Iron ore producers on the ASX are under severe threat from China’s property crisis

![]() Marc Kennis, September 27, 2022

Marc Kennis, September 27, 2022

Iron ore under pressure as sticky inflation is pushing the global economy into recession

A key role of central banks is to conduct monetary policy to achieve price stability. The persistent global inflation has been forcing central banks around the world to keep driving interest rates up to bring inflation under control. As central banks’ task of maintaining price stability mostly comes before their task of maximizing economic output, there’s now a serious risk of central banks pushing the global economy into a recession.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

The ASX iron ore producers are in great danger

Although a looming recession is bad news for virtually all sectors on the stock market, one sector on the ASX that we’re the wariest of is the iron ore producers, because in case of a global recession, China’s already growing property crisis will likely turn into complete nightmare. That would mean substantially lower iron ore prices that can remain low for some time.

China’s property crisis is just getting worse

It is now almost a year since China Evergrande Group, one of the largest Chinese property developers, warned its bondholders about its extreme cash flow constraints and that it might not be able to pay back some of its US$300bn debt. In December 2021 it defaulted on interest payments to its offshore bondholders. Shortly after, some other developers in the country followed the same path and defaulted on their debts, including Kaisa and Fantasia (China’s real estate crisis deepens as big Shanghai developer defaults).

China’s strict Covid policies haven’t been helpful to its property developers

Since then, China’s property prices have kept on declining and the Chinese government’s strict Covid policies and widespread lockdowns have only made things worse for property developers. Hundreds of thousands of scared homebuyers are now refusing to pay their mortgages on off-the-plan properties as cash-strained developers struggle to complete housing projects on time.

Bad home loan debts are soaring

Almost 30% of all property loans in China are now classed as bad debts and we think it will get much worse when the average homebuyer’s spending power declines further in a recessionary scenario. That’s why we think witnessing a full-on Chinese property crisis is an increasing possibility that should be considered when making investment decisions in the current market.

Potential to exacerbate the current global economic recession

China has the world’s second-largest economy with more than 18% share of global GDP in 2021, according to World Economics. It is estimated that every 1% decline in the country’s GDP results in a 0.3% decline in global GDP. China’s real estate sector accounts for roughly 20% to 30% of its annual GDP. So, a severe Chinese property crisis would leave a substantial impact on the country’s economy, which would then leave an impact on the global economy to exacerbate the current recession further.

A broke Chinese real state would mean substantially lower iron ore prices

A Chinese property market that’s going broke would spell disaster for iron ore prices and Australian iron ore producers. The real state sector is a large part of China’s economy and its expansion has been a main driver of the country’s economic growth.

In FY21, Australian iron ore producers exported more than $130bn worth of iron ore to China, which stands for more than 85% of their total export value (Leading markets for iron ore). China is also the largest consumer of iron ore in the world and it accounted for more than 70% of total imported iron ore in 2021. Therefore, a slowdown in China’s real state growth would mean a significant decline in demand for iron ore and much lower prices for the commodity that can remain low for some time to come, in our view.

