A2 Milk (ASX:A2M) is successfully adjusting to a ‘new normal’ in the China infant formula market

A2 Milk shares have been listed on the ASX for over 10 years, listing in late March 2015 at $2.30 per share. After hitting an all-time high of $20.05 per share, it was downhill for a couple of years, then a period of uncertainty as to where the company was going next. But while there has been a mixture of thick and thin…it’s been mostly thick in the last year.

In this article, we ask why did A2 Milk shares surge so high in the first place, why did shares go so low and what does the future hold?

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

How did A2 Milk shares go so high?

A2 Milk rose in the first place because it had significant success in selling its dairy products (milk and infant formula), particularly in China. China was not just an opportunity because of the population size and its consumption of dairy products (roughly 30 kilograms per year), but because consumers preferred foreign brands. There are local brands, but they have been tainted since a contamination scandal in the 2000s.

In the 12 months to June 2019 (FY19), it recorded NZ$1.3bn in revenue. Although China and the rest of Asia was by no means its largest market (accounting for roughly 31% of revenues), it was growing fast. The company’s sales in Australia and New Zealand only grew by 28% but sales in China and the Asia-Pacific grew by over 74%.

During the Corona Crash, when the ASX 200 fell by >30%, A2 Milk shares actually gained 4% and ultimately reached its all time high in July of 2020. We think there were 4 reasons. First, because it provided essential products so its operations (and therefore revenues) were unaffected by lockdowns. Second, ‘panic buying’ by consumers in all markets. Third, a depreciation of the NZD against the USD which artificially inflated revenues.

Why did A2 Milk shares fall after mid-2020?

As of October 2025, A2 Milk shares have failed to reached their mid-2020 levels in the >5 years years since they peaked, notwithstanding they they are as close as they have been since then (even if more than half the 2020 levels).

Issues bubbling under the service during the early days of the pandemic started to bite the company including supply chain disruptions, diplomatic spats between China and the West and the drying up of the daigou trade (which was a major source of revenue). Daigous are exporters who buy in Australia or New Zealand on order from contracts in China and despatch the goods back to China themselves. Some investors were also concerned about the company’s high marketing budget and perceived low return on it.

Ultimately, the China opportunity was shrinking but there was one factor more important than any other. Namely: China’s falling birth rate. The abolishment of China’s one child policy had done little to encourage couples to have more children. And women were delaying their pregnancies to get vaccinated against COVID-19.

In FY21, the company’s revenue fell 30% to NZ$1.2bn and its net profit fell 79% to NZ$80.7m. This after four guidance downgrades in the preceding 4 months. Ouch for A2 Milk shareholders. This led to shareholder launching multiple class actions against the company.

What about the USA?

Prior to COVID-19, A2 Milk had a presence in the US market but it was just 2.6% of sales in FY19. Obviously, the US has a high population and a big market (at US$4.3bn) but it is a competitive market with local brands dominating. However, a severe shortage in April 2022 led to the Biden administration launching ‘Operation Fly Formula’ – flying infant formula into the country from overseas.

A2 Milk was a little late to the party compared to its peers, thanks to the FDA taking its time to review its application. It first applied in May and heard nothing until August, only hearing then that the FDA was deferring a further review. And keep in mind that there were 160 companies around the world trying to crack this market too, some of which were getting approval faster.

Eventually, A2 received market access in November 2022. But this was only on a temporary basis and gross margins were lower due to higher air freight and rework costs. In 1HY24, it only made NZ$56.8m in the US, not even 10% of the company’s total NZ$812.1m in that period. The company is still pushing for long-term regulatory approval, aspiring for this to happen in FY26.

