Chalice Mining (ASX:CHN): Its got 17Moz of 3E (Palladium, Platinum and Gold combined), but when will it be in production?

Chalice Mining (ASX: CHN) has been the exploration story of the decade. All of the hundreds of explorers on the ASX dream of stumbling across a monster deposit that can become a major mine. That’s just what has happened to Chalice Mining. Since March 2020 it has re-rated from 20 cents to over $9, its all-time-high, as it came across Julimar. From its all-time high, the stock has collapsed. We look at the rise and fall of the company, as well as where it might be headed next.

What are the Best ASX Resources Stocks to invest in right now?

Check our buy/sell tips

Introduction to Chalice Mining

Chalice Mining (ASX:CHN) owns the Julimar PGE-nickel deposit that lies an hour out of Perth. The company has never looked back since it first discovered the deposit and scratched the surface of its potential, given its resources, convenient location and the perfect timing of the discovery amidst the push for decarbonisation.

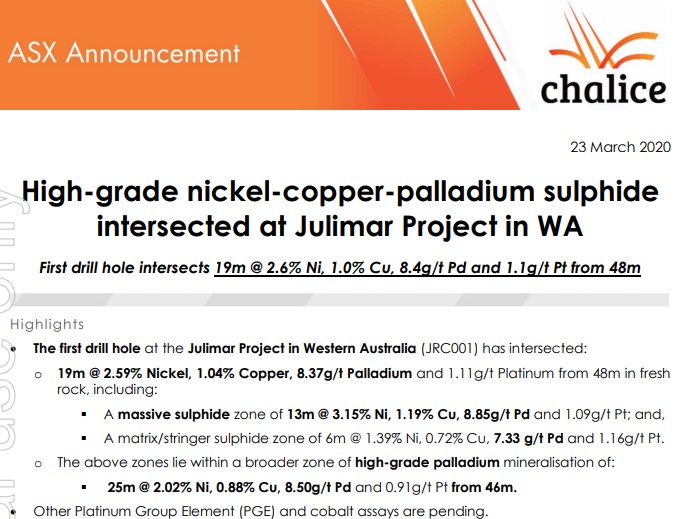

Julimar was an afterthought at best, in an area that had never been explored for nickel or PGE before and barely rated a mention in Investor Presentations. But from that first drill hole intersection, unveiled in March 2020, the rest is history.

Chalice announcement (Source: Company)

Julimar, or specifically the Gonneville prospect at the project, was the largest nickel sulphide discovery anywhere in the world in 2 decades and the largest PGE (Platinum Group elements) discovery in Australian history. And keep in mind that was the maiden Resource 2 years ago!

Take a bow Tim Goyder, Alex Dorsch and everyone else involved. The irony is that with a ~$700m market cap, it is well ahead of where it was 5 years ago (less than $40m). The dilution that has occurred in capital raisings since Julimar’s discovery has made the share price decline look worse than it is – it would be nearly $2 if the same number of shares on issue 5 years ago was used. However, there is no denying that a decline has occurred as it once held a market cap of over $1.5bn. But back to the deposit…

Julimar/Gonneville is huge!

According to the most recent Resource – outlined in July 2023, it has a resource of 560Mt @ 0.54% nickel or ~1.7g/t palladium equivalent. 55% of this is Measured and Indicated with the balance Inferred. This equates to 17Moz of 3E (Palladium, Platinum and Gold combined), 960kt nickel, 540kt copper and 96kt of cobalt. This is equivalent to 3Mt of nickel equivalent or 30Moz of palladium equivalent.

As if this was not good enough, this project lies barely an hour from Perth. So, there’s no need for FIFO infrastructure – workers can go home each night! And there could be even more to come. Keep in mind the resource is just ~2km of a broader >30km long Julimar complex.

2025 concluded with the long-awaited PFS (Preliminary Feasibility Study). The study envisioned a mine life of over 2 decades delivering 220koz of 3E metals along with 7kt of nickel, 8kt copper and 0.7kt cobalt. This derived $4.7bn in cumulative pre-tax free cashflow, a $1bn post-tax NPV and a pre-tax IRR of 23%. It was estimated that it’d cost $820m to bring into production and there’d be a 2.7 year payback.

This was using prices at the first half of 2025. since then, palladium is 61% higher, platinum is 108% higher. Obviously this would mean even higher returns if these prices hold.

