Lamb Weston (NYSE:LW): Here’s why we like the world’s largest chip maker

Nick Sundich, September 18, 2023

If you like chips (or French Fries), you’ve most likely tasted Lamb Weston‘s (NYSE:LW) offerings at some point. The subject of week’s international stock deep dive is the world’s largest maker of them. And it just made a big plunge into the Australian market.

What are the Best stocks to invest in right now?

Check our buy/sell stock tips

Introduction to Lamb Weston (NYSE:LW)

Lamb Weston was founded in 1950 and is based on the outskirts of Boise, Idaho. It was named after founder Gilbert Lamb and the Oregon city of Weston where it was first founded. It specialises in frozen potato foods such as french fries, potato cakes and onion rings.

Foods in this category extremely popular foods and are continuing to be – across all age demographics. This company has increased its revenues from under $3bn to over $5.3bn in just 7 years. It sells 80m portions of fries sold every day worldwide in over 100 countries.

A fresh foothold in Australia

You won’t find Lamb Weston branded chips on supermarket shelves but it serves several wholesale customers including Merivale. It bought Marvel Packers in 2018, Ready Meals in 2019 and it just announced it was buying Crackerjack Foods last week. These companies too service Aussie fish and chip shops, clubs, pubs and other accomodation and hospitality venues with frozen processed potato-based foods.

Crackerjack featured in a limited edition Maccas menu which offered potato scallops. And potatos are a good space to be in, especially in Australia. Potato prices rose 20-25% in the last 12 months after a poor growing season in 2022. The shortage was that bad, that Coles put a temporary limit on the items last summer.

