Luxury fashion retailer Cettire (ASX:CTT) has ~60% upside

Cettire (ASX:CTT) has been a volatile company ever since its late-2020 listing. It is an online luxury goods retailing business currently selling to markets in Australia, the US, the UK.

The company has made a significant retreat from all time highs seen in late-2021. But after bottoming out, the company has been making up lost ground and we think there’s more growth to come.

SIGN UP FOR THE STOCKS DOWN UNDER NEWSLETTER NOW!

Cettire investors have been on a rollercoaster ride

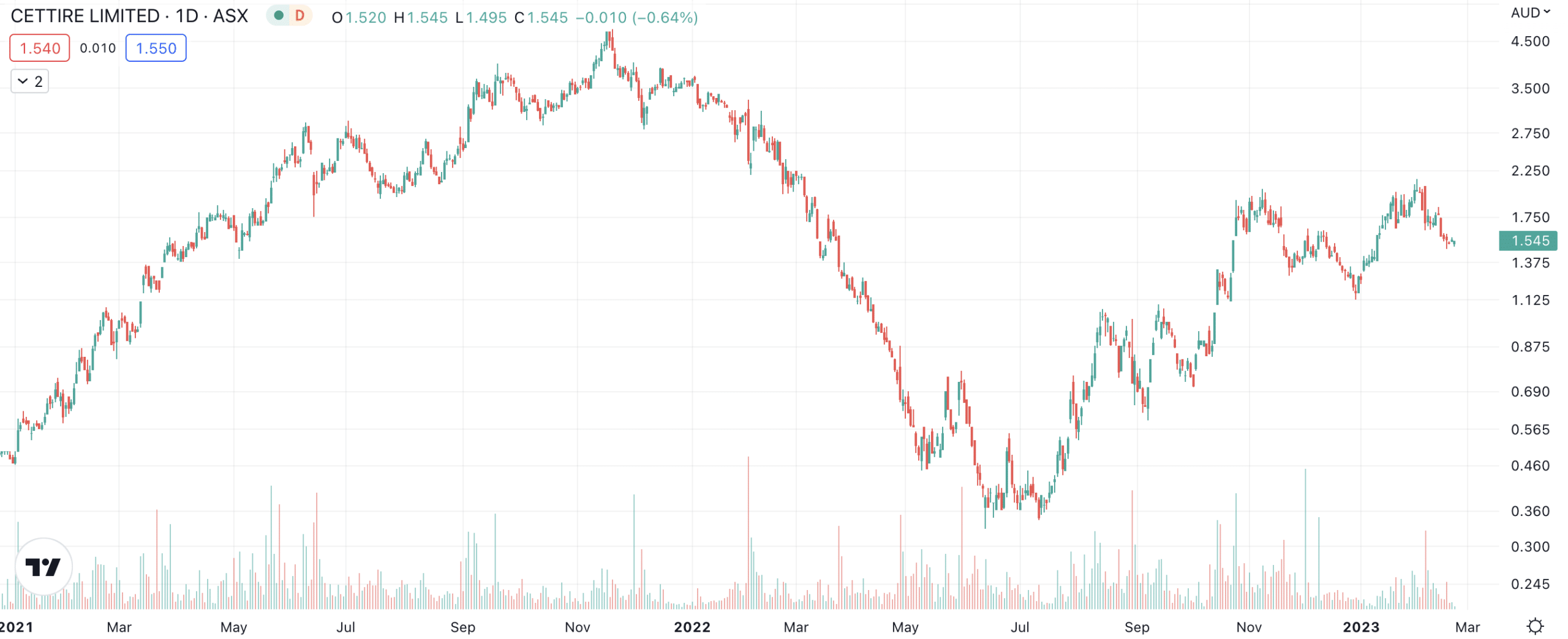

Cettire was nearly a 10-bagger in late 2020, having rocketed from 50c to $4.50 in barely a year as consumers shopped online.

Cettire (ASX:CTT) share price chart, log scale (Source: TradingView)

In FY21, the first year the company was listed and the financial year that was most affected by the pandemic, the company’s sales grew by over 304%.

Since the company reached an all time high, things have become more difficult. Investor tastes have waned from companies that are not profitable and from eCommerce companies – Cettire happens to be both.

Although sales were up another 127% in FY22, its operating cash flow swung from $13.4m in the black to $14.7m in the red. This was due to higher customer acquisition costs.

Cettire’s Catch 22 is that it needs more customers and scale to be profitable, but it is tough to be profitable as marketing costs continue to soar.

