Infomedia (ASX:IFM) is set to rebound strongly in CY24 with the worst of the Tech Wreck behind us

![]() Nick Sundich, February 6, 2024

Nick Sundich, February 6, 2024

Infomedia (ASX:IFM) is one tech stock that was unfairly sold off during the tech-wreck, but is gradually rebounding with a vengeance.

The company has a long-term track record of growth, has remained profitable and is at the forefront of several trends in the automotive industry.

Who is Infomedia?

Infomedia, which was founded in 1987, provides cloud-based parts and service software to the global automobile industry. It has over 250,000 active users in 186 countries and it has a healthy geographical mix of revenue (37% from the Americas, 32% from the Asia-Pacific and 31% from Europe).

Infomedia has four key products which complement each other while proving their individual worth at different stages of the vehicle and customer lifecycles:

MicroCat – EPC parts solutions focused on driving parts sales.

SuperService – Service quoting and vehicle inspection solutions.

InfoDrive – Vehicle and customer lifecycle management.

SimplePart – Grows sales of automaker parts and accessories.

Difficulties during the pandemic

Similar to many ASX companies with an overseas presence, business development activities were impeded by pandemic restrictions. The company was also rocked by the departure of 5-year CEO Jonathan Rubinsztein who ultimately joined Nuix (ASX: NXL). He was replaced by Jens Monsees who most recently came from WPP, but had some automotive experience, having spent over 3 years as Chief Development Officer for BMW in Munich.

Car sales have been volatile throughout the pandemic, not to mention road traffic, and this flows downstream to parts and servicing providers. Shareholders also did not like its initial FY23 outlook in which the company warned shareholders it was seeing a slower than expected growth rate in Simple Part along with product delivery and implementation delays. And there has been takeover interest in the company throughout 2022 but this interest has failed to convert itself into a final offer even with months of due diligence.

Although IFM was the one that chose to close the talks, investors suspected potential suitors found something in their due diligence that scared them away from closing a deal.

What are the Best ASX Technology Stocks to invest in right now?

Check our buy/sell tips

FY22 and FY23 were strong

In FY22, Infomedia generated revenue of $120.1m (up 23%) and EBITDA of $24.8m (up 29%). On an organic basis (excluding acquisitions), EBITDA was up 13% and revenue was up 8%. Infomedia’s NPAT halved from $16m to $8.2m although this was impacted by $14m of non-cash depreciation and amortisation plus the expensing of earnouts during the period relating to the SimplePart and Nidasu acquisitions. It closed the period with $69m in cash on hand, $147m in net assets and no debt.

Turning to FY23, Infomedia’s total revenue was $129.9m (up 8%) and its NPAT was up 16% to $9.6m, even with an acquisition earnout expense. It paid a total dividend of 4cps, representing a 2.8% yield.

