Looking for EV stocks other than Tesla? Here are 5 of the hottest ones

![]() Nick Sundich, February 10, 2023

Nick Sundich, February 10, 2023

Tesla (NDQ:TSLA) has undoubtedly been the pioneer among EV stocks, but it’s not the only one anymore. There are other pioneer EV stocks, not to mention traditional automotive stocks that are chasing market share in this growing market. But where are they all at?

SIGN UP FOR THE STOCKS DOWN UNDER NEWSLETTER NOW!

The hottest EV stocks that is not Tesla

One company is BYD (SHE:002594), a Chinese company that is actually a bigger seller in China than Tesla, selling 1.9m cars in 2022 when Tesla only sold 1.3m. It has benefited from selling vehicles at lower price points and not being forced to slow down production due to lockdowns in China (while Tesla was).

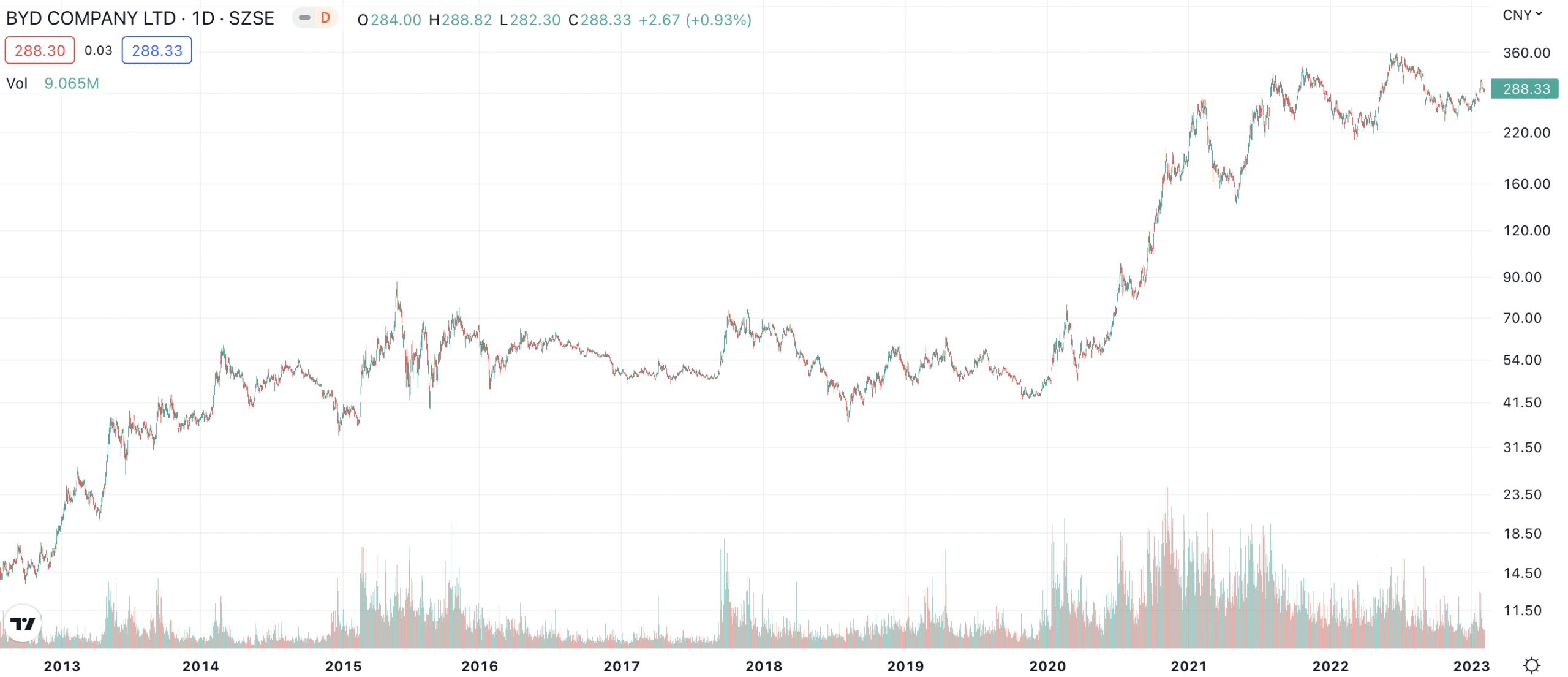

Warren Buffet invested in this company back in 2008 and still owns a 16% stake, despite selling over US$1bn in shares recently. This EV stock is up more than 350% in 5 years and more than 900% since 2011.

BYD (SHE:002594) share price chart, log scale (Source: TradingView)

There are other EV stocks, but they’re lagging the competition

There are several other emerging EV stocks including Nio (NYSE:NIO), Xpeng (NYSE:XPEV), Rivian (NDQ:RIVN), Lucid (NDQ:LCID) and Polestar (NDQ:PSNYW). But none of these have endured as significant share price growth as BYD over the last few years, because there is significant competition in the industry and these companies are lagging Tesla and BYD, not to mention traditional automakers that are turning electric.

For instance, NIO only sold 122,486 vehicles in 2022 and although this was higher than the year before, sales have begun to retreat in recent quarters given lockdowns in China (its primary market).

XPeng is in a similar situation, selling 120,757 cars in 2022 (up 23%), but it has been seeing year-on-year declines for four consecutive months now.

Although Rivian’s sales are growing strongly, it is well behind the competition having only produced 10,020 vehicles and sold 8,054 during 4Q22. Lucid only sold 2,000 in that same period, while Polestar sold 21,000.

You may not have thought of these companies as EV stocks

Traditional automakers may not be considered EV stocks at first glance. But these manufacturers are pivoting towards electric vehicles seeing the threat from Tesla. There are four in particular that we highlight.

