Here are 4 ASX Value Traps and how not to fall into them

![]() Nick Sundich, February 19, 2024

Nick Sundich, February 19, 2024

One mistake investors can make, especially on the ASX, is to fall for ASX value trap stocks. We thought we should outline what value traps are, how investors can avoid them, as well as a few examples of stocks that fall into this category.

What is a value trap?

A value trap is a stock or investment that appears to be cheaply priced relative to its financial performance or assets, tempting investors to buy shares in the hope of securing a bargain.

However, these investments often fail to provide the expected returns because the factors that led to the low valuation—such as declining revenues, obsolete technology, or industry headwinds—may persist or worsen over time.

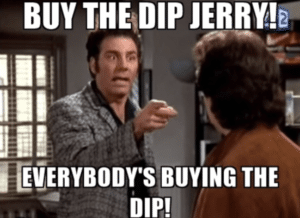

Investors keep buying into these stocks, but they keep going down nonetheless.

Source: Reddit

How to avoid value traps?

The easiest way to fall into value traps is thinking that such stocks are ‘buy the dip‘ opportunities, but are companies in medium or long-term decline. To avoid getting into them, investors should conduct their own due diligence, looking beyond basic valuation metrics like price-to-earnings (P/E) ratios. They should analyse the company’s business model, competitive advantages, earnings quality, and growth prospects to ensure that their investment thesis is based on solid foundations, not just a temporarily depressed share price.

Furthermore, it is important to evaluate management’s track record and their decisions regarding capital allocation and shareholder value. In addition to conducting thorough research and analysis, investors should also exercise discipline and patience when investing in potentially undervalued stocks. It can be tempting to jump into a stock that appears to be cheap, but it is important to remember that price does not always reflect value.

Moreover, it is essential for investors to regularly review their portfolio and reassess their investments to ensure that they are not holding onto any value traps. Companies and industries can change quickly, and what may have seemed like a good investment initially could turn into a long-term underperformer. By regularly monitoring their investments and staying informed about market developments, investors can avoid getting caught in value traps.

With this out of the way, and to help investors better understand what value traps are, here are 4 examples of them on the ASX.

Examples of ASX Value Trap Stocks

Myer (ASX:MYR)

You could make an argument that Myer is not an example anymore, but it has been for so long and so many investors have fallen for it that we had to include it here.

It is the best example of a bad private equity IPO – led by Blum Capital and TPG Capital back in 2009 and they sold their investments at almost 6 times their initial investments.

Shares never traded above their $4.10 IPO price and bottomed out at 19c amidst the Corona Crash. It was hit by the decline of brick and mortar retail generally, profit downgrades, Solomon Lew’s investor activism and continual replacement of turnaround plans.

Although the company may appear to be realising the reality and downsizing stores whilst improving their digital capabilities, the glory days of the 2000s are never coming back.

Magellan (ASX:MFG)

How can a stock with a $104m 1HY24 profit and average FUM of $36.9bn have a market cap of just $1.7bn?! Well, because little over two years ago it had over $110bn in FUM. This figure has evaporated rapidly due to volatile investment markets and investors pulling their money from Magellan. And no, this was not just because of the markets nor just private HNW individuals, but institutional investors too. These clients were unable to justify the premium fee structure Magellan charges above its peers.

Flight Centre (ASX:FLT)

You could call just about any travel stock a value trap. Two years into the travel recovery and many companies (Flight Centre included) still have not reached pre-COVID highs? Surely they’ll keep rebounding. After all, consumers keep whinging about cost of living pressures but are still spending on travel.

Well, the harsh reality is that the post-COVID travel environment is highly competitive and lower margin for many companies. Many travel providers, especially airlines, slashed commissions paid to agents (from 5% to 1% in some instances). And although efforts were made to cut brick and mortar networks, we think some companies could have gone further.

Skycity (ASX:SKC)

Why wouldn’t you want to own a company with monopoly casinos? Surely things have to turn at some stage?

Eerily similar to its Australian cousins (Star Entertainment and Crown), the company has failed to see a return of high-roller tourists that bankrolled its books for so long. It has been hit with allegations it failed to do due diligence on high-risk customers and recently agreed to set aside $73m for potential penalties.

The company has not reached its 2016 highs when rival Crown saw 18 employees detained in China for nearly 12 months.

Conclusion

In the end, the most successful investors understand that true value lies not just in a low price, but in the strength and potential of a company’s underlying business. By conducting thorough research, exercising discipline and patience, and regularly reassessing their investments, investors can avoid value traps and make informed decisions that align with their long-term investment goals. Ultimately, this will lead to better returns and greater success in the stock market.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Xero (ASX:XRO) delivered another stellar result in FY25, but is there further upside? Here are 3 reasons why we think it does

Xero (ASX:XRO) is one of the ASX’s best-performing tech stocks over the last decade, offering accounting software helping SMEs do…

Cleanaway Waste Management (ASX:CWY): Is its $5.9bn price right or a load of rubbish?

This week’s Australian stock of the week is Cleanaway Waste Management (ASX:CWY). Capitalised at $6bn, it is Australia’s biggest waste…

Investors are excited about Core Lithium’s planned re-start of Finniss! But here’s why they’re overreacting

Core Lithium’s (ASX:CXO) planned re-start of Finniss has got plenty of investors excited. Shares closed yesterday 35% higher than the…