Island Pharmaceuticals (ASX:ILA): One of the rare ASX biotechs fighting mosquito diseases – and it’s in Phase 2

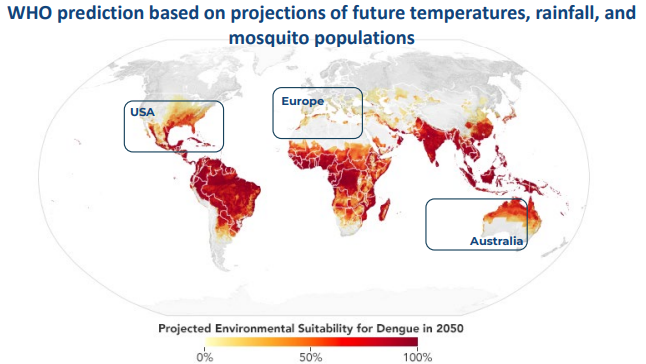

Island Pharmaceuticals (ASX:ILA) is one of the few (if not the only) ASX-listed Biotechs that is focused on mosquito diseases, primarily Dengue fever. Mosquito diseases, such as Dengue, are expensive to treat and are expected to proliferate due to climate change and the consequential boom in the mosquito population. But maybe Island Pharmaceuticals can help.

Introduction to Island Pharmaceuticals

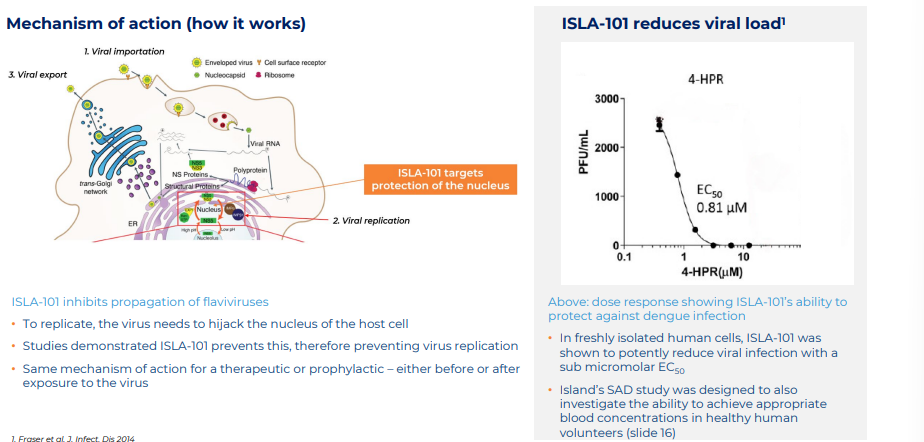

Island Pharmaceuticals’ flagship drug ISLA-101 was developed by Johnson and Johnson and initially purposed against cancer. After dozens of clinical trials, the biotech giant eventually retired the drug and donated the rights to the National Cancer Institute in the US. Pre-clinical work at Monash University identified the molecule’s potential to be an anti-viral drug. ISLA-101 works by inhibiting the nuclear uptake (propagation) of flaviviruses that include dengue, among other mosquito diseases, such as Zika and yellow fever, although not malaria because malaria is parasitic and not viral.

Source: Company

Island Pharmaceuticals was co-founded in 2017 by American biotech entrepreneurs William Garner and David Foster. The aim was to develop molecules for the prevention and treatment of mosquito infections, having observed the impact of Zika first-hand.

It listed at 25c a share in April 2021, raising $7.5m in the process, and went as high as 67c on the opening day. Notable investors include William Garner, who is the largest shareholder with a 26% stake, Jason Carroll who owns over 17% and another 9.7% is owned by Albert Hansen who is a director of Island as well as a managing partner of Kesa Partners.

Dengue is a problem

Dengue infects 400m people annually and ~500,000 of these are severe. The severe version of the virus, dengue haemorrhagic fever, kills 25,000 people per year. A further three billion people – nearly 40% of the planet’s population – are deemed to be at risk. Both figures are expected to rise in the future due to climate change. Dengue has recently been observed in areas where it isn’t formally expected, such as in France. Even traditional hotspots have seen rising case numbers.

