Breville (ASX:BRG) is brewing up something blissful for 2024, so when should you buy the stock?

![]() Nick Sundich, February 21, 2024

Nick Sundich, February 21, 2024

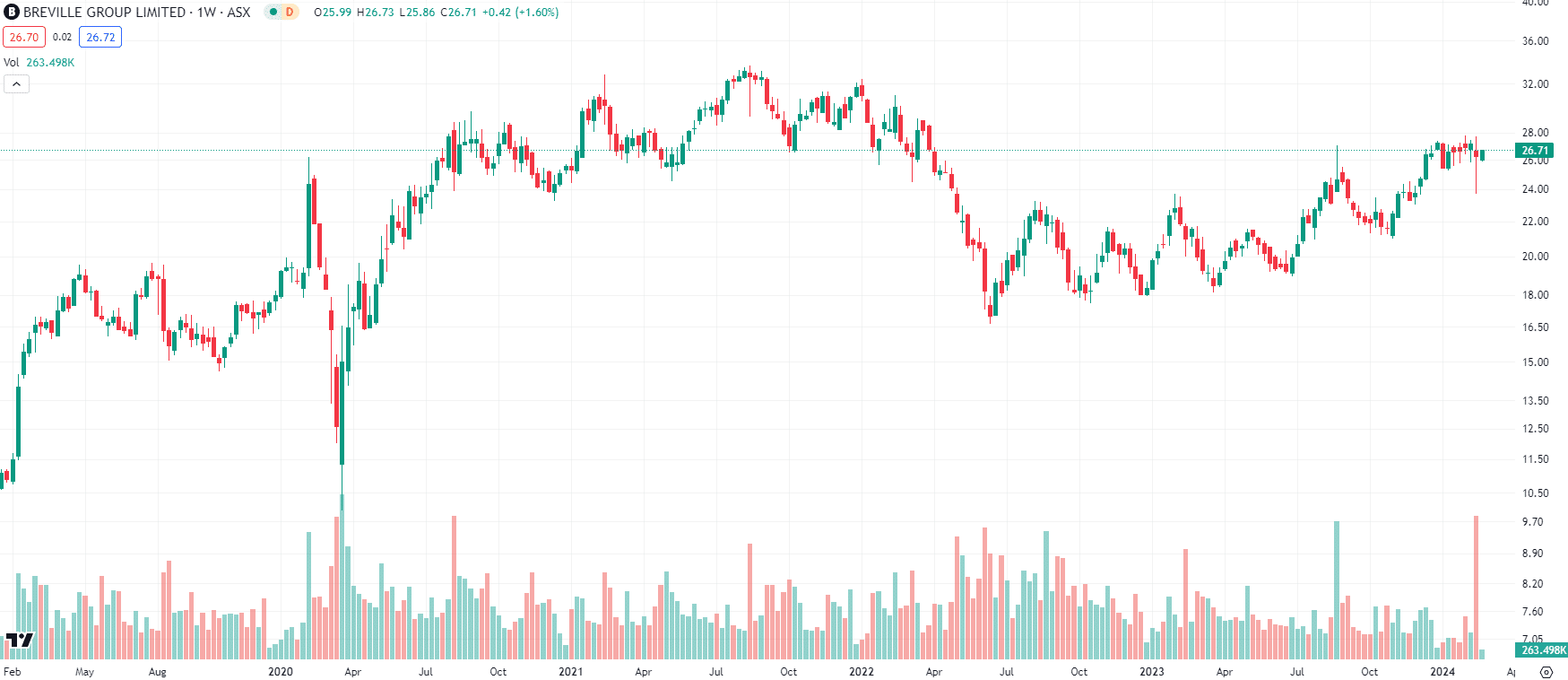

Breville (ASX:BRG) is one of those consumer stocks that has been sold off over fears that it will be hit by inflation…well, it was until investors realised it was not. Despite its 26% gain in the last year, it remains below 2021 highs, and so we think this is a stock that represents an opportunity for investors in 2024.

Who is Breville?

This company is a premium kitchen appliances business with a presence in Australia, Europe and the Americas. It was founded in 1932 – founded from capital obtained from a successful 4-to-1 bet at the 1932 Melbourne Cup.

Breville sells nearly $1.5bn in goods each year in over 100 countries globally and caters to middle to higher income earners. It is headquartered in Sydney, has manufacturing facilities in China and regional offices in key markets.

An example of Breville’s coffee machines

The shares are rangebound

Breville listed in 1999 and has achieved growth of over 2000% since. In the last 10 years, it has gained 200%. In FY23, it generated $1.48bn in revenue (up 4%), $172m in EBIT (up 10%) and a $110.2m NPAT (up 4.2%). It recorded a 35% gross margin. The 4% revenue growth is hardly earth shattering, but follows 3 years of revenue growth of 19-25%.

