Could the collapse of Silicon Valley Bank be a blessing in disguise for Tech stocks in 2023?

![]() Marc Kennis, March 15, 2023

Marc Kennis, March 15, 2023

No one likes a banking crisis, but the demise of Silicon Valley Bank (SVB) has led to a major shift in the interest rate outlook, almost overnight and this could be good news for tech stocks. Instead of another few Fed rate hikes in the next little while, many economists are now expecting that the Fed will pause future hikes or that it will stop hiking rates in the United States altogether. Some are even expecting a rate cut at the next Fed meeting on 23 March …. all to stem the unrest in financial markets following the collapse of SVB and two other financial institutions in recent days. So, why would this be good for Tech stocks?

To answer this question, we need to have a quick look at what drove Tech stocks down in 2022.

Central banks were behind the curve in 2021

The main reason for the strong decline in share prices over the last 14 months has been the very rapid rise of interest rates around the world as central banks scrambled to try and bring inflation under control. Central banks were caught off guard in 2021 after assuming that the rising inflation at the time would be transitory, which we have always argued was a load of bull faeces.

As a result of their interest rate complacency during 2021, central banks around the world embarked on a massive interest rate hiking cycle that took the US 10-year bond yield up from around 1.36% in December 2021 to 4.22% in October 2022!

