Silicon Valley Bank has collapsed. Why are markets freaking out? Is it 2008 all over again?

Nick Sundich, March 13, 2023

Silicon Valley Bank collapsed over the weekend and markets are expected to fall this week as a consequence.

Why are markets panicking? Is this 2008 all over again?

To answer the latter question, probably not. Although there will be a significant fallout.

SIGN UP FOR THE STOCKS DOWN UNDER NEWSLETTER NOW!

Who was Silicon Valley Bank?

Silicon Valley Bank was the 16th largest bank in the USA but the largest by deposits in Silicon Valley. It was consequently perceived as a ‘go-to’ bank for US tech start ups.

It collapsed on Friday (US time) after a ‘bank run’ on its deposits.

A bank run is where depositors ‘run’ to cash out all their money and the bank runs out of money as a consequence.

Silicon Valley Bank was the largest failure of a US bank since Washington Mutual in 2008.

Although a bank run could theoretically happen to any bank, Silicon Valley Bank was more vulnerable because it served the tech sector.

As venture capital began drying up, start ups were cashing out funds. Although the bank had a US$21bn bond portfolio, it was only yielding an average of 1.79%, not even half the current 10-year Treasury Yield.

The ‘bank run’ got serious in the middle of last week when it announced it would sell US$2.25bn in new shares to shore up its balance sheet.

Ergo, the bank run and collapse in US markets on Friday.

