Lynas Rare Earths (ASX:LYC): The best of the bunch in a sector bound for better times

![]() Nick Spencer, February 15, 2024

Nick Spencer, February 15, 2024

Yes, we said it – Lynas Rare Earths (ASX:LYC) is in our view the best company in the rare earths sector, and we think the rare earths sector is bound for better times.

We know what you’re thinking – we are crazy covering a rare earths stock in such a positive light and for the most part, you’re right. The sector is going through a rough patch at the moment which may very well be here to stay. We do also think however, that current market sentiment towards critical minerals is the perfect chance to separate those that will be insulated from headwinds by taking a good old look at the fundamentals. This is where we believe Lynas has the chance to separate itself from the pack and shine in an increasingly proliferated rare earths sector.

Who is Lynas Rare Earths (ASX:LYC)?

Lynas is the world’s largest producer of rare earth materials outside China. The Lynas Advanced Material Plant—the company’s primary processing plant in Kuantan, Malaysia—is also the world’s largest rare earth extraction facility outside the Middle Kingdom.

The accolades don’t stop there. Lynas’ premier project at Mount Weld in WA comprises two elements; the mineral deposit there itself and a concentration plant nearby. The Mount Weld Central Lanthanide Deposit is rated as one of the highest grade rare earth deposits in the world. Mount Weld’s average head grade—the average grade of ore fed into a mill— is 14.8% compared to around 8% in Bantou, China—one of the world’s most critical processing facilities for global rare earths supply.

Lynas is also building another processing facility in Kalgoorlie, WA for closer proximity to its deposit.

After Kalgoorlie is built the way the operation will work is simple. The raw mixed rare earth concentrate will be mined at the deposit (who would’ve thought?) and then sent to Kalgoorlie to produce a mixed rare earth carbonate (MREC). The MREC churned out at Kalgoorlie will then be sent to Kuantan for further processing before a final product can be sent to the company’s mostly manufacturing customer base.

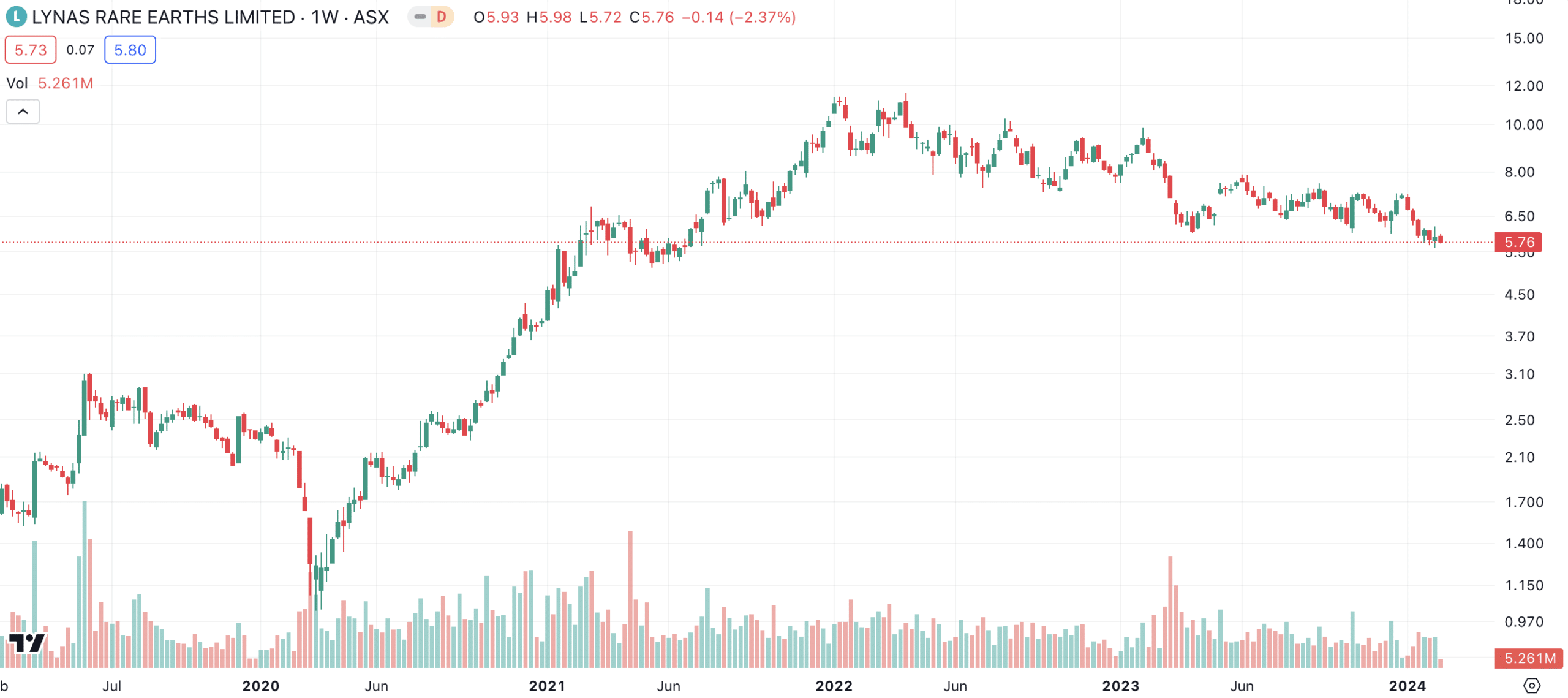

Lynas Rare Earths (ASX:LYC) share price chart, log scale (Source: TradingView)

