Chalice Mining (ASX:CHN): Its got 17Moz of 3E (Palladium, Platinum and Gold combined); so why the sell off?

Chalice Mining (ASX: CHN) has been the exploration story of the decade. All of the hundreds of explorers on the ASX dream of stumbling across a monster deposit that can become a major mine. That’s just what has happened to Chalice Mining. Since March 2020 it has re-rated from 20 cents to over $9, its all-time-high, as it came across Julimar. From its all-time high, the stock has collapsed. We look at the rise and fall of the company, as well as where it might be headed next.

What are the Best ASX Resources Stocks to invest in right now?

Check our buy/sell tips

Introduction to Chalice Mining

Chalice Mining (ASX:CHN) owns the Julimar PGE-nickel deposit that lies an hour out of Perth. The company has never looked back since it first discovered the deposit and scratched the surface of its potential, given its resources, convenient location and the perfect timing of the discovery amidst the push for decarbonisation.

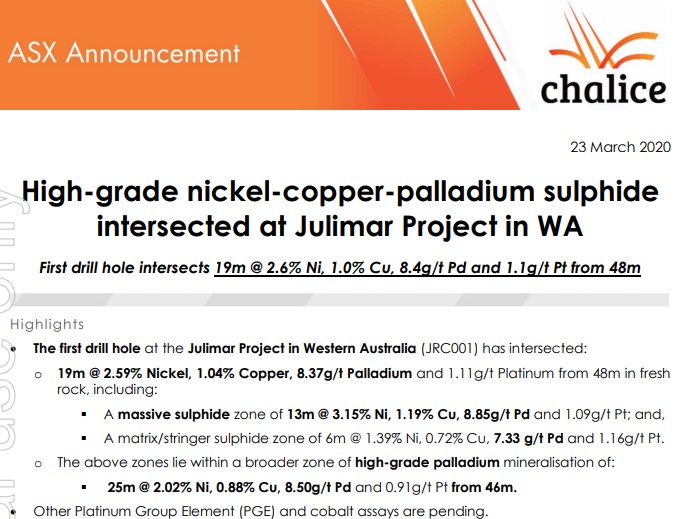

Julimar was an afterthought at best, in an area that had never been explored for nickel or PGE before and barely rated a mention in Investor Presentations. But from that first drill hole intersection, unveiled in March 2020, the rest is history.

Chalice announcement (Source: Company)

Julimar, or specifically the Gonneville prospect at the project, was the largest nickel sulphide discovery anywhere in the world in 2 decades and the largest PGE (Platinum Group elements) discovery in Australian history. And keep in mind that was the maiden Resource 2 years ago!

According to the most recent Resource – outlined in July 2023, it has a resource of 560Mt @ 0.54% nickel or ~1.7g/t palladium equivalent. 55% of this is Measured and Indicated with the balance Inferred. This equates to 17Moz of 3E (Palladium, Platinum and Gold combined), 960kt nickel, 540kt copper and 96kt of cobalt. This is equivalent to 3Mt of nickel equivalent or 30Moz of palladium equivalent.

As if this was not good enough, this project lies barely an hour from Perth. So, there’s no need for FIFO infrastructure – workers can go home each night! And there could be even more to come. Keep in mind the resource is just ~2km of a broader >30km long Julimar complex.

Playing into emerging decarbonisation technologies

The discovery comes at a perfect time with the Australian government (and Western allies) keen for critical minerals, such as Palladium, Platinum, Nickel and cobalt. They are all important for emerging decarbonisation technologies, such as electric vehicles, hydrogen, energy storage and semiconductors, just to name a few.

Take a bow Tim Goyder, Alex Dorsch and everyone else involved. The irony is that with a ~$500m market cap, it is well ahead of where it was 5 years ago (less than $40m). The dilution that has occurred in capital raisings since Julimar’s discovery has made the share price decline look worse than it is – it would be nearly $2 if the same number of shares on issue 5 years ago was used. However, there is no denying that a decline has occurred as it once held a market cap of over $1.5bn.

So why have Chalice Mining shares gone down?

We see 3 key issues.

The first has been that it could cost $1.6-$2.3bn to turn into an operating mine and this is why shares fell this year. The price tag will depend on the output, 15m tonnes a year would lead to the lower figure while 30m tonnes a year would lead to the higher figure.

Secondly, it not make a Final Investment Decision until 2027 and first production may not occur until 2029 at the earliest. This is no certainty in an era of supply chain issues and NIMBYs. Also don’t forget that even in spite of there being a resource since 2021, there are no binding offtake deals. Perhaps because of this timeline.

And thirdly, there’s the issue of commodity prices. Prices of battery metal commodities, particularly nickel and lithium, collapsed due to a perceived oversupply as demand for electric vehicles slowed.

No PFS just yet

Keep in mind that Gonneville doesn’t even have a Preliminary Feasibility Study (PFS) out right now. Yes, there is a scoping study completed, but it relied on far more optimistic assumptions than commodity prices right now. The study assumed US$2,000 per ounce for palladium when it is currently half of that.

Given issues one and three, it was fascinating to observe that investors have been more reluctant to give it credit for news such as the ‘non-binding memorandum of understanding’ it signed with Mitsubishi last year. It does not have confirmed offtake partners yet.

But Chalice plans for a PFS to be released by the end of 2025 and for Draft Environmental Review Documents within 12 months. So the company is doing what it can behind the scenes and purports to be funded through to the FID.

It all hinges on commodity prices

Where Chalice Mining goes to next will hinge on a number of things including where commodity prices go, if the PFS turns out as good as earlier Scoping Studies, and if it can get any binding offtake partners ahead of production. The PFS, due by Christmas, will be crucial for all involved with this company.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…