Light & Wonder (ASX:LNW): With PointsBet out of the picture, is this the best way to play the US sports betting market in 2024?

![]() Nick Sundich, November 21, 2023

Nick Sundich, November 21, 2023

Light & Wonder (ASX:LNW) is now the best way to gain exposure to the US sports betting market on the ASX. Can it succeed where PointsBet failed? It certainly has a better chance, but is no certainty to succeed in a highly competitive market.

Introduction to Light & Wonder (ASX:LNW)

We used a picture of Las Vegas for this article for a good reason, because the company (fittingly) is based there. Light and Wonder claims it to be a leader in ‘cross-platform games and entertainment’, but it is a specialist in gambling applications.

This company has had a long history which traces back over a century, but it only got into lottery systems in the 1970s. It became Scientific Games Corporation in 2001 after acquiring a company by that name which made instant lottery equipment. By 2020, it had a diverse business in the gambling industry.

Dual-listed sports betting play

However, it also had $9.2bn in debt and was forced to sell its lottery and sports betting business to focus on casino gaming. It adopted the name Light and Wonder in March last year.

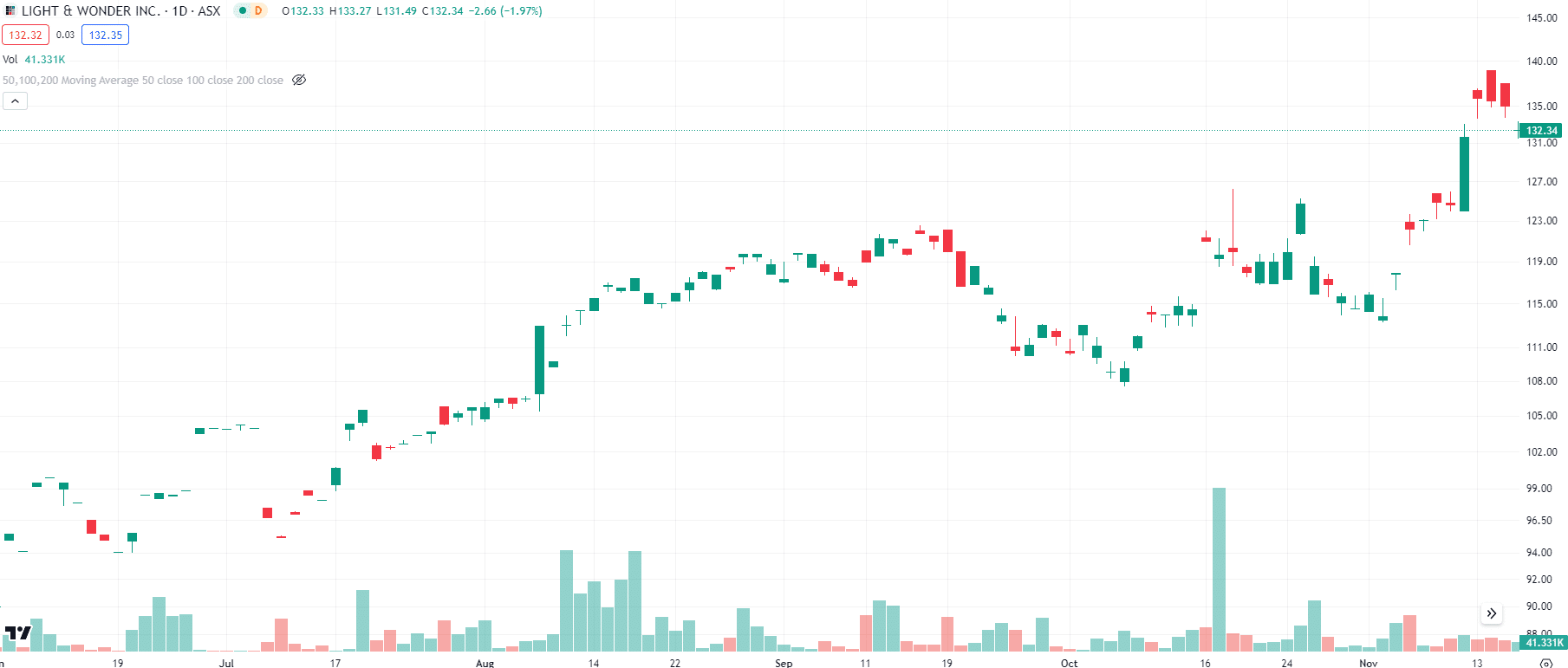

It has been listed on the Nasdaq for several years, but only listed on the ASX at the end of May last year. The company opted to list Down Under due to interest from Australian fund managers that could only invest in Australian-listed shares. It retains a NASDAQ listing, however, but has performed well since its ASX listing (unlike Block).

Light & Wonder (ASX:LNW) share price chart, log scale (Source: TradingView)

The opportunity PointsBet couldn’t crack

From June 2019 to June 2023, PointsBet (ASX:PBH) appeared to be the best bet for ASX investors to gain exposure to the US betting market.

You see, sports betting over there is way behind Australia with the practice only legalised in 2018, with America’s Supreme Court striking down a law preventing individual states (except Nevada) legalising sports betting. Five years on, only 33 states and the District of Columbia had legalised sports betting.

But the roll out was slower than investors anticipated and the company struggled to make money. It couldn’t enter all the states it wanted to because some states only allowed in-person betting and it had to pay licensing fees to states, not to mention significant marketing costs. By May 2023, PointsBet was only in 15 US states.

And so PointsBet bit the dust and cashed out on its US business. So the question is, can Light & Wonder succeed? It is difficult to give a yes or no answer, but we would note it is better equipped, being a larger and more established company,

How has Light & Wonder been performing?

Since its listing earlier this year, the company integrated social casino business SciPlay into the company, having swallowed up the remaining 17% it already owned.

It reported results for the September quarter in early November and this marked the tenth straight quarter of consolidated revenue growth, not to mention the fifth with double digit growth. Revenue was US$731m and it made a profit of $80m for the quarter (up from $648m and $20m respectively in the September quarter of CY22). For the first 9 months of CY23, it made $2.1bn in revenue and a $112m profit (compared to $2.1bn in revenue and a $197m loss in the first 9 months of CY22). All of the company’s divisions performed well, although it was iGaming revenue that performed the strongest, with a 21% revenue jump.

Evidently, Light & Wonder is in good shape financially. It does have debt of $3.9bn, but total cash of $891m and available liquidity of $1.8bn.

Solid upside potential

There are 12 analysts covering the company – 9 in North America and 3 in Australia. The mean target price is US$137.53 per share, a modest 5% premium. Analysts are expecting $2.9bn in revenue (up 16%) and a $162m profit. Comparison with the previous year is difficult because the core operations notched up a loss but the broader company recorded an enormous profit as it cashed out of non-core assets.

Looking ahead to CY24, analysts expect $3.1bn in revenue (up ~10%) and a $321m profit (nearly double the year before). In CY24, $3.3bn in revenue (up 6%) and a $432m profit (up 35%). The company’s P/E for CY24 is 25.3x. This may seem high for an ASX stock, but not for a US stock. If you believe consensus estimates, it is trading at a PEG of barely 0.3x.

The risks with this one are regulation and competition. However, the company is in a better position to succeed than PointsBet given its profitability and existing position in the US market.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips on the top Stocks in ASX

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…

Here’s why drug reimbursement is so important for ASX healthcare stocks

Let’s take a look at the concept of drug reimbursement, something that is crucial for ASX healthcare stocks looking to…