Big growth in China in FY23 and FY24

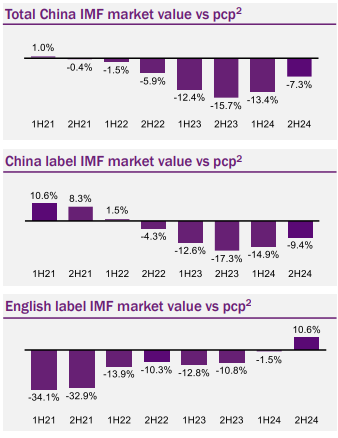

In FY23, the company made NZ$1.6bn in revenue and a $155.6m profit, up 10% and 27%. $1.0bn of its revenue came from China and this rose 38% from FY22. Pleasingly, this occurred despite a decline in the overall IFM market (which includes the daigou trade) and in births. The takeaway from this results was that cost inflation had peaked, and even if the Chinese market stagnates, the company can grow (and is doing so) by taking market share from competitors. Still, the company told investors it expects the number of newborns to grow in CY24 overall.

In FY24, the company delivered $1.68bn revenue and a $167.9m profit, up 5% and 8% respectively. It was at this point when we last wrote about the company and noted investors received a shock when the results were released which put a halt to what had been an impressive run in CY24 up to that point. Investors were told to expect revenue growth of ‘mid-single digit percentage’. This did not stop shares declining on the day the company released its results. Why? We think it was because the company admitted conditions were challenging impacted by the decline in newborns, intense industry competition and tough macroeconomic conditions.

However, the company hung its hat on several facts including that its own market share and that of English-label brands are continuing to grow, with a 3.3% and 17.2% market share respectively. It is now a top 5 brand by market share and the second biggest among English label brands (only trailing Aptamil).

Source: Company

With the daigou trade in Australia all but dead, and even shrinking within China, more than half of A2 Milk’s sales occur through Cross Border E-Commerce (CBEC). It is promoting on platforms including Baidu, TikTok, WeChat and JD and claims these campaigns are bearing fruit. It is entering other Asian markets like Vietnam and Singapore as well. But sales from these markets will pale in comparison to China.

A better FY25?

Shares are up 45% in 12 months and the key inflection points have been its half-yearly and full year results. In 1H25, sales rose by 10% and its profit rose by 19%. Then in the full year, sales rose 13.5% to NZ$1.9bn marking the highest growth in its history. Its net profit was NZ$202.9m, a 21% increase from the year before. Sales in China rose 3.3% and it was amongst the top 4 IMF brands, even with the market contracting. Other key developments included reaping NZ$100m from divesting its stake in Mataura Valley Milk and it bought Yashili NZ’s manufacturing facility for NZ$282m. It guided to ‘high single digit’ revenue growth and a 15-16% EBITDA margin for FY26.

Will the years ahead be better for A2 Milk?

Analysts covering the stock expect NZ$1.9bn in revenue, $300.3m EBITDA (which would be 9.4% growth) and a $210m profit in FY26. For FY27, they expect NZ$2.1bn revenue, $364.1m EBITDA and a $246.6m profit. Then in FY28, $2.3bn revenue, $427.3m EBITDA and a $290m profit.

On the basis of these estimates, A2 Milk is trading at 36.7x P/E and 3.2x PEG for FY26, not cheap in our view. The mean target price on the stock is A$8.61, a discount to the current price, and even the highest estimate of A$10.19 is not that much of a premium.

So, is it time to buy A2 Milk shares?

We think it could be, but investors need to keep in mind a few things. Most importantly that the situation in Chinese market opportunity is improving from what it was a few years ago and never will be again. And also, it will be under pressure to maintain its momentum and meet its guidance.

All things considered, we think this is a solid company that is adjusting to the ‘new normal’ and appears to be successfully doing so right now. The risk is that, with the bar set high, any setbacks could kill investor confidence in the company for good.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Australian Dollar Hits Multi-Year High Against JPY: What’s Driving the Rally and Who Benefits?

Australian dollar jumps against the yen as rate gaps widen The Australian dollar has been on a tear against the…

Copper Surges Past $14,000 to Record Highs: What It Means for ASX Copper Stocks

Copper prices have surged past US$14,000 per tonne this week, reaching a historic peak of US$14,527 on Thursday before profit-taking…

Star Entertainment (ASX:SGR) Drops 16% Despite First EBITDA Profit in Quarters: Buy, Sell, or Wait?

Star Entertainment turns EBITDA positive but survival risks remain Star Entertainment (ASX: SGR) plunged 16 per cent to A$0.14 on…