Also not helping Cettire’s cause in CY22 was a major sell-down by shareholder Dean Mintz. He pocketed $47m from selling a stake worth 9% of the company.

To be fair, he still retains a majority stake of over 56%.

But, investors hate seeing founders or directors selling shares, taking it as a sign of a lack of confidence in the company.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips on the top Stocks in ASX

Positives and negatives about Cettire

Cettire has been a controversial company not just because of the reasons above, but unique advantages and disadvantages it has that other companies don’t.

On the positive side, it has a focus on high-end fashion which is less likely to be impacted by an economic downturn and is a major industry. Cettire has claimed the industry is worth over US$460bn.

Turning back to Dean Mintz’s majority stake, we think (as with other founder-led businesses) it incentivises him greater than a managing director just receiving a salary.

Also keep in mind that unlike a conventional fashion retailer, Cettire does not bear manufacturing costs.

Disadvantages that Cettire faces are that it relies heavily on marketing, bears delivery costs to the end customer, as well as intensive industry competition.

There are plenty of other platforms like Cettire such as Farfetch, Net-a-Porter and Bluefly, among others.

We also observe that it has a high return rate, 25.7% in FY21 and 28.1% in FY22.

1HY23 might be a pivotal point

Cettire’s 1HY23 results, released in early February, depicted the company might be turning around.

It recorded a 65% jump in sales revenue to $187.7m, while gross revenue rose 57% to $242.7m (revenue prior to returns and allowances). The company’s EBITDA swung from $9.9m in the red to $16.7m in the black, while NPAT went from an $8.3m loss to a $8m profit.

Other pleasing news for CTT shareholders were that active customers grew 50% from 208,721 to 313,982 while the average order value rose 7% from $712 to $759.

The company also provided a trading update for the first two months of 2HY23, reporting that sales revenue was 80% higher than the prior corresponding period and that it remained EBITDA positive.

Consensus estimates expect strong growth in future years

Cettire’s solid revenue growth is expected to continue in future periods.

Consensus estimates are for $363.3m for the full FY23 (which would be up 73% from FY22), $465.8m for FY24 (up 28%), $618.4m for FY25 (up 33%) and $711.2m for FY26 (up 15%). This represents 18.2% CAGR.

Looking to the EBITDA line, consensus estimates expect $26.6m in FY23 (compared to a $21.5m loss in FY22), $28.1m in FY24 (up 5%) and $36.9m in FY25 (up 31%).

Cettire’s EPS is expected to swing from -$0.05 in FY22 to $0.05 in FY23. It is expected remain constant in FY24 but increase 20% to $0,07 in FY25.

We think CTT is worth $932m or $2.45 – 60% higher than it is now

At Stocks Down Under, we have built a 10-year DCF model for Cettire. We have taken into account these consensus estimates and:

- Assumed 10% revenue growth after FY26

- Assumed 7% inflation in FY23 and 3% thereafter for most costs except merchant fees and depreciation

- Assumed merchant fees remain ~4.8% of revenue, in lin e with past trends.

- Used an 11.07% WAAC consisting of a 1.5x beta, a 5% equity premium and a 3.6% risk-free rate of return, as well as a 2% terminal growth rate.

We derive a value of $932.8m, which equates to $2.45 – a 60% premium to the current share price.

The key challenge facing Cettire, and the determinant as to whether or not it can create shareholder value, is that it can continue to grow revenues while still becoming profitable.

Its 1HY23 results are a good indication that it is on track, although there is risk that it could be derailed in its attempts.

This could be the case if economic conditions worsen to the point that high-end fashion does become affected.

Cettire looks like a good opportunity, but needs to maintain growth and grow profitably

Overall, we think Cettire represents a good opportunity for investors.

Unlike other eCommerce outlets, it has been able to maintain growth even as consumers return to brick and mortar retailers and inflation remains at 4-decade highs.

It is not exposed to many costs that other fashion companies are exposed to such as manufacturing costs and high inventory levels.

However, the company needs to maintain its high levels of growth, while still becoming profitable. And even though the company is on track, it is no certainty that it will be able to remain on track.

Stocks Down Under Concierge is here to help you pick winning stocks!

The team at Stocks Down Under have been in the markets since the mid-90s and we have gone through many ups and downs. We have written about every sector!

Our Concierge BUY and SELL service picks the best stocks on ASX. We won’t just tell you what to buy – we give you a buy range, price target and stop loss level in order to maximise total returns. And we will only recommend very high conviction stocks where substantial due diligence has been conducted.

Our performance is well ahead of the ASX200 and All Ords.

You can try out Concierge for 3 months … for FREE.

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

There’s no credit card needed – the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…