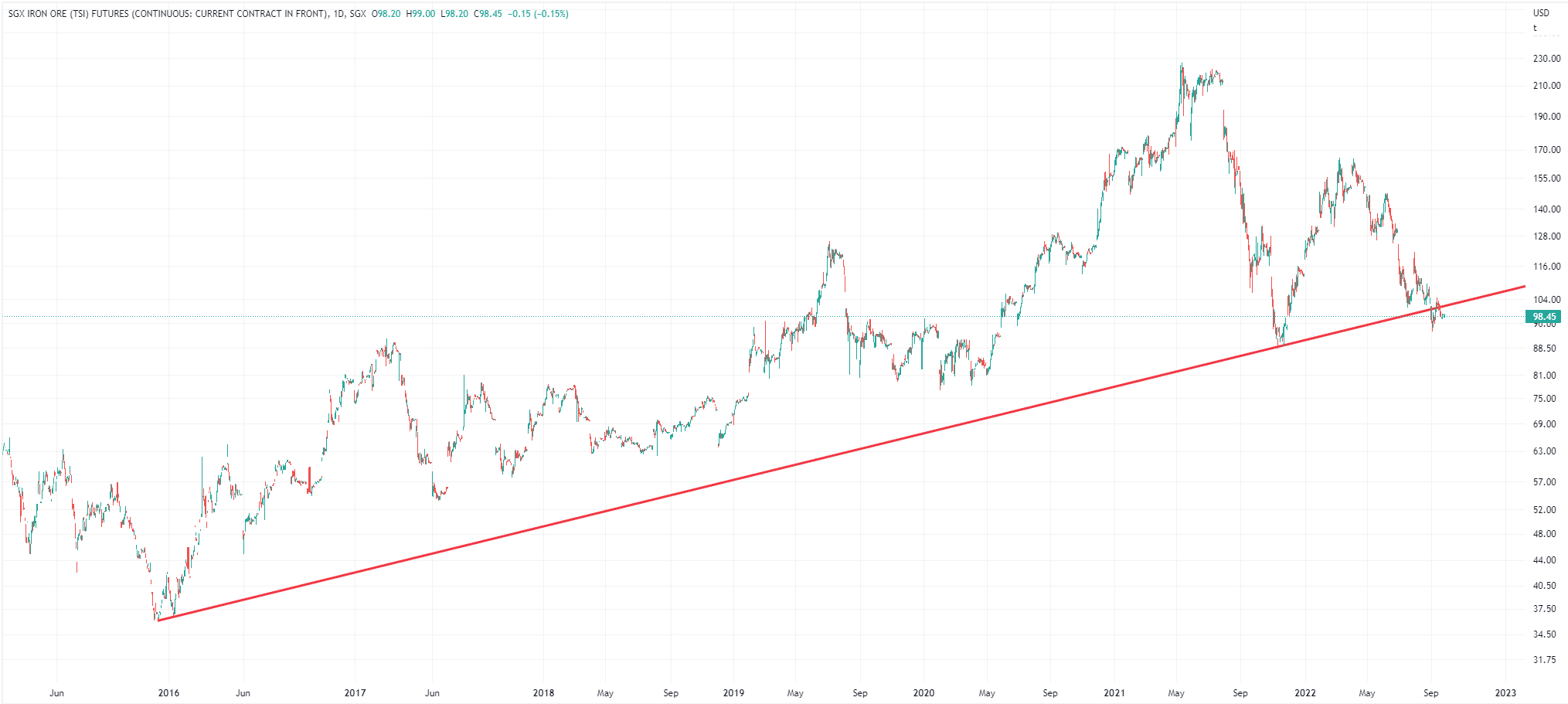

SGX Iron Ore futures, log scale (Source: TradingView)

Australian iron ore producers at risk

Some larger producers, such as BHP Group (ASX: BHP), with a more diversified range of products are likely to take a smaller hit than smaller pure plays, such as Mount Gibson Iron (ASX: MGX). Mount Gibson made an after-tax loss of $174m in FY22, which was partially the result of pre-tax impairments of $184m reflecting the impacts of lower iron ore prices. MGX produces low-grade iron ore and low iron ore prices can potentially make its operations completely uneconomical.

Be very careful with Fortescue Metals

Fortescue Metals (ASX:FMG) is one of the large players with a very significant exposure to China. Around 90% of its production goes to China, so if that country sneezes, FMG gets sick. We covered Fortescue in depth in the ASX200 edition of Stocks Down Under on Monday 26 September.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

The $3m super tax is coming! If you’re invested in equities, here is how it might impact you

It seems during the next 3 years, the $3m super tax will be officially a thing. Itwas blocked by the…

Northern Star Resources (ASX:NST): The $28bn gold miner that stands above them all

Northern Star Resources (ASX:NST) is by far the largest gold company on the ASX, capped at $28bn as of May…

6 ASX stocks you forgot were listed

Here are 6 ASX stocks you forgot were listed Brisbane Broncos (ASX:BBL) No it is not a mistake. This…