Here’s why Kogan (ASX:KGN) should be on your watchlist for FY25

Nick Sundich, February 29, 2024

Kogan shares (ASX:KGN) have been volatile in the past couple of years, but is a better future ahead of it? At first glance, it may not appear a good pick given softening consumer demand, intense competition and negative earnings right now. But the company appears in better shape when you take a deeper dive – arguably even better than it was during the pandemic.

Who is Kogan?

Kogan is an eCommerce retailer, founded in 2006 by Ruslan Kogan. You would likely know Kogan because of its online store. This is indeed the business’ flagship division, but it is more than that. It offers mobile phone plans, insurance, internet and financial services.

Even amidst its eCommerce store it sells its own products and exclusive Brands in addition to products made by third-party companies. Exclusive Brands now account for more than half of Kogan’s gross profit. The company also owns Mighty Ape, an ecommerce retailer in New Zealand, and the eCommerce assets of Dick Smith. And importantly, it has 31 warehouses to meet the demand of its 4.1m active shoppers.

It also has a membership program called Kogan First that is designed to be similar to Amazon Prime. It has more than 400,000 members. Kogan First is the company’s opt-in premium membership service. It is similar to Amazon Prime, offering exclusive deals and perks, such as free shipping and exclusive access to Kogan First Day, one annual day where members get exclusive deals.

Kogan shares dropped back to Square One, but are recovering

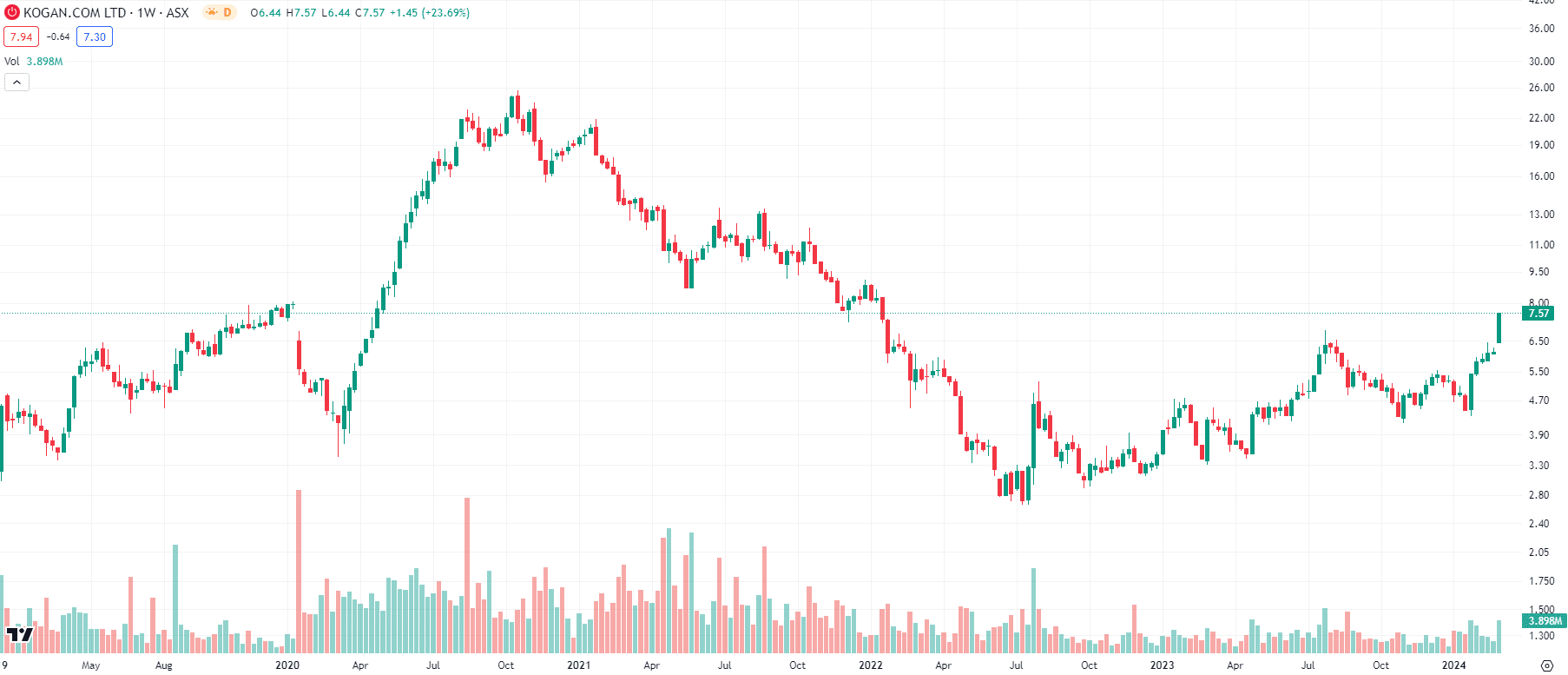

After the Corona Crash, KGN shares increased by nearly 500% in just 7 months as Australian consumers swapped brick-and-mortar stores for online retail. But the shares gave up just about all of these gains over the following 2 years as illustrated in the chart.

