Objective Corporation (ASX:OCL) is a superb ASX 200 tech stock

![]() Nick Sundich, February 7, 2024

Nick Sundich, February 7, 2024

Objective Corporation (ASX:OCL) is one of a kind.

There are few companies with a 2-decade listed life without raising a cent of capital and even fewer that have been 65%-founder owned all the while. Objective Corporation is one such company.

It may seem like it has had its run and can’t get any bigger, particularly amidst the Tech Wreck of 2022-3. But we think that Objective is solid enough with its existing clientele and still has plenty of growth potential.

Who is Objective Corporation?

Objective Corporation has software products that can handle common problems or manually intensive tasks local governments and businesses in highly regulated sectors undertake on a daily basis as well as to store data. This software increases the ease, security and efficiency with which such tasks can be accomplished.

For example, one of Objective’s recently won clients was the New Zealand Police Force which chose Objective to manage the registration and licensing of all firearms in New Zealand, an outcome of the Christchurch mosque attack in 2019.

Self-funded since IPO

When it was founded, Objective Corporation was an on-premise license business, but has transitioned into a subscription model. It makes over 75% of its revenue from Australia, but also has a significant presence in New Zealand and the UK.

Although the latter two jurisdictions make up a small proportion of total revenue (23%), they have a higher share of local councils as Objective Corporation customers (90% of councils in New Zealand, 70% in the UK but only 40% in Australia). It is targeting expansion into the US over time.

The company IPO’d in mid-2000 at just 50c per share, raising $6m. It has not raised a cent of capital ever since and has been 65% owned by founder and CEO Tony Wall.