Source: Company

It is also expensive to treat dengue fever. The typical hospitalisation cost in the US is US$7,040. Even then, no treatment is guaranteed to work, let alone a vaccine. There’s only a vaccine for secondary dengue infections – Sanofi Pasteur’s Dengvaxia. But it is never prescribed for primary infection, is only recommended for people between the ages of 9-45, doesn’t protect against all strains and there is some controversy with the clinical trial that led to its approval.

This is where Island Pharmaceuticals has been keen to make a difference.

Island is making progress

ISLA-101 was on a solid footing before Island Pharmaceuticals picked up. There had been 45 human clinical studies of ISLA-101 in other indications. In animal models, ISLA-101 was shown to be protective in dengue fever and Zika. In extremely lethal animal models, ISLA-101 was shown to prevent death in 70% of subjects. Island’s own Single Ascending Dose Study, completed in early 2024, and further modelling has reinforced safety/tolerability and identified ideal Phase 2 dosing (300mg/m2 twice daily).

And so now, the company is is about to commence a Phase II study, currently named PROTECT, short for PROphylactic and TrEatment Challenge Trial. ILA is collaborating with the US Army and its Dengue Human Infection Model (DHIM). It will commence after the end of the current mosquito season, which ends at the end of September. This is to ensure that the public is protected from unwanted transmission of the virus.

There will be 2 cohorts: An A cohort with 4 subjects randomized 3:1 (Active:placebo) & the B cohort (Phase 2b) that will include 10 subjects randomized 8:2 (active:placebo). The A cohort is a prophylactic or preventative arm, whilst the B cohort will be a preventative arm. This may seem like a small number of subjects for a clinical trial, but this will be used in conjunction with data from the US Army from a further 28 subjects.

It will be done at SUNY Upstate Medical Hospital in Syracuse. The trial will cost around US$1.1m. The trial is being aided with US$625,000 in funding from a Congressionally Directed Medical Research Programs grant, allocated by SUNY Upstate New York. Island Pharmaceuticals also has a CRADA (Cooperative Research and Development Agreement) in place with the US Army for ISLA-101.

There could be upside, and it could be realised soon

The fast pace of Dengue’s spread and ISLA-101’s mechanism means the company will have results from the first cohort by the end of CY24. A Phase 2b cohort will begin being dosed in January 2025. Results from the trial are expected in the first half of CY25, following which the company will conduct an end of Phase 2 meeting with the FDA. During and after the trial, the company will have ongoing discussions with potential partners.

After this, the next step would be a Phase III study which would be the pivotal clinical study, the passage of which could see ILA apply for regulatory approval. In parallel, Island will test ISLA-101 against other mosquito-borne indications such as West Nile, Zika, Yellow Fever and Japanese encephalitis – although not malaria.

Our friends at Pitt Street Research recently published a report on Island Pharmaceuticals which we commend to investors curious to find out more about the company. It valued the company at $0.31 per share in a base case and $0.41 per share in an optimistic case scenario.

Conclusion

The key risk with Island Pharmaceuticals is that there’s no Plan B if ISLA-101 fails at any stage of the clinical process. You need only look at the example of Factor Therapeutics back in 2018 to see what happens to single-asset biotechs that fail at Plan A. Keep in mind that there’s a long way to go before ISLA-101 is commercialised. It is also not certain that even if this eventually happens, ILA will be the company to make it happen. Back at its IPO, the company said the question of whether or not it commercialises the drug will depend on the results of Phase II and the potential costs of a Phase III trial. And as a clinical stage Biotech, Island Pharmaceuticals’ short-term share price will be vulnerable to investor sentiment towards the broader industry.

For those comfortable with the risks of clinical stage biotechs, we think Island Pharmaceuticals is worth a look at for two reasons. First, the unmet need for mosquito disease treatments. Second, the company’s solid investor register and management, as we outlined above.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Australian Dollar Hits Multi-Year High Against JPY: What’s Driving the Rally and Who Benefits?

Australian dollar jumps against the yen as rate gaps widen The Australian dollar has been on a tear against the…

Copper Surges Past $14,000 to Record Highs: What It Means for ASX Copper Stocks

Copper prices have surged past US$14,000 per tonne this week, reaching a historic peak of US$14,527 on Thursday before profit-taking…

Star Entertainment (ASX:SGR) Drops 16% Despite First EBITDA Profit in Quarters: Buy, Sell, or Wait?

Star Entertainment turns EBITDA positive but survival risks remain Star Entertainment (ASX: SGR) plunged 16 per cent to A$0.14 on…