Bellevue Gold (ASX:BGL): Meet Australia’s newest gold producer, newly minted in 2024!

![]() Nick Sundich, March 14, 2024

Nick Sundich, March 14, 2024

Bellevue Gold (ASX:BGL) is Australia’s newest gold producer. It has timed its run pretty well given gold prices are booming and achieved quite a feat in actually getting there given the struggles of small-cap explorers, but also given rising inflation that has made it more difficult for aspiring miners to reach their dreams. In the end, this company has made it, and we think there’s more growth to come.

Bellevue Gold’s story

The current company was a tiny shell company known as Draig Resources back in 2016. It bought its namesake project in WA after it had spent 15 years in the hands of Barrick, which had done little work on the project. It had been an operating mine between 1897 and 1997 and produced nearly 1Moz (million ounces) of gold but had appeared to run out of life.

Bellevue Gold was chaired by Ray Shorrocks who bought onboard Steve Parsons, who founded Gyphon Minerals and made a successful M&A exit after finding a 3Moz resource. Tolga Kumova also came onboard as a key investor. The company began a drilling campaign in the last quarter of 2017 and has never looked back, delivering a return of over 5000% to investors.

Bellevue Gold (ASX:BGL) share price chart, log scale (Source: TradingView)

A monster deposit

It has Total Mineral Resources of 9.8Mt at 9.9 g/t for 3.1Moz of gold. 1.7Moz of this is Indicated with the balance inferred. This makes it one of Australia’s highest-grade gold mines. Production has just begun. The company forecasts a 10 year mine life and for $2.1bn of free cash flow, assuming a gold price of A$2,500/oz. This is the stuff dreams are made of.

The company prides itself not just on its ‘rags to riches’ story but how it is fully funded with A$133m in liquidity and has a solid ESG angle. It is aiming for Net Zero by 2026, to be 70-80% renewable energy powered and it has signed appropriate agreements with local Indigenous landholders.

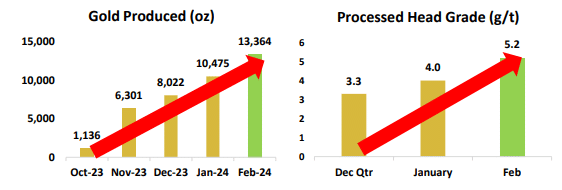

Production began in late October 2023 with the first gold pour. Again, BGL has never looked back. Not just from produced gold, but from a grade perspective.

Source: Company

BGL has issued guidance of 75,000-85,000oz production for the first six months of CY24, along with positive free cash flow, and confirmed earlier this week that it is on track to achieve this. The company has not yet issued cost guidance, but expects to shortly.

How does it compare to other gold stocks?

Bellevue is obviously no large cap miner like Northern Star Resources (ASX:NST) is. Amongst companies that have made major discoveries in the past decade, it stands out in a number of ways – in some respects it is better than De Grey Mining (ASX:DEG), one of the few other companies with a successful discovery. De Grey may have a resource of 5.1Moz and higher annual production (at over 500,000oz) but it is lower grade at 1.5g/t. And De Grey will not be entering production until FY27. Ultimately, during the current gold bull run, it will be easier to profit from gold companies than it otherwise would be, and there is opportunity left in newly minted producers like BGL.

Our valuation

The consensus target price is $1.71, a modest premium to the $1.52 it is trading at right now. The analysts covering the company expect $289.3m in revenue for FY24, $181.3m in EBITDA and 7c EPS – up exponentially from FY23 when there was no production from the project. Then in FY25, $535.4m in revenue (up 85%), $344.3m in EBITDA (up 89%) and 19c EPS (up 171%). It is trading at a 22.4x P/E for FY24, but the sector average is 27x. We therefore think Bellevue Gold is worth $1.89 per share – 24% higher than what it is now.

We acknowledge that sentiment around the gold sector is not hot right now. But keep in mind that there is past precedent for companies to do well if their project is truly a good one – see Gold Road (ASX:GOR) as an example. Also keep in mind that gold prices are currently near A$3,000/oz. Admittedly, this has been in part due to the weak AUD.

But keep in mind that its feasibility studies assumed A$2,500/oz, so it could be on track to make more money than it had originally anticipated. And it’ll be entering production over 3 years before De Grey Mining.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…