James Hardie (ASX:JHX): Things have turned glum and there could be worse to come, but are fears overblown?

![]() Nick Sundich, May 30, 2024

Nick Sundich, May 30, 2024

James Hardie (ASX:JHX) is one of the companies many would struggle to have sympathy for. It had a tortured history with its asbestos products, and now is struggling with high inflation and subdued demand from aspirant home renovators. But is its recent profit downgrade a one off, or a warning sign of a poor few years ahead?

James Hardie has a tortured history

This company is named after an actual person by that name, a Scottish expat who established a business importing oils and animal hides. In the early 1900s, the business pivoted to a building composite known as fibro-cement. It used asbestos fibres to reinforce cement sheets and was used as a roofing and lining slate. And so, James Hardie became a substantial business, expanding into several building products containing asbestos, as well as mining for it in its own right.

The asbestos ban

From the late 1970s onwards, governments started to ban asbestos as its side effects became known. The Australian government was late to that party, only banning asbestos in 2003. James Hardy had pivoted into non-asbestos building products by this time and now specialises in wall cladding and plasterboard products to builders and renovators. Unfortunately, the company has been paying the asbestos price for sometime, being sued by people that had suffered asbestos injuries. The company ended up redomiciling to Europe, first the Netherlands and then Ireland for tax reason. And it became more successful outside Australia, particularly in the USA. James Hardie was not the only business to be sued for asbestos, but one of the more prominent given it played such a role in the building and construction sector, and because it had known as far back as the late 1950s about the impacts of asbestos.

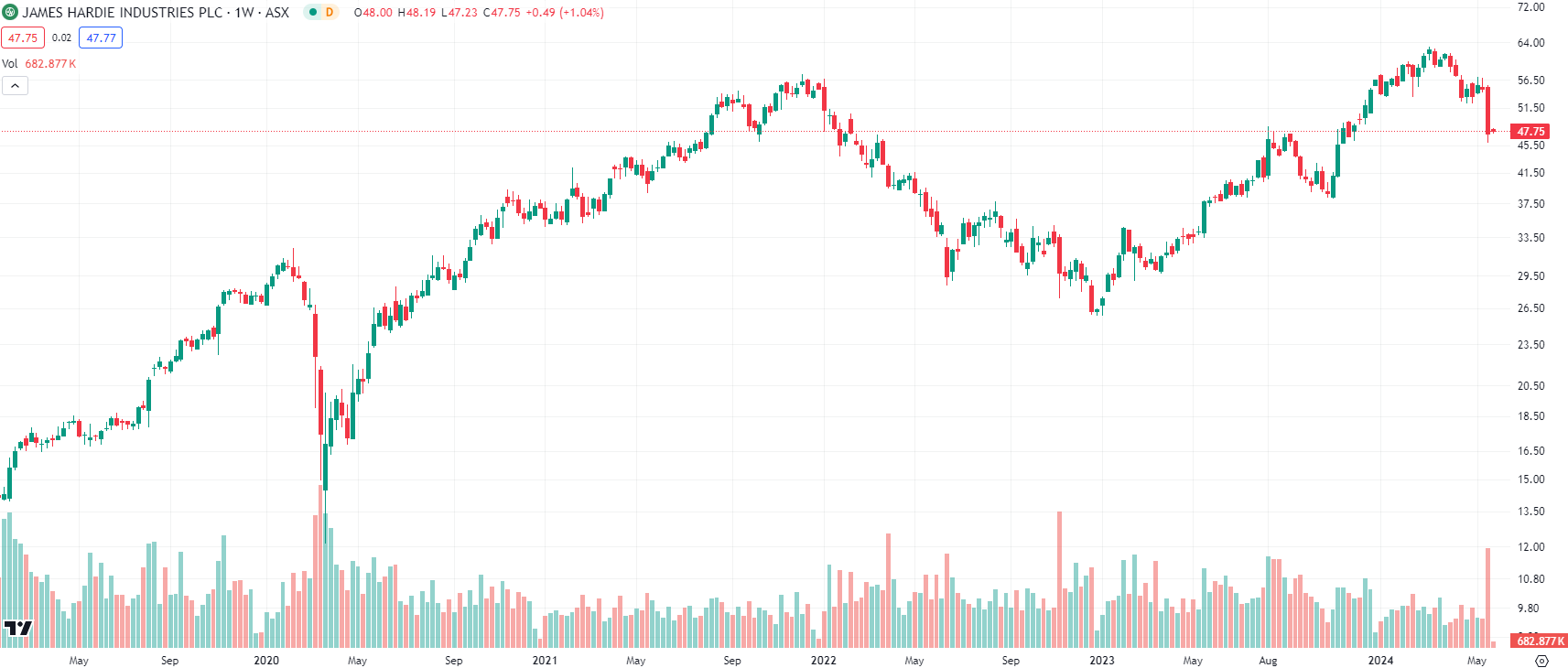

But now onto more recent history. The company rode the wave of the pandemic boom, driven by government stimulus. The past couple of years have been a mixed picture with volatile equity market conditions.

James Hardie (ASX:JHX) share price chart, log scale (Source: TradingView)

An unwanted profit downgrade sours the picture

On Tuesday last week (May 21 2024), James Hardie shares fell 15% in a day when the company forecast that profits would fall. Pandemic era-stimulus was receding, households were putting off plans to renovate given interest rates rose rapidly, and it appears rates will remain high for some time. And while it had raised prices, this only mitigated the damage somewhat, and the company projects volumes in Australia to be down 5%. The US won’t fare as badly, but the market is expected to decline by 2%.

The company uses an April-March financial year and reported record net sales of US$3.9bn (up 4%) and a US$707.5m profit (up 17%) for FY24 (the 12 months to March 31 2024). However, it told investors that its profit for the year ahead (FY25) would be lower, at US$630-700m.

Consensus estimates (drawn from 15 analysts in Australia) expect the higher end of that range, US$690m, but still slightly lower than the year before. But the company is expected to record US$4.1bn in revenue. Looking ahead to FY26, revenue is expected to be higher again at $4.6bn, while the bottom line is forecast to bounce back with a vengeance and reach US$804.5m. The mean target price is A$52.82 per share, up 11% from the current levels.

So should I buy James Hardie shares?

In our view, not right now. We think investors should wait until its next set of quarterly results, due in August, and there is evidence that the company’s bottom line is improving. Because however much revenue grows, it won’t help it margins shrink and there is no sign that things are improving.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…