A lot to like about Lynas, but there are some things to be aware of and to look forward to

Let’s look at some caveats facing the company. The only real caveat from an operational perspective is the fact that a major by-product of the processing at Lynas is radioactive waste, a fact that hasn’t gone unknown to either the locals or politicians in the region.

In fact, last year the Malaysian Government banned Lynas from conducting any cracking and leaching on its shores, a purification process that will take place at Kalgoorlie. So yes, political risks are a factor but not one that Lynas hasn’t proved adaptable to.

It is also continuing to diversify its production process as it grows, this year kicking off building a new facility in Texas as part of a contract to supply the US Department of Defence (DOD) and commercial customers in the states. The facility is currently set to be operational between July 2025 and June 2026.

There also may be some sort of trans-pacific partnership on the cards in the near future. Lynas just walked away from a mega-merger with MP Materials—the largest critical minerals company in the US—a transaction that would have created a global critical minerals superpower. In fact, the only reason the deal supposedly blew up is because of tanking commodity prices at the moment.

So we shouldn’t speculate too much, but Lynas may be active on the M&A front in the future. At the same time, we’d imagine the company will be more careful and selective about deals it attempts to undertake, given the damage to investor sentiment whenever a deal fails. For the record, we are not singling out Lynas here – this can happen to any stock when a takeover of it or another company it is trying to take over fails, even the best of companies endure this.

Taking a look at Lynas’ books

Lynas’ stats are solid. There is a consensus amongst all 12 analysts covering its stock that it is trading at over 20% below its fair value, indicating very strong fundamentals hedging the stock against the ruthless hand of the market.

The analysts’ agreement range is also spread less than 15% from the average, so it’s reasonable to say they’ve given Lynas a fair hearing. Remember, rare earths have largely been overhyped in the wake of the global transition to net zero by 2050 and as a result many stock prices have departed from their companies’ intrinsic values.

The fact that Lynas’ 5% share price volatility is significantly lower than both the market itself and its contemporaries within the mining and metals industry is testament to the fact that this company is one with strong innate value in which potential investors can trust.

This is fundamentally why we have focused on the company’s assets and projects rather than current market activity and the downturn in commodity prices. We think it’s partly irrelevant in the case of Lynas’ unique projects and endowments as well as the inevitability of the energy transition.

Let’s crunch some more numbers.

At -32.8% for the last fiscal year, LYC shareholder returns underperformed the Australian mining and metals industry that returned -8.2%. However, it’s important to note that the rare earths sector is nowhere near as close to as established as the iron ore and fossil fuel sectors that also are a part of the mining industry.

And when you get a bit more specific, Lynas is still a winner given its good P/E ratio (17.8x) compared to an average (20.2x) of four peers within the critical minerals space. Earnings and revenue are also forecast to grow by 19.9% and 23.6% per annum respectively on average.

The company’s Financial health is sound with a low debt-to-equity ratio (8.2%) and significantly more cash than leverage, protecting the company from potentially sustained high interest rates. The company’s short-term assets ($1.2B) substantially exceed both its short-term liabilities ($164.98M) and long-term liabilities ($310.3M).

Lynas might be a good opportunity, but…

To make a long story short, we think Lynas might be a smart opportunity if you’re in it for the long term but there is no excuse for not doing your homework on the rapidly changing market sentiment within the critical minerals space and the unpredictable commodity price swings seen in recent months.

So tread lightly and caveat emptor!

What are the Best ASX Stocks to invest in?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Paladin Energy (ASX:PDN) Jumps 10% as Revenue Surges Past A$177M

Paladin Energy (ASX: PDN) Surges as Uranium Producer Era Begins Paladin Energy (ASX: PDN) gave investors reason to cheer as…

Metal Powder Works (ASX: MPW) Falls 14% — Growing Pains or a Setup for Long-Term Gains?

Metal Powder Works Plunges 14% as Growth Story Faces Reality Check Metal Powder Works (ASX: MPW) took a sharp fall…

Blinklab (ASX:BB1): Is this exciting company the next ResApp?

Blinklab (ASX:BB1) is the answer to the question of how you could help children with autism – a response that…