First is European company Volkswagen (ETR:VOW3). It is one of the industry leaders, because it offers high-end luxury EVs, like the Audi e-tron and Porsche Taycan as well as budget models like the ID3 hatchback and ID4 crossover SUV.

The second major player is, Toyota (TYO:7203). It is producing popular hybrid vehicles such as the Prius and Corolla Hybrid alongside traditional gasoline models, including the Camry and Rav4 SUV.

The third is Detriot-based Ford Motor Company (NYSE:F). Ford is ramping up its EV operations very quickly, aspiring to reach a production rate of 600,000 per annum by the end of this year and is investing US$50bn to make it happen. It will be one of the few manufacturers to offer pickup trucks (known in Australia as utes). Ford’s shares have been under pressure in recent weeks due to supply chain issues that have led it to miss its guidance.

Finally, General Motors Company (NYSE:GM), one of America’s oldest automakers, has made strides towards becoming an all-electric automaker over the past few years. It recently announced plans to invest $27bn into developing 30 new electric vehicle models by 2025 under their new “EV Everywhere” initiative.

Toyota stands head and shoulders above the rest as the best long-term performer gaining 31% in 5 years.

Good EV stocks might be found where you’re not looking for them

It will be clear that Tesla isn’t the only EV stock anymore. There are several other companies, both newcomers and traditional carmakers, that are pivoting from internal combustion engines. But different EV stocks serve different market segments and are at different stages of their journey.

The EV market is undoubtedly a significant opportunity, but not all companies will grab the same share of the pie as others.

Stocks Down Under Concierge is here to help you pick winning stocks!

The team at Stocks Down Under have been in the markets since the mid-90s and we have gone through many ups and downs. We have written about every sector!

Our Concierge BUY and SELL service picks the best stocks on ASX. We won’t just tell you what to buy – we give you a buy range, price target and stop loss level in order to maximise total returns. And we will only recommend very high conviction stocks where substantial due diligence has been conducted.

Our performance is well ahead of the ASX200 and All Ords.

You can try out Concierge for 3 months … for FREE.

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

There’s no credit card needed – the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…