Why its a good opportunity now

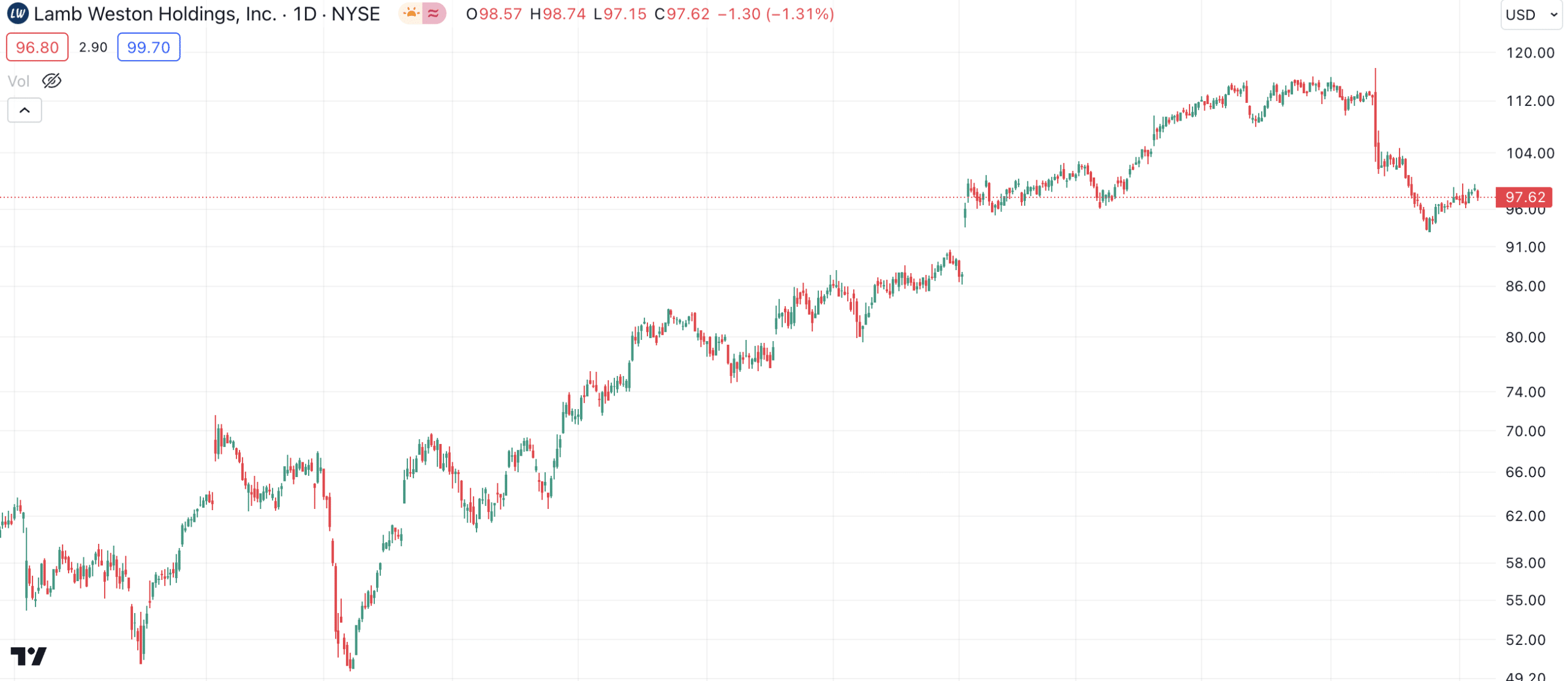

Although Lamb Weston shares are up 26% in the last year, they are down 13% in the last 6 weeks or so. Investors were spooked when the company delivered its most recent quarterly results. It uses a May 29-May 28 financial year for some reason and unveiled its results in July. It outpaced its own estimates, delivering net sales of $1.69bn and $1.22 EPS. But Lamb Weston warned about elevated potato costs, stemming from poor crops in North America and Europe. The company is also undertaking a $15m expansion of its Idaho facility which will enhance production capacity by 40% and necessitate an extra 12,000 acres of potato cultivation. Investors fear margins will be crippled for both these reasons.

Lamb Weston (NYSE:LW) share price chart, log scale (Source: TradingView)

Quite some upside left

It has guided to $6.7-$6.9bn in revenues for FY24 and EPS of $4.95-$5.40. Consensus estimates call for $6.8bn in revenue (up 25%), $1.5bn in EBITDA (up 22%) and $5.20 EPS (down 25%). In FY25, $7.2bn in revenue (up 6%), $1.6bn in EBITDA (up 8%) and $5.72 in EPS (up 10%). The mean target price is US$119.11, a 22% premium to the current share price of $97.62. This price represents 11.7x EV/EBITDA and 18.5x P/E.

We have valued the company at US$139.79, based on a blended DCF/relative approach. This is a 46% premium to its current price. Our relative valuation is $120.81 per share, using a P/E of 19.9x based on 10 of its peers. And our DCF is $158.77, using consensus estimates and a WACC of 8%. Consensus estimates have it growing net margins from 11% to 19% over the course of this decade.

The key risk with this stock is that consumer demand falls. The company has warned that the restaurant division is not performing as the consumer facing division. There is also the risk of a bad potato growing season for whatever reason.

Source: Paws Inc

Watch its next earnings release

The company is due to release its results for the first quarter of FY24 in early October. If it can deliver on its guidance, we think there is a good chance that the company can return to levels seen earlier this year.

Stocks Down Under Concierge is here to help you pick winning stocks!

The team at Stocks Down Under have been in the markets since the mid-90s and we have gone through many ups and downs. We have written about every sector!

Our Concierge BUY and SELL service picks the best stocks on ASX. We won’t just tell you what to buy – we give you a buy range, price target and stop loss level in order to maximise total returns. And we will only recommend very high conviction stocks where substantial due diligence has been conducted.

Our performance is well ahead of the ASX200 and All Ords.

You can try out Concierge … for FREE.

GET A FREE TRIAL TO CONCIERGE TODAY

There’s no credit card needed – the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Is the S&P 500 Really Doomed to a ‘Lost Decade’? Goldman Sachs thinks so, but will it eventuate?

The term ‘Lost Decade’ gets thrown about a lot, but most recently to the next decade to the S&P 500.…

Halloween Stocks: Here are 5 ASX Stocks that Will Benefit from Halloween

Here are 5 ASX Halloween Stocks! The Reject Shop (ASX:TRS) The Reject Shop is one of Australia’s most notable…

Here’s Why ASX Mineral Sands Stocks Are Gaining Momentum & Our Top 2 Picks

Mineral sands are naturally occurring materials that are made up of heavy minerals like zircon, ilmenite, rutile, and more. These…