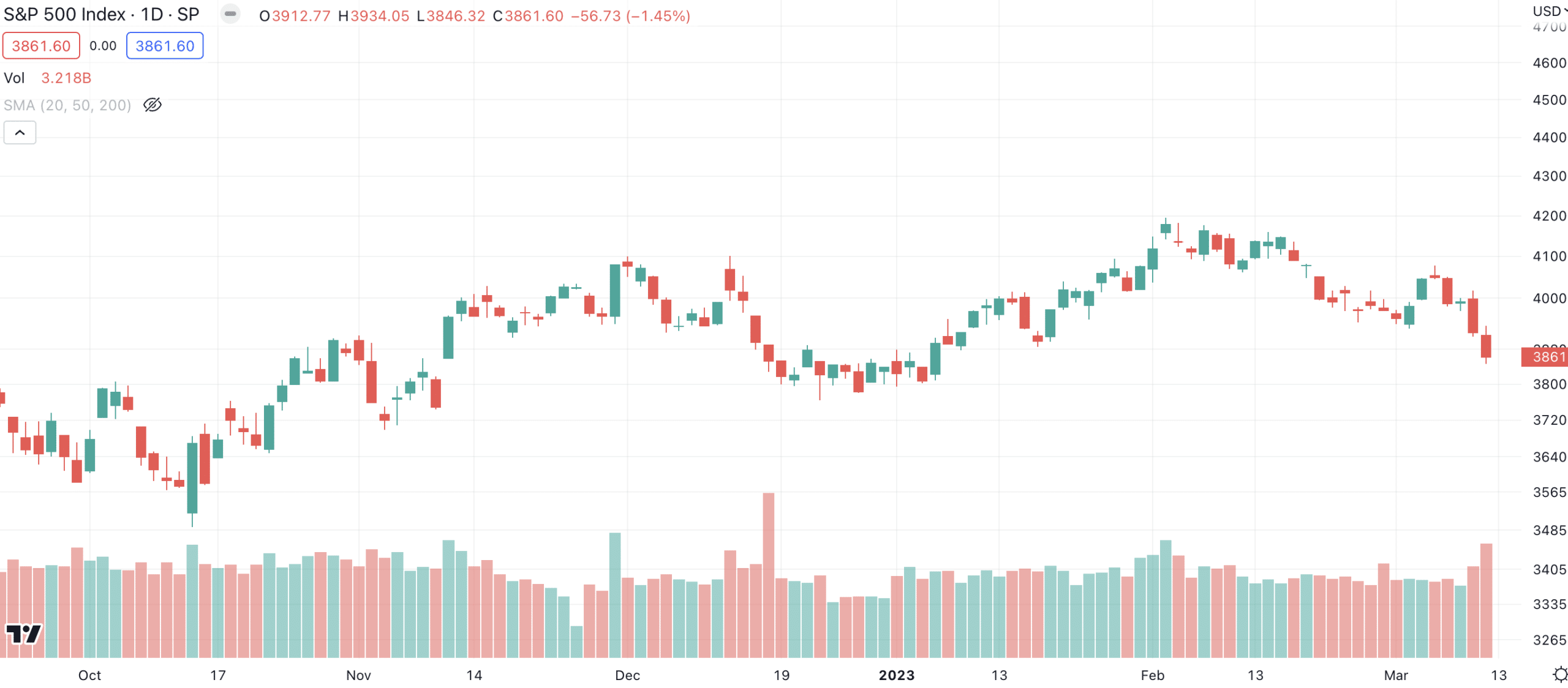

The S&P 500 fell 1.45% on Friday (Source: TradingView)

Why are investors worried about the collapse of Silicon Valley Bank?

You can understand why tech investors would be worried about the collapse given the bank’s focus.

Normally, only funds above US$250,000 are guaranteed although US regulators have stated that they will guarantee all Silicon Valley Bank deposits – so that shouldn’t be a concern.

However, investors across all sectors are worried that more bank runs could be to come and that regulators may not be as generous in such scenarios.

We also note that companies with undrawn funding facilities may need to find alternative facilities and some banks may be more wary about lending money than Silicon Valley Bank was.

It is unlikely we will see a 2008-like scenario although there could be more collapses in the tech sector, both banks and potentially companies with funds deposited with Silicon Valley Bank.

In turn, investment companies that are shareholders in these companies will also be affected.

Tech companies with funds in another bank might rush to withdraw them, thereby impacting those banks.

Are any ASX companies caught up in this?

Yes, there are several of them. Ownership Matters has named several companies that have banking relationships with them.

Some of these companies have – and more of them will – publicly disclosed it to investors this morning.

The most prominent include Life360 (ASX:360) and SiteMinder (ASX:SDR). Life360 has A$5.6m in exposure but expects no significant disruption given that it has $95.1m in cash and cash equivalents.

As for SiteMinder, it too said there would be no significant disruption and reaffirmed it would be free cash flow neutral by 4QY24.

However, it has a lot more exposure with A$10m in cash and an undrawn US$20m revolving credit facility.

It told shareholders it was working to establish a replacement facility and to have its customers redirect payments elsewhere.

With A$68.2m in cash and term deposits, it is not like the company is at risk of collapsing although this is a fair blow.

One more company significant impacted is Nitro Software (ASX:NTO). It has US$12.2m of cash held on deposit at Silicon Valley Bank.

Although the company said the current takeover offer was unaffected, it warned investors to promptly accept the offer.

Keep an eye on the aftermath of the Silicon Valley Bank

Investors need to watch the aftermath of the Silicon Valley Bank collapse.

We think plenty of companies will be caught up by the share market decline even if they aren’t in the tech sector and don’t hold any money with the bank.

Only a handful of companies are at risk of collapsing as a consequence – only those that have a large proportion of their funds with the bank and particularly those that aren’t profitable.

For other tech companies, this decline could be a buying opportunity.

Stocks Down Under Concierge is here to help you pick winning stocks!

The team at Stocks Down Under have been in the markets since the mid-90s and we have gone through many ups and downs. We have written about every sector!

Our Concierge BUY and SELL service picks the best stocks on ASX. We won’t just tell you what to buy – we give you a buy range, price target, a stop loss level in order to maximise total returns and (of course) we tell you when to sell. And we will only recommend very high conviction stocks where substantial due diligence has been conducted.

Our performance is well ahead of the ASX200 and All Ords.

You can try out Concierge for 3 months … for FREE.

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

There’s no credit card needed – the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Here’s why Rich Lister WiseTech boss Richard White ‘stood down’, and how the A$30bn+ cargo software giant may be affected

WiseTech boss Richard White has been viewed as a key reason for his company’s success over its 30-year history and…

Is the S&P 500 Really Doomed to a ‘Lost Decade’? Goldman Sachs thinks so, but will it eventuate?

The term ‘Lost Decade’ gets thrown about a lot, but most recently to the next decade to the S&P 500.…

Halloween Stocks: Here are 5 ASX Stocks that Will Benefit from Halloween

Here are 5 ASX Halloween Stocks! The Reject Shop (ASX:TRS) The Reject Shop is one of Australia’s most notable…