Here’s what you need to know about dual class shares and why the ASX still bans them in 2024

![]() Nick Sundich, March 7, 2024

Nick Sundich, March 7, 2024

If you want to invest in the world’s biggest tech companies, you need to know about Dual class shares.

Even if you want to stay at home, you still should know. Because if some individuals are to be believed, the prohibition on dual class is why Australia is missing out on the world’s biggest tech companies – so it is said…by some of the companies themselves.

What are dual class shares?

Dual class share structures are a type of corporate structure in which two separate classes of stock are issued to shareholders. The two classes of stock entitled to different voting rights, dividend payments, and even additional privileges.

Generally speaking, one class (Class A) offers more voting power than the other (Class B), increasing the control that the founder or primary shareholder can exercise over decisions made by the company.

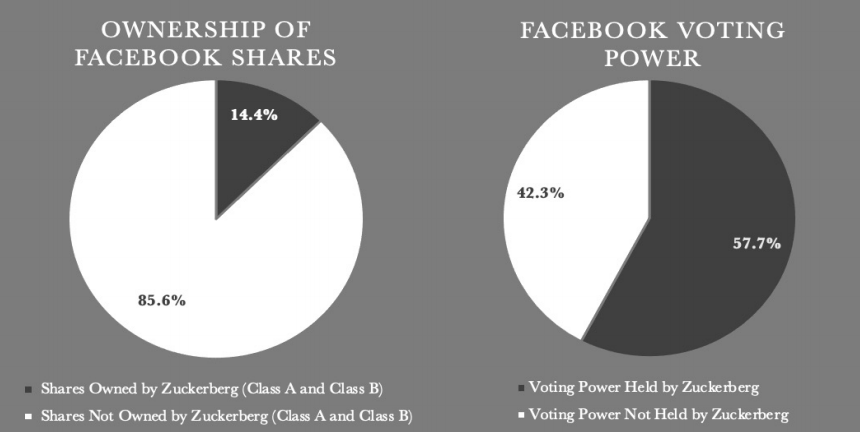

There may be other rights, Class A has over Class B. For example, Class A have a higher rate of dividend payments than Class B shares do. But the essential effect, as depicted below, is that minority shareholders have power over the majority.

Some companies may have even more classes. Alphabet (NDQ:GOOGL) has three structures – Class C have no votes at AGM, Class A have 1 vote each and Class B shares have 10 each.

Why do companies use dual class share structures?

The purpose of these structures is to allow founders and core investors continued control over their holdings while still allowing new investors access to company ownership via Class B shares. They may restrict or even outright prohibit the acquisition of higher class shares. This helps create an incentive for those who invest in a startup early on but want to protect their interests as more investors enter the fray. The founders can maintain tight control over decisions that could affect the value of all shares, like acquisitions or product development decisions.

The dual-class structure is meant to provide stability and long-term growth opportunities for companies. Obviously this assumes the founders know what’s right!

Not all shareholders are created equal with dual class shares

Despite its popularity among tech stocks and startups, however, dual class share structures have also been heavily criticised by some investor groups due to their lack of transparency and accountability with respect to shareholder interests.

It is important to note that listed companies with a dual-listed structure typically have it as a legacy of when they were private. No public shareholders would agree to shares they bought being retrospectively having power taken away from them.

Dual class shares are banned in Australia

Regulations in some jurisdictions prohibit companies from issuing multiple classes of stock with unequal voting rights and Australia is one of them. Even in countries where it is allowed, like the US and Singapore, this is only allowed at IPO and this structure already exists. Companies cannot recapitalise and create a dual-class structure then.

There may be other restrictions too. Singapore requires IPO dual-class structure companies to have fast growth potential. Hong Kong has specific hurdles on financial status that must be overcome. It is important to note that Singapore (and Hong Kong) have only allowed this for a few years whilst the US has relied on it far longer.

Both Singapore and Hong Kong saw the light because they perceived to be missing out on big listings. Hong Kong missed out on Alibaba’s listing, although the Jack Ma-founded company has since listed after the rules changed. Atlassian bosses Scott Farquhar and Mike Cannon-Brookes both cited the ASX’s opposition to dual-class structured companies as why they went to list on the NASDAQ rather than the ASX.

Might we see dual class shares one day in Australia?

We don’t think so. We think the ASX recognises that it’ll never be as big as Wall Street and is content with the occasional big name coming here, such as Life360 (ASX:360), Down Under and nourishing high-growth companies of Australia’s own. Perhaps Atlassian would never have listed in Australia anyway, even had it allowed it.

However, if you want to invest in overseas markets, you need to be aware of dual-class share structures and we hope we’ve helped get you started with the basics.

Would we invest in a company with dual class shares? It would depend. For a company like Google with multiple co-founders and other management in the business, we would. But for a company like Meta with all the power in the hands of one person who has all control over the day to day operations too and is unlikely to depart anytime soon? Not a chance.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell stock tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…