A significant number of consumers that shifted online moved back to their regular shopping habits once stores re-opened. Kogan was left with a glut of inventory, having built up its inventory in anticipation that the boom would persist in the medium term and wanting to avoid supply chain disruptions.

Kogan (ASX:KGN) share price chart, log scale (Source: TradingView)

Founders selling down

The drying up of dividends and the selling down of shares by the company’s co-founders haven’t helped the cause either. Co-founders Ruslan Kogan and David Shafer owned 69.5% of Kogan shares in 2016, but barely own 19% between them today. In particular, the company’s namesake sold $114m when the share price was over $20.

In FY22 (the 12 months to 30 June 2022), the company made a $35m statutory loss, down from a ~$3m profit in FY21. Admittedly, both figures were impacted by one-off items, such as disposals of assets and equity-based compensation expenses. But even the adjusted NPAT didn’t paint a rosy picture, falling from $42.9m in FY21 to a $2.9m loss in FY22. Although Kogan’s revenues were ahead of pre-COVID levels, these fell 8% to $718.5m.

Things are getting better

Kogan’s FY23 results did not appear good at first glance. The bottom line (NPAT) was still in negative territory and revenue was down 32% in 12 months. However, there were some positive sign:

- Inventory falling from $159.9m to $68.2m

- Recording $70.9m in operating cash flow

- The net cash balance doubled from $31.2m to $65.4m even with the last Mighty Ape acquisition payment

- Group customers were nearly $3m

- The Loyalty program (Kogan First) surpassed 401,000 subscribers and made $26.3m in revenue, a figure up 70% year on year.

Although the pandemic is long behind us, it is easy to forget that Kogan First was growing even before the pandemic at 12% a year. Kogan was consistently outperforming the market with 20% sales growth per year.

Kicking @ss in FY24 so far!

The 1HY24 results were well received by investors, at least judging by the 20% share price increase on the day it was released. Although gross sales and revenue fell 6% and 10% to $446.6m and $248.2m, this was due to the company’s inventory clearance and pivot to subscription revenue. Gross profit came in 42% higher, at $89.5m, the cash balance grew to $83.3m, and it was NPAT positive, $10.2m on an adjusted basis and $8.7m on a statutory basis.

You might be wondering how a relatively small, local eCommerce company can compete with global giant Amazon. Well, Kogan is in a different space than Amazon, because they are in different product categories. Amazon tends to sell perishables and low-cost apparel products, while Kogan sells consumer electronics and home furnishings. The company has simplified its supply chain so it obtains the goods straight from the manufacturer.

The next 3 years are looking good

There are 7 analysts covering Kogan and they expect $465.7m in revenue (down 5%), $41.3m in EBITDA (up 506%) and a $15.2m profit, up from a $7m loss on a statutory basis and a $25m on a statutory basis. In FY25, they expect $502.3m in revenue (up 8%), $59.4m in EBITDA (up 44%) and $20.2m NPAT (up 33%). In FY26, $535.7m in revenue (up 6%), $67.1m in EBITDA (up 13%) and a $26.3m profit (up 30%).

The company is trading at 11.9x EV/EBITDA and 36.9x P/E for FY25 and 10.5x EV/EBITDA and 29.6x P/E for FY26. The P/E multiples may seem high, but not when you consider its PEG multiple for FY25 is barely over 1.1x and is below 1x for FY26. We think Kogan is worth $9.37 – a ~24% premium to the current share price. We come to this valuation using a DCF model using consensus estimates and a 9.1% WACC.

Kogan is one for the watchlists

We think investors should take a look at Kogan, but hold off buying until just before the FY24 numbers come out. We think the company is headed in the right direction, although there is potential for short-term volatility given the surge after its results.

All things considered, we think Kogan is a company investors should watch closely. It has been through a volatile 3 year period, but we think it is set for a more stable future with consistent growth just like that which it endured prior to the pandemic and will be a better business than otherwise would be the case.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Recent Posts

How do analysts value stocks? Here are 3 key ways to judge what a stock is worth

In this article we answer the question ‘How do analysts value stocks?‘ By knowing how they do it, you can…

Corporate Advisors: What do they do for your stock and are they worth the dazzling fees?

Most small cap ASX stocks will have corporate advisors (one or multiple). At first glance, you may think of them as…