And it was a fair achievement to be in positive territory, with a strong second half, not to mention how the company recovered inflation and finance costs as well as keeping inventory levels from spiralling out of control. It paid a full year dividend of 30.5c per share, 100% of which was franked.

In 1HY24, it achieved $906m in revenue (up 2%), $131m in EBIT (up 8.2%) and a $84m NPAT (up 6.7%). Breville shares are still down 20% since reaching an all-time high in mid-2021, but have made progress towards recovering lost ground.

Breville (ASX:BRG) share price chart, log scale (Source: TradingView)

Why Breville was sold down

We see three reasons why. First, fears that inflation will impact demand. But if you look at the company’s group-wide results, this has not been the case. However, there was a decline in sales in Europe due to the war in Ukraine, while group sales were buoyed by a solid performance in the Americas. Investors perceived the European decline as more important than American growth given the higher degree of vertical integration between markets in Europe.

Secondly, fears that the company will be hit by cost increases and supply chain issues. Granted, Breville manufactures in China and supply chain disruptions have happened to competitors, such as Whirlpool, KitchenAid and De’Longhi. Still, the company has taken some steps, such as acquiring Italian coffee machine maker Lelit in mid-2022.

Third, the company’s inventory uplift in FY22. Inventories doubled to $445.9m in FY22 to improve stock availability. The company went from a $129.9m net cash position to $4.1m in net debt. Investors have not liked stocks with such significant uplifts in inventory given the potential to over-estimate demand and have to discount to clear inventory – as Kogan (ASX:KGN) had to do during the pandemic. The difference is that Kogan bought inventory anticipating that peak demand would last forever whilst Breville just wanted to keep up with ordinary levels of demand.

What does the future hold?

OK, we see a fourth reason. Because the company hasn’t always provided guidance, and has not been too confident when it has – always noting it is subject to macroeconomic factors. It has only told investors to expect EBIT growth of 5-7.5%, down from 10% growth in the year before.

There are 15 analysts covering Breville and their estimates for FY24 call for $1.53bn in revenue (up 3.6%) and $115m profit (up 4.5%). Looking to FY25, estimates call for $1.6bn in revenue (up 8.5%) and $130.8m profit (up 14%). With these estimates, Breville is trading at 28.6x P/E for FY25. The mean share price target is $25.29, slightly below the current share price. We, however, are more optimistic.

We have built our own DCF model for Breville and we think it is worth $30.33 per share, representing 13% upside from the February 20 intraday price ($26.73). We followed consensus estimates, used a 9.84% WACC (representing a 1.1 beta, a 4.5% risk free rate of return and a 5.5% equity premium, along with a 2% terminal growth rate).

Why we’re confident about Breville

We think there are four reasons why Breville can grow. First, it’s track record of sales growth with 14.6% CAGR in EBIT over the last seven years. While this isn’t a guarantee it can achieve the same results, it does inspire confidence.

Second, the company’s experience in successfully entering new markets. We note that it hasn’t been as active in Asia as an Australian company with a global distribution network probably would be. But it entered South Korea last year and has been successful in doing so. In our conversations with the company, it has noted ambitions to enter further countries in the region. Entering new European countries could be done far easier given its existing network. The company estimates 70% of its revenue potential is unaddressed and it could ultimately achieve $9.7bn in revenue.

A good coffee maker is a must-have for coffee addicts

The third reason is the market the company is in. Breville offers premium and functional goods, targeted at consumers with higher disposable income. It is therefore less likely to be hit by a slowdown in consumer spending, at least to the extent of companies targeting lower incomes. Consumers feeling the pinch might view upfront investments in Breville’s products – coffee machines, ovens and juicers – as saving money in the long run. And consumers already with appliances and needing new ones won’t put off purchasing a new one for too long.

Fourth, we observe that Breville has not had the same supply chain issues other companies have had. Unlike Kogan (ASX:KGN), Breville did not over-invest in new inventories predicting the boom would go on indefinitely. Still, Breville has not been and is not immune. In the US, it has encountered shipping delays in the Los Angeles port delaying the delivery of its goods to US consumers. The company therefore ‘stocked up’ for 1HY23 with the hope of minimising delays as we noted above. Although this met demand and did not leave a glut of inventory, Breville had to enter a net debt position to do this, as we noted above.

One of the best consumer discretionary companies out there

We are bullish on consumer discretionary stocks that have only been sold down due to fears that they will suffer from inflation when in reality there is little to no impact. Breville is one of the best companies in this regard, in our view. Ideally, we buy this stock towards the lower end of the current trading range.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…

Here’s why drug reimbursement is so important for ASX healthcare stocks

Let’s take a look at the concept of drug reimbursement, something that is crucial for ASX healthcare stocks looking to…