The Nasdaq composite dropped 37%

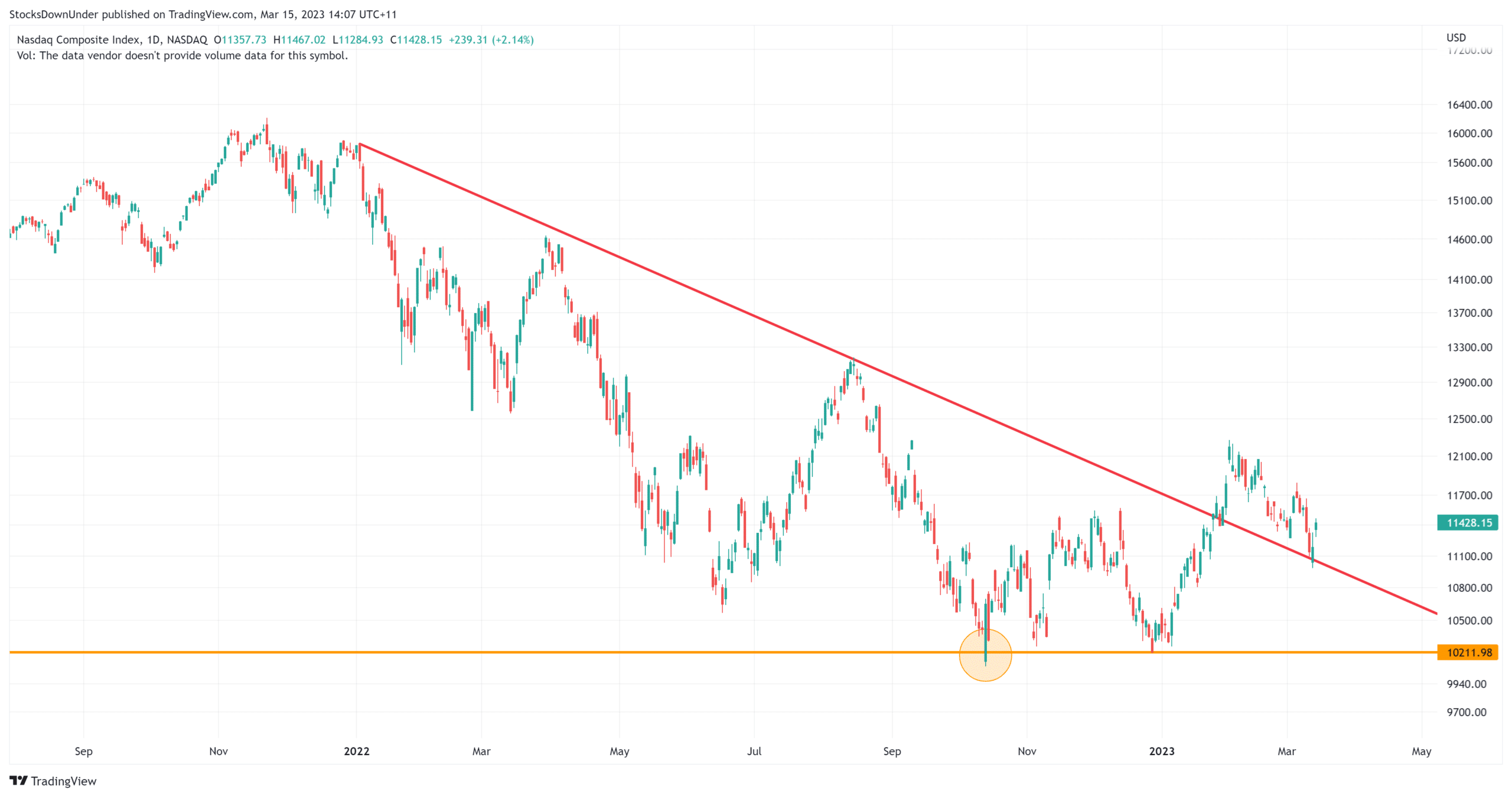

In turn, this strong rise in interest rates significantly hurt stock valuations, especially stocks that are highly sensitive to interest rates, like Tech stocks and Life Sciences stocks. The Tech-heavy Nasdaq Composite index dropped more than 37% from late 2021 until it bottomed in October 2022 as investors reassessed stocks valuations using higher interest rate expectations.

In early March, just before the issues at SVB became apparent to the outside world, US interest rates were expected to peak at just over 5% sometime in mid-2023 with the market pricing in another 1%-point increase in the Federal Funds Rate.

But the collapse of SVB has changed the interest rate outlook

The problem is that in its fight to bring down inflation, the Fed has driven up interest rates so much that banks’ asset valuations (i.e. bond portfolios) have taken big hits, which in the case of SVB caused a liquidity crunch following a classic, albeit online, bank run.

The Fed is now faced with a massive dilemma: continue with its inflation-fighting policy, i.e. more rate hiking down the line, which may bring more banks in hot water and would likely drive up systemic risks to the banking system. Or go easier on the rate hikes to avoid more collapses like the ones we have seen in the last few weeks.

The latter option, however, would mean that inflation will take longer to come down. The February core CPI print in the US, published on 14 March, came in at 5.5%. While that was lower than the 5.6% for January, the rate of decline has been slowing compared to the second half of 2022, i.e. inflation keeps coming down, but at an increasingly slower pace. At this rate, the Fed’s target inflation rate of 2% will not be reached for a long time.

Will the Fed stay hawkish or become dovish?

So, will the Fed remain relatively “hawkish” to drive inflation down or will it turn more “dovish”, so it doesn’t push more banks to the brink? The market seems to have made up its mind, judging by comments coming out of the big US brokers this week. Many are now expecting the Fed will at the very least put rate hikes on hold for the moment instead of an earlier-expected hike of 25 basis points on 23 March. And some economists have brought forward their expectations of when the Fed will start its rate cutting cycle, from early 2024 to mid-2023.

Whatever happens, just in the last 10 days, 10-year US bond yields have dropped from 4.07% to a low of 3.51% on Tuesday, 13 March. At the time of writing, on 15 March, they had bounced up a little to 3.66%.

Tech stocks’ valuations should start to recover throughout 2023

Just as higher interest rates pushed down valuations for Tech stocks during 2022, these lower interest rates we’re now starting to see may results in a reverse, albeit much slower, valuation adjustment. Why slower? Because we don’t see interest rates going back to 2021 levels and any drop will likely be much more gradual compared to the rise we saw.

Nevertheless, most equity investors would welcome a more benign interest rate environment. The interest rate-sensitive Tech sector would be one of the main beneficiaries of lower interest rates as valuations should be going up after 14 months of declines.

On top of that, many Tech stocks have been right-sizing their businesses recently and may be able to report improving numbers in the second half of 2023. After all, the much-predicted recession in the US hasn’t materialised yet and if it does, we believe it will be mild, especially with peak interest rate expectations coming down.

NASDAQ Composite index, log scale (Source: TradingView)

We like Tech stocks at the moment

In our Investor Webinar on 21 October 2022, we talked about how we thought we’d seen the bottom in the Nasdaq (see chart) and why we expected solid returns for Tech stocks in 2023. Since then, the Nasdaq has broken the downward trend and tested that breakout on Monday 13 March.

Recent developments have only reinforced our bullish expectations. And with the market looking ahead 6 to 9 months, we believe there are definitely some solid investment opportunities in the Tech space this year. So, it’s time to move your favourite Tech stocks to the top of your watch list.

And check out our Insights articles to stay up-to-date on what’s happening with ASX-listed Tech stocks!

Stocks Down Under Concierge is here to help you pick winning stocks!

The team at Stocks Down Under have been in the markets since the mid-90s and we have gone through many ups and downs. We have written about every sector!

Our Concierge BUY and SELL service picks the best stocks on ASX. We won’t just tell you what to buy – we give you a buy range, price target, a stop loss level in order to maximise total returns and (of course) we tell you when to sell. And we will only recommend very high conviction stocks where substantial due diligence has been conducted.

Our performance is well ahead of the ASX200 and All Ords.

You can try out Concierge for 3 months … for FREE.

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

There’s no credit card needed – the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…