suggest higher nominal growth and inflation, but with investment returns dispersed by geography and industry and with the potential for longer-term productivity gains from developments in AI’.

Conclusion

The Future Fund is worth knowing about, and its executives are worth listening to every quarter when the fund reports. It may never rival China or Norway, but it may not be too much longer before it has more prominence on a global stage because of its spectacular performance.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…