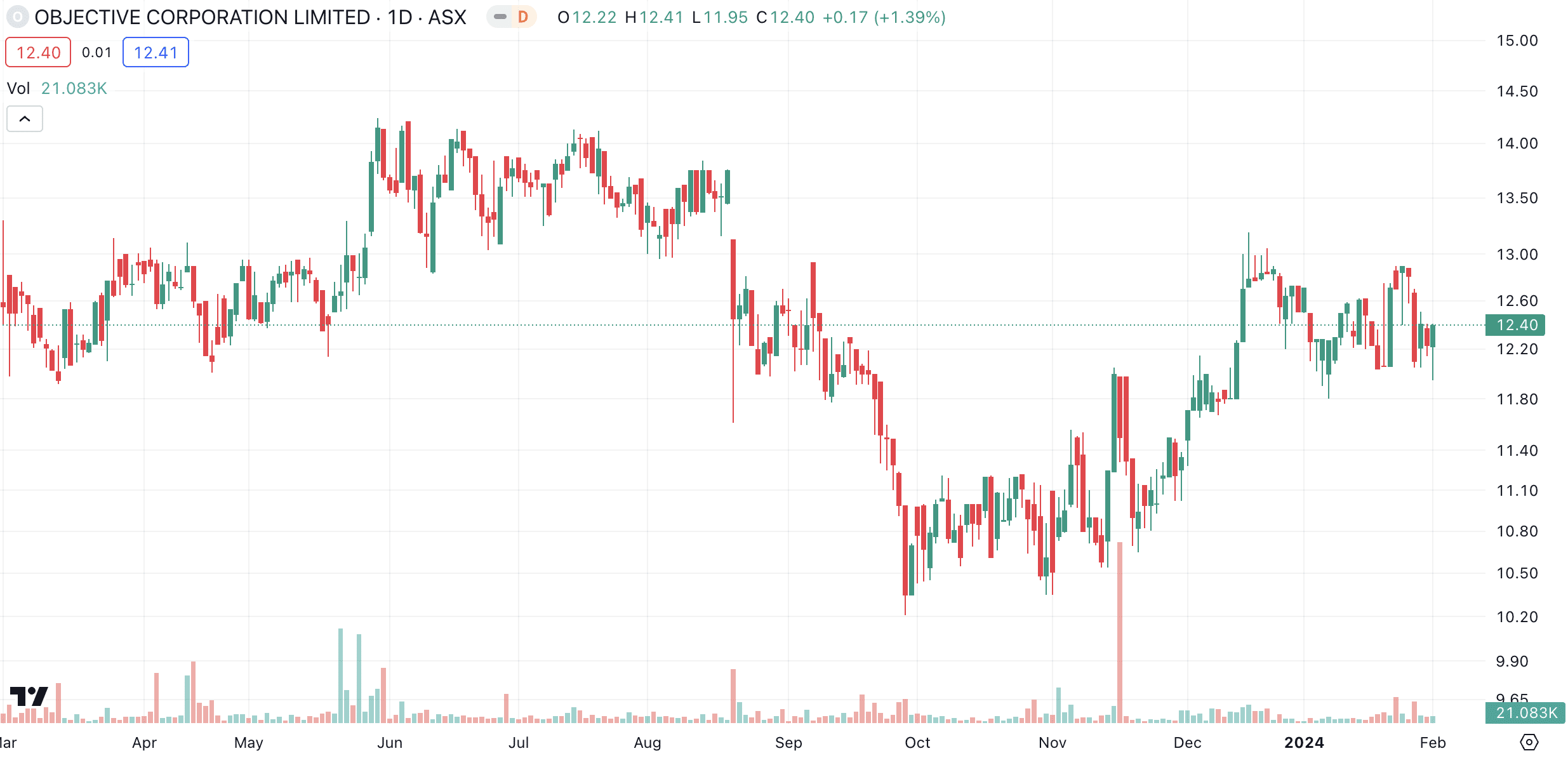

Objective Corporation (ASX:OCL) share price chart, log scale (Source: TradingView)

The Cloud transition is only just getting started

Since the pandemic, it is easy to think that the transition to the Cloud is virtually complete and that the ‘Big Tech’ stocks cannot get any bigger (at least in the current environment).

But we note two observations by Goldman Sachs that put to bed these theories. First, that the transition of organizations from on-premises software to cloud SaaS is only 20% completed. And second, SaaS could be a US$800bn Total Addressable Market globally within an overall cloud software TAM of US$1tn. Today, global revenues are US$235bn (about 25% of global GDP) but enterprise IT revenues are much larger (at US$1.4tn). Goldman thinks that the Cloud could easily grab the latter and even more from non-digital spending.

Now this is all well and good, but worthless to a company if it cannot take a market share of this. But we think Objective Corporation stands out because of its market position, underpinned by its long-term track record. It has undertaken M&A but has primarily grown organically and innovated internally. And government spending only goes in one direction, in Australia up 4% on a CAGR basis since 1960 without ever declining in nominal terms.

Overcoming market challenges

For FY22, Objective Corporation made $106.5m in revenue (up 12%), Annualized recurring revenue (ARR) of $85.5m (up 15%), EBITDA of $30.7m (up 20%) and a NPAT of $21m (up 31%). It held $63.8m in cash (without a cent of external debt) and paid a dividend of 11c per share, up 22% from the year before but representing a yield of less than 1% and an EPS payout ratio of only 50%.

In FY23, Objective Corporation made $110.4m in revenue (up 4%) and a $21.1m NPAT (flat). Impressively, Annualised recurring revenue grew 10% to $94.2m and some product lines recorded strong growth of over 60% (specifically RegWorks and ECMaaS).

Solid outlook

For FY24, estimates call for $118.2m in revenue and a $31.4m profit which represent 7% and 48% growth. For FY25, $131.7m in revenue and a $35.2m profit, up 11% and 12% respectively.

Objective Corporation is trading at 25.5x EV/EBITDA, 37.4x P/E for FY24. These figures may suggest the company is overvalued, but we argue you get what you pay for. After all, its PEG multiple is less than 0.8x.

Our view

We built a DCF model for Objective Corporation and obtained a valuation of $16.64 per share, a 33% premium to the current share price. We used a WACC of 9.9%, representing a risk free rate of Return of 3.6%, a 5% equity premium and a 1.1x beta, along with a terminal growth rate of 2%.

We followed consensus estimates up to FY27 and assumed more modest 5% growth thereafter. We’ve assumed it can slightly grow its margins to over 20% from FY24 onwards.

A look at the risks

What are the risks with this one? Most obviously the risk of rising interest rates and inflation, particularly relevant for a tech stock seeking expansion in the US. Ironically, software has proven its ability to grow throughout economic cycles, yet investors will mark down the company because higher interest rates decrease the value of future cash flows.

Another one is the risk of cyber-attacks. Even though one of its selling points is military-approved levels of security, the Optus cyber breach depicts that there is always a risk in this regard. Other risks include talent shortages, wage inflation, competition from larger peers and the risk of higher churn.

You also have to bear in mind that the company has invested over 20% of its revenue on R&D for the past couple of years. Although this are hardly impacting profits right now, because these expenditures are 100% expensed when incurred, investors should still watch this figure closely. Still, this is below many of its peers (Xero’s R&D for instance is 43% of sales).

Not for the yield junkies

Objective Corporation isn’t a company for dividend investors, given its yield is low and unlikely to grow given future acquisitions and high R&D expenditure. ESG investors may also not like the risk of cyberattacks, even if some of its projects are ESG friendly – earlier this year it was hired by the Victorian government to help it enforce anti-wage theft regulation.

Finally, we observe that it has less upside than peer ReadyTech (ASX:RDY), which we have analysed here. But investors looking for a profitable tech stock with high-recurring revenues, growth potential, a sticky client base, and relatively lower R&D expenditure, have their company right here.

What are the Best ASX Stocks to invest in?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…