BHP wanted to buy Anglo American, but not even A$75bn could get the deal over the line

![]() Nick Sundich, May 30, 2024

Nick Sundich, May 30, 2024

Nearly a month since it was made clear BHP wanted to buy Anglo American, it seems the deal is off. Although a formal offer was never put, BHP put forward a non-binding proposals, the last of which was US$49bn or A$75bn.

Why BHP wanted to buy Anglo American

When it first made its intentions clear, BHP gave several reasons including:

- Economies of scale with Anglo America’s assets and long-term growth potential, combined with BHP’s higher margin assets, growth projects, free cash flows and balance sheet

- The combined company would have far greater commodity diversity with financial capacity to support M&A deals for future projects

- Operational synergies that would come from both mergers.

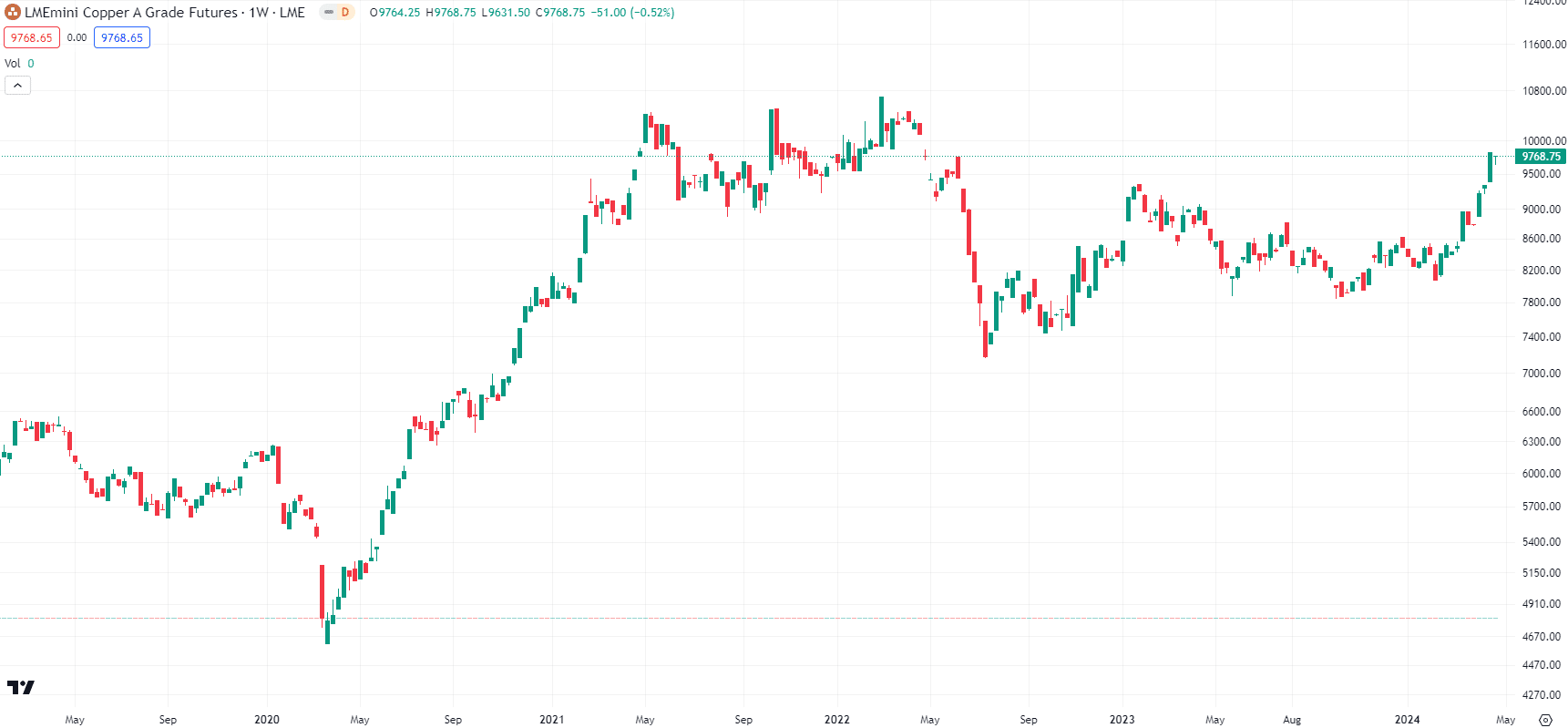

But investors know it is really all about one commodity – copper. Copper is one of the most highly used metals because it conducts electricity well. The average Australian home has 90kg of copper, in wiring pipes and appliances. It occurs naturally in humans, animals and plans, can be mixed with other metals to form alloys, and is one of the most recycled metals in the world. It is a critical metal for EVs, used four times more in EVs than petrol based cars. While many other EV metals, like lithium and nickel, have plunged in recent years, it has not been the case with copper. LME copper prices have risen over 13% this year and are at the highest levels in 2 years.

LME copper price, log scale (Source: TradingView)

Copper demand is set to double

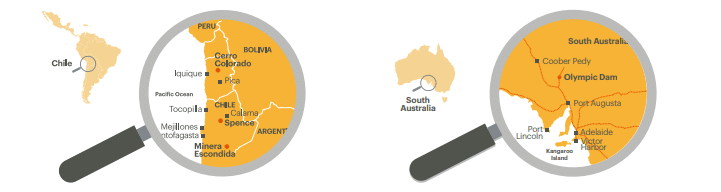

BHP has assets in South Australia and in Chile and produced 1.7Mt of copper in FY23. It is anticipating 1.9Mt production in FY24. But, with copper demand set to double over the next 30 years, it wants even more.

BHP’s copper assets (Source: Company Fact Sheet)

BHP bought Oz Minerals last year for $9.6bn. Anglo American has assets all over the world, on all continents except Antarctica, and taking it over would make it the world’s biggest copper producer, with more mines in Chile and Peru.

What’s more, BHP can buy Anglo American at a slightly discounted price, with its shares having dropped 12% in the 12 months prior to this deal being confirmed. Anglo American is heavily exposed to nickel and price declines led to a fall in profit and consequential cut in its dividend. It wrote down its nickel business as well as its De Beers diamond unit.