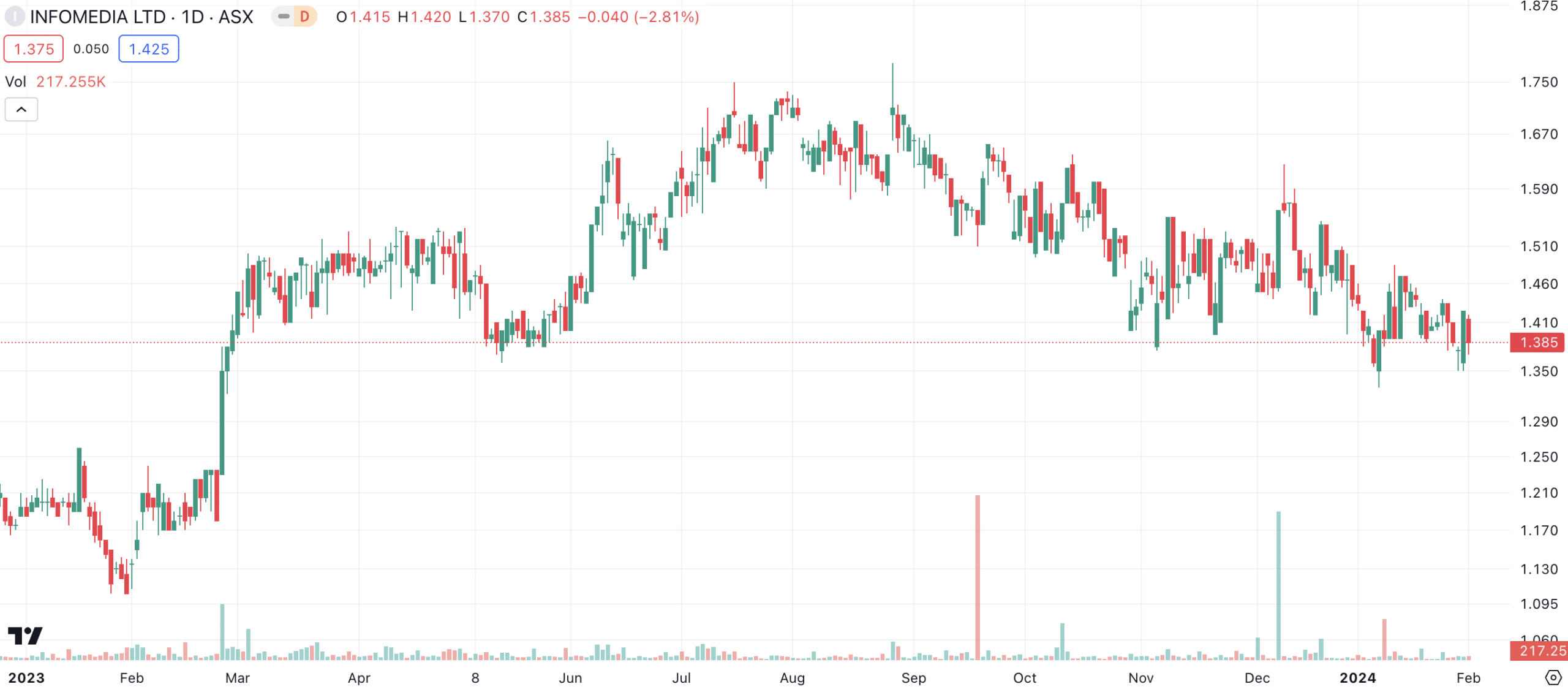

Infomedia (ASX:IFM) share price chart, log scale (Source: TradingView)

Growth expected in future years

Looking ahead to FY24, it is expecting revenue of $135-142m but has not given any other guidance besides that. Analysts covering the company expect $140.4m in revenue (up 8%), $59.4m in EBITDA (also up 8%) and 5c EPS, equating to a ~$18.8m profit (nearly double the year before).

For FY25, analysts expect $152.3m in revenue (up 8%), $61m in EBITDA (up 3%) and 7c EPS, equating to a $26.3m profit. These mean the company is trading at 7.7x EV/EBITDA, 20.6x P/E and a PEG of just 0.5x.

We think the company can capitalise on several trends being adopted in the automotive industry including electric vehicles, the dealer agency business model and data-driven marketing.

A brave new world

All of these trends are transforming vehicle innovation, dealer efficiency and customer expectations. OEMs, dealers, suppliers and industry stakeholders are evolving to pursue total brand experiences by capturing the abundance of information available in an increasingly connected world.

Infomedia can help its customers capture data, provide more personalised service to existing and would-be customers and monitor supply chains. We are also optimistic that the global automotive industry can recover to pre-pandemic levels – 75m vehicles were sold in 2019 and this figure is expected to be achieved in FY24.

Our model of Infomedia

Last year, our friends at Pitt Street Research valued Infomedia at A$2.13 per share base case and A$2.93 per share bull case. The revenue model modelled growth for each of IFM’s four software assets (MicroCat, SuperService, InfoDrive and SimplePart) over the next decade, and modest expense growth in line with inflation. We used a WAAC of 10.62%.

This is derived from a risk-free rate of Return of 3.8%, in accordance with the 10-year Australian government bond at that time, a 1.37 beta (the current average beta for Application Software companies) and a 5% equity premium. We did not assume any capital raisings given that the company is profitable. Our base case assumed 15% revenue growth from FY23 to FY25 for InfoDrive and SimplePart with 10% growth thereafter.

For Superservice, we assume 5.2% growth from FY23 to FY25 with 4% thereafter. And for MicroCat, we assume an average of 6% revenue growth from FY23 to FY25 and 5% thereafter.

The only difference between our base and bull cases is that we have added 25% higher revenue growth assumptions for each of Infomedia’s products. For instance, in the latter example of SuperService, we assumed 6.5% growth from FY23 to FY25 with 5% thereafter.

Key risks with Infomedia

We think the main risks for this company are those typical to software companies. Namely, the risk of customer churn and competition. Products can become out of date at a more rapid pace than in any other industry. But, judging by the company’s growth and popularity in recent years, Infomedia has kept up with customer needs and has the cash balance to undertake further M&A activity.

We trust it can keep existing customers and win new ones. Case in point, in late 2020 it won a ~$14m contract with Ford Europe, which switched to Infomedia from a company that it actually part-owned.

We wouldn’t be surprised to see new takeover bids for Infomedia in the near future at a significant premium (they’ll have to be for management to entertain the bids). But we think it has a positive enough outlook in its existing business to make it a compelling investment. This is before you even consider its multiples and possible future expansion of its product suite.

What about a takeover?

Could companies try to takeover IFM again? This question cannot be answered with certainty. But we can say with certainty that any would-be bidders would have to make an offer at a significant premium to attract the attention of IFM and its management.

We don’t think that shareholders should own IFM simply because they think that it will be acquired for three reasons. First, we think that if the company executes on its current strategy, it can re-rate without takeover bids. Second, there may be strategic interest beyond a simple takeover offer, for instance a merger or commercial alliance with another company. This could create more value for shareholders down the track beyond an M&A deal in the next 6-12 months, or even beyond what we have forecasted in our model.

And third, we think many takeover bids towards ASX tech companies were opportunistic bids, driven by favourable exchange rates for US companies and share price declines. We would expect less M&A activity in the tech sector next year.

Infomedia is a solid company

Infomedia is one of our favourite stocks, both amongst SaaS stocks and generally, at the moment. We think it has a very positive outlook in its existing business given the favourable trends in the car industry. We also like that it is profitable, reasonably valued and has potential to undertake further value accretive M&A.

What are the Best ASX Stocks to invest in?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…

Here’s why drug reimbursement is so important for ASX healthcare stocks

Let’s take a look at the concept of drug reimbursement, something that is crucial for ASX healthcare stocks looking to…