Playing into emerging decarbonisation technologies

The reason the project has resonated with investors, governments and industrial end-users that have expressed interest in offtake is its exceptional concentrations of palladium and platinum — two metals that sit at the heart of the global energy transition.

Palladium and platinum are not generic commodities; they are critical enablers of decarbonisation technologies. Both belong to the platinum group metals, which have unique chemical and physical properties — especially their catalytic activity.

That makes them indispensable in catalytic converters for reducing vehicle emissions, hydrogen production and fuel cell technologies, advanced electronics, and industrial catalysts used in chemical processing. As the push toward net-zero intensifies, these metals are woven into the infrastructure of clean energy systems.

Palladium, in particular, dominates in automotive catalytic converters used in petrol engines to reduce harmful exhaust emissions. Even as electric vehicles gain share, internal combustion engines remain a large part of the global vehicle fleet for years to come, sustaining demand for palladium as manufacturers work to meet tightening emissions standards globally.

Platinum, meanwhile, plays a central role in hydrogen electrolysis and fuel cell technologies — sectors widely recognised as critical for decarbonising heavy transport, industrial heat and long-duration energy storage. Hydrogen fuel cells offer a zero-emission alternative for heavy vehicles and hard-to-electrify sectors, and platinum’s catalytic properties are essential to those systems.

Palladium and platinum supplies are concentrated in only a few regions worldwide, notably South Africa and Russia, each with sovereign, geopolitical and operational challenges. This concentration exposes global supply chains to disruption, price volatility and political risk — a concern for industries reliant on steady access to these metals.

In contrast, Julimar represents one of the few large-scale, high-grade PGE deposits outside those dominant jurisdictions, and significantly the largest in Australia. That geographic diversity is increasingly valuable as Western markets pursue supply chain resilience and reduce exposure to geopolitical risk.

Furthermore, Julimar’s endowment extends beyond palladium and platinum. It also hosts meaningful nickel and copper, both of which are integral to electrification through battery technologies and grid infrastructure. But it is the density and quality of its PGE content that set the project apart. In an era where clean energy technologies define future industrial growth, Julimar isn’t merely another mining project — it represents a domestic source of metals that are both scarce globally and essential to decarbonisation.

So what does 2026 hold?

While Julimar is widely recognised as one of the most significant critical minerals discoveries in Australia, it will be a multi‑year pathway before capital is committed and construction begins.

Assuming Chalice stays on schedule, 2026 will not be the year of capital spend or construction — but it will be the year in which the project’s economic and engineering foundations are fully established and the regulatory pathway formally launched. Chalie is eyeing off a Definitive Feasibility Study (although management is just saying Feasibility Study) for 2027, then a Final Investment Decision in 2028.

2026 will see the foundations being laid for these milestones including engagement with potential commercial partners (especially offtake partners) and regulators. There will also be further work on the project.

One thing investors should keep an eye on is commodity prices, especially with platinum and palladium rebounding. Palladium has returned toward US$1,700–1,900/oz and platinum is also climbing above US$1,100–1,200/oz, driven by a combination of renewed automotive demand, supply tightness from South Africa and Russia, and growing interest in PGMs as a hedge for green hydrogen and fuel cell adoption.

Structural deficits for palladium and platinum are likely to persist through the late 2020s, especially as decarbonisation technologies such as fuel cells, hydrogen electrolysis, and catalytic converters continue to require these metals. This will help the cause of Julimar by the time it enters production.

Conclusion

Few, if any, companies can boast of such a project like Chalice Mining has. It has world‑class concentrations of palladium, platinum, nickel, copper, and cobalt – all metals at the heart of the decarbonisation transition; it in an ideal location and is well placed to benefit from both operational progress and favourable market conditions.

The challenge now is to secure offtake deals and get the next feasibility study done. But even though the company has more work to do, we think it is on track and has made significant strides in the last 6 months.

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

Electro Optic Systems (ASX:EOS) US$42m Slinger Order Lands as Defence Demand Heats Up

New Highs, New Contract, But Valuation Is Now the Debate Electro Optic Systems has pushed to new highs on the…

Immutep’s Phase 3 trial for Efti has gotten the chop and shares plunge >90%! What now for investors?

After nearly a week in suspense, Immutep (ASX:IMM) confirmed news about Efti that its investors did not want to hear,…