CSL (ASX: CSL) poised for exciting growth in FY23

![]() Nick Sundich, April 18, 2022

Nick Sundich, April 18, 2022

The healthcare sector has a reputation for being a growth sector resilient to market uncertainty and there’s no better example of this than the cream of the crop – CSL (ASX: CSL).

Get a 14-day FREE TRIAL TO STOCKS DOWN UNDER

What is CSL?

CSL, ASX’s biggest biotech, has two primary businesses: flu vaccines and blood products – it takes plasma from donors and turns it into life-saving therapeutics, particularly immunoglobin products. Plasma is the substance that carries red and white blood cells through the body – these therapies are relevant for disorders such as hemophilia, primary immune deficiencies, hereditary angioedema and inherited respiratory disease.

A 300-bagger

CSL was once a government entity, established in 1916. It was privatised in 1994 at $2.30 a share, although it undertook a three for one share split in 2007 making its IPO price 76.7c in real terms, meaning it has been more than a 300-bagger since listing!

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips on the top Stocks in ASX

CSL is not afraid to acquire

Despite its size, CSL continues to spend hundreds of millions of dollars on R&D annually and is not hesitant to undertake M&A activity. Recently it made the biggest buyout in its history: Switzerland’s Vifor Pharma for which it paid US$11.7bn late in 2021. CSL is evidently looking to profit from kidney disease, which affects 850m people globally – a figure expected to grow given the global obesity epidemic. Additionally, the firm has steady leadership with only two CEOs since listing.

CSL was hit by COVID-19, but the worst is over

The pandemic was not an easy time for the company. While demand for its products remains solid, the availability of plasma can fluctuate. And it has suffered through lower donations in the USA due to the COVID-19 pandemic. Things have gradually improved as the company hiked the fees it paid to donors and offered free flu vaccines. But considering plasma products have a lead time of several months, it will take a while for this to show up in the bottom line. There were also perceptions that despite long term interest from CSL, the final deal to buy Vifor was rushed.

The company undertook a $6.3bn capital raising at an ~8% discount to the previous day’s closing price, which did little to dent the company’s long-term returns, though.

