Goodman Group (ASX:GMG): It looks expensive, but can its expansion into Data Centers make it worth its high price?

![]() Ujjwal Maheshwari, January 18, 2024

Ujjwal Maheshwari, January 18, 2024

Goodman Group (ASX:GMG), the ASX’s biggest industrial property player, is making a shift into the world of data centres. On one hand, could be a good opportunity for Goodman given it can surmount the high barriers to entry and because the demand for data storage is sky-high. On the other hand, this won’t come cheap to the company, and you could argue that the company is expensive for investors.

All about Goodman Group

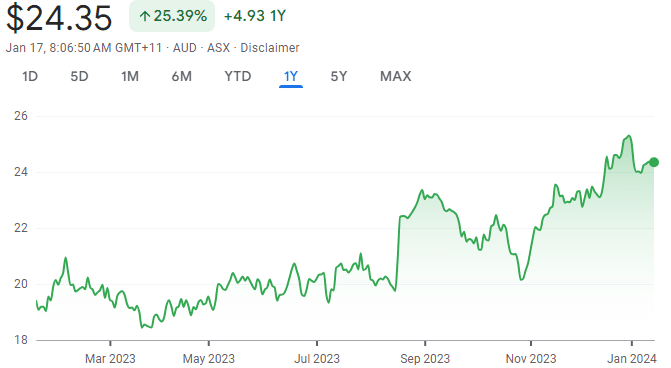

Capped at over $46.5bn today, Goodman has been listed on the ASX since 2005. After shedding over half its value during the GFC and consolidating its shares in 2012, the company recovered and has gained over 100% in 5 years.

As of early January 2024, it has $82.9bn in total Assets Under Management with a further $12.7bn in projects as a Work In Progress. It owns industrial properties across the globe that have an average of 4.9% rental growth, 99% occupancy and a 5.4 year WALE (Weighted Average Lease Expiry). Goodman top tenants include Amazon, Coles, Australia Post, FedEx, JD, DHL and Global Express.

Demand for logistics facilities was growing pre-COVID and could arguably have got to this point eventually if not for COVID, although a lot slower. Demand took off exponentially when COVID-19 restrictions hit, leaving to substantial growth in eCommerce.

It made a $1.8bn operating profit in FY23, a figure that has grown by a CAGR of 17% in 5 years, and boasts $3.1bn in Group Liquidity – not accounting for a further $17.6bn across its Partnerships. ESG investors will like this company because it has already achieved carbon neutrality across all its operations.

However, as with many of its eCommerce peers, it suffered a decline in 2022 (by over 30%) as investors pondered what the ‘new normal’ would look like. However, unlike niche, unprofitable players in the space, Goodman has regathered lost ground in the past year. And it may have another trick up its sleeve that can help the company grow further.

Goodman’s Data Centre ambitions

Goodman is no NextDC just yet. But it is planning on gradually entering the space, with 25% of its WIP projects being data centres. It has a 3.7GW power bank (in other words data centre pipeline), just over half of which is secured. This pipeline is spread across 12 cities (LA, London, Amsterdam, Frankfurt, Paris, Madrid,, Tokyo, Osaka, Hong Kong, Sydney, Melbourne and Auckland) and are in locations consistent with its existing approach to logistics. Goodman has only delivered 0.6GW so far, but slow and steady could win the race.

Brokers have a Positive Outlook, but the valuation looks stretched

There are 12 brokers covering Goodman stock and they anticipate FY24 revenue of A$2.6bn and $1.05 EPS, up 12% and 11% respectively. In FY25, $2.9bn in revenue and $1.13 EPS, up 10% and 8%. In FY26, $3.1bn in revenue and $1.25 EPS, up 9% and 11%. On this basis of these multiples, it is trading at a P/E multiple of 23.2x. Not too unreasonable, in our view.

However, it is trading at a PEG of 2.3x and is at a 170% premium to its NTA, which is just $9.12 per share. You could argue you get what you pay for, but is it worth such a premium at a time when so many REITs are trading at discounts or single digit percentage premiums?

Goodman has told shareholders it anticipates paying 30c per share in dividends. This is a yield of just 1.2% at the current share price. We would argue this is low for a property stock, especially one going as well as Goodman. If you consider the yield accounting for its NTA, it would be 3.3% – a little better, but hardly jaw-dropping so far as property stocks go.

Should you consider buying Goodman Group?

Certainly not if you are an income investor who wants a stock with a high yield – you won’t get it here any time soon. Growth investors may consider this one, but they should keep in mind that you are buying this stock at a premium and that it has higher capex than many other property stocks. All this said, there are few opportunities to buy a company at early stage when it comes to data centres and where you can have a hope that a company will be able to deliver on its ambitions given its balance sheet…and this is one of them.

What are the Best ASX Stocks to invest in?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Trump vs. Jerome Powell: What Happens to the Market If Powell Is Fired?

The relationship between President Donald Trump and Federal Reserve Chair Jerome Powell has often been tumultuous, particularly around decisions regarding…

Telix Pharmaceuticals (ASX:TLX): It’s made ~A$1.7bn in revenue from Illucix, but here’s why the best is yet to come!

What would you have thought if you were told 5 years ago you would see Telix Pharmaceuticals as a successful…

Anti Woke ETFs: Do they practice what they preach and have they outperformed since Trump’s return to power?

Have you ever heard of so-called ‘Anti Woke ETFs’? If you’re sick of companies that are big on ESG, this…