The deal was never certain

We now know the deal is not going ahead. As with all deals, it was never going to be a fait accompli. It would have been subject to shareholder and regulatory approval. Not all of them were keen, some of Anglo American’s biggest investors have criticised the deal, including the South African government – specifically the state-owned Public Investment Corporation.

Mining Minister Gwede Mantashe told the Financial Times he was against the plan, noting the country’s previous experience with BHP was not positive. Perhaps another secret reason is because it does not want to see the platinum it mines fall even more out of favour than they are already, with price declines. In fact, the deal is conditional on Anglo American giving up its platinum and iron ore operations. Another investor, Legal & General Investment Management, declared that it undervalues the future prospects of Anglo America. If the deal proceeded it would be a big blow for the UK market, losing such a big company.

So, now it’s off

BHP told its investors on May 29, 2024 that it would not be making a formal offer. ‘While we believed that our proposal for Anglo American was a compelling opportunity to effectively grow the pie of value for both sets of shareholders, we were unable to reach agreement with Anglo American on our specific views in respect of South African regulatory risk and cost and, despite seeking to engage constructively and numerous requests, we were not able to access from Anglo American key information required to formulate measures to address the excess risk they perceive’, the company said. Long story short, Anglo American just wasn’t able to be persuaded, even with the final A$75bn price tag.

Ultimately, even though this deal won’t go ahead, investors should keep their eye out to see what BHP will do with its M&A war chest.

What are the Best ASX Resources Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Here’s why Rich Lister WiseTech boss Richard White ‘stood down’, and how the A$30bn+ cargo software giant may be affected

WiseTech boss Richard White has been viewed as a key reason for his company’s success over its 30-year history and…

Is the S&P 500 Really Doomed to a ‘Lost Decade’? Goldman Sachs thinks so, but will it eventuate?

The term ‘Lost Decade’ gets thrown about a lot, but most recently to the next decade to the S&P 500.…

Halloween Stocks: Here are 5 ASX Stocks that Will Benefit from Halloween

Here are 5 ASX Halloween Stocks! The Reject Shop (ASX:TRS) The Reject Shop is one of Australia’s most notable…