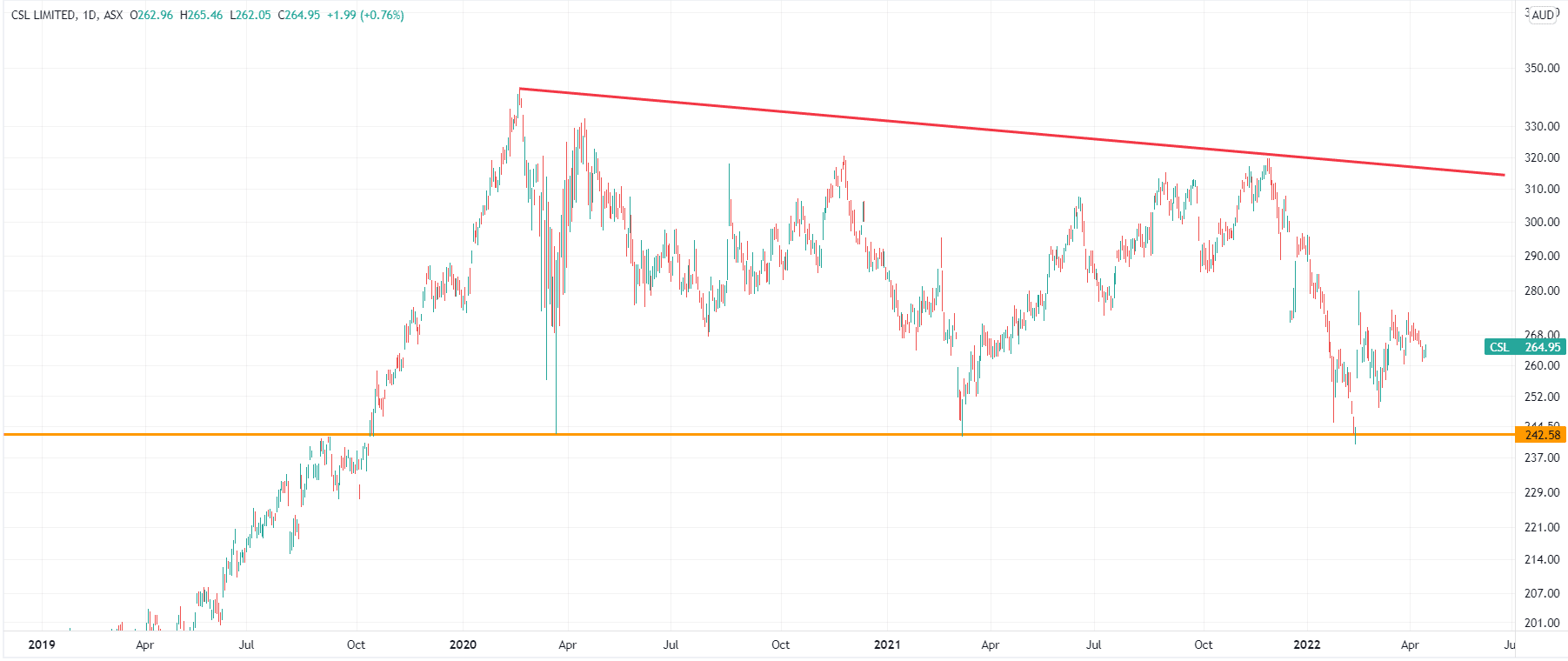

CSL (ASX:CSL) share price, log scale (Source: Tradingview)

Rebound coming in FY23

In FY21, CSL generated revenues of US$10.3bn and delivered EBIT of US$3.13bn and a net profit of US$2.38bn – up 11% and 10% on a constant currency basis from FY20. In 1HY22, it delivered EBIT of $2.27bn and a net profit of US$1.76bn, down 8% and 5% respectively from 1HY21, but in line with company expectations. For FY22 it is expecting a net profit of US$2.15-$2.25bn, which would be down from FY21, but inclusive of US$90-110m of transaction costs relating to the Vifor acquisition.

Consensus estimates for FY23 call for an EBITDA of US$6.4bn which would be a strong bounce back of 35% following the 5% decline in EBITDA in FY22.

Valuation looking attractive

Consensus EBITDA for FY23 would value the company at 19.7x EV/EBITDA. This is a significant premium to the ASX 200 average of about 15x. However, if you believe the consensus EBITDA growth projections for FY23 of 35%, this valuation is highly attractive for a long-term growth stock like CSL.

To bring a further view into the conversation, our friends at Pitt Street Research have done a DCF analysis based on consensus estimates for the next ten years. Their analysis yielded a value per share of $305.61, which is a ~15% premium to the current share price. The study used a 3% risk premium, a 7.1% equity premium, a 0.9x beta leading to a WACC of 8.81% and a 2% terminal value – the latter figure arguably conservative given this company’s track record.

Is CSL a BUY?

CSL may not be the company for you if you’re looking for a stock that can be a multi-bagger in a couple of months. But if you’re looking for a company with a proven track record of sustainable long-term growth and positive tailwinds for the future, this one should be on your watch list.

Trading range of $245 to $310

Looking at the chart, we can see a trading range of approximately $65, from $245 to $310. The stock is currently trading around the lower third of this trading range (around $265). We believe $250 is a good price to pick up the stock for your portfolio. It would give an approximate 23% upside to the top of the range, which is a solid return for a long-term growth stock. If you were to buy CSL at the current share price, you’re looking at an upside of just 17%.

Put in a stop-loss around $238, which is just below the lower end of the trading range, in case things don’t work out for the company.

Stay up-to-date on ASX-listed Healtcare stocks!

Make sure you subscribe to Stocks Down Under today

No credit card needed and the trial expires automatically.

Frequently Asked Questions about CSL

- Is CSL an Australian company?

Yes, the company is based in Melboure, Australia.

- Does CSL pay a dividend?

Yes, the company paid $2.96 per share in FY21.

- What is CSL?

CSL, ASX’s biggest biotech, has two primary businesses: flu vaccines and blood products – it takes plasma from donors and turns it into life-saving therapeutics, particularly immunoglobin products. Plasma is the substance that carries red and white blood cells through the body – these therapies are relevant for disorders such as hemophilia, primary immune deficiencies, hereditary angioedema and inherited respiratory disease.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…