Does Macquarie Group (ASX:MQG) deserve its reputation as the ‘millionaires factory’? And will it continue into FY25?

![]() Nick Sundich, February 19, 2024

Nick Sundich, February 19, 2024

Macquarie Group (ASX:MQG) has a reputation as the ‘millionaire’s factory’, and it did not just develop it by accident.

Despite it being a relatively young bank compared to the Big Four, it has grown into a company worth over $66bn. It oversees investments in over 30 countries close to $800bn and is even challenging the Big Four in the Australian home loan markets (being the next largest lender). It has grown by over 60% in 5 years, easily more than any of the Big Four. The last couple of years haven’t been as easy, however.

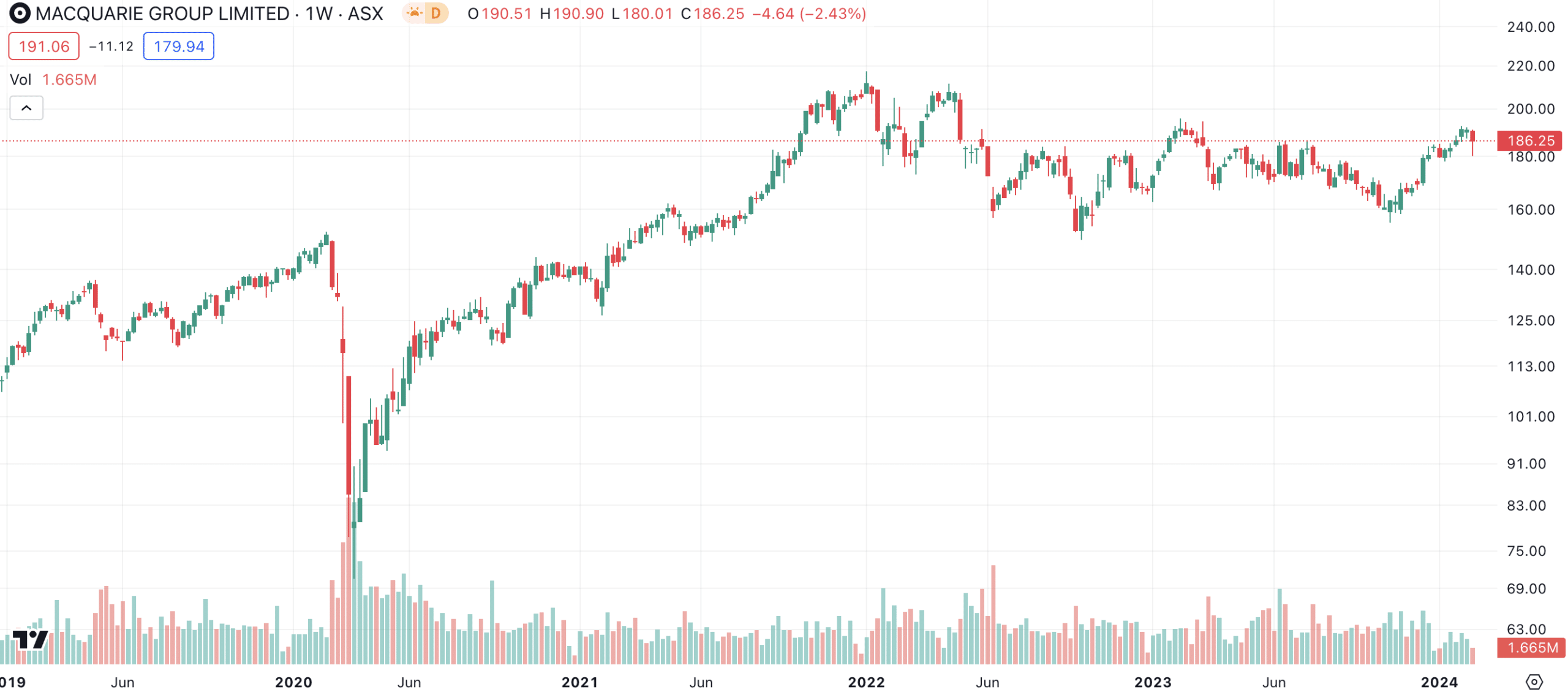

Macquarie (ASX:MQG) share price chart, log scale (Source: TradingView)

Who is Macquarie Group (ASX:MQG)?

Macquarie is a diversified financial services company. It is commonly called ‘Macquarie Bank’ and does indeed have banking services, although there is more to it than that. It offers Asset Management, Banking and Financial Services, Commodities and Global Markets Trading and money management (through Macquarie Capital). These are all four of its segments.

It is a relatively young bank compared to the Big Four (Westpac traces its origins over 2 centuries ago), although it has had a stellar run since its founding in 1969, when it was just a subsidiary of UK merchant bank Hills Samuel and just had 3 employees.

Why has it been successful?

We don’t have space to go into the full details that Joyce Moullakis’ and Chris Wright’s fantastic book The Millionaires Factory did, although in a nutshell it is because Macquarie has gone where no other Australian bank has gone. Namely, into offshore investments to the extent few other Australian companies have.

For 30 years under successive CEOs Allan Moss, Nicholas Moore and Shamara Wikramanayake, the Martin Place headquartered bank has done so and been very successful. This is largely due to its focus on disciplined and bold investing strategies, which have enabled Macquarie to identify attractive investments in markets where other players may not be able to do so.

In FY23, Macquarie made a net profit of $5.2bn, up 10% on 12 months ago, even in spite of choppy investment markets. It had $870.8bn in Assets Under Management and paid a full-year dividend of $7.50 per share. It has over 21,000 employees and over 200,000 people employed across its various investments.

Macquarie is also making strides the mortgage market with a $118bn loan book, a figure that is up 24% over the last decade and has given it a 5.3% market share. A decade ago, it had barely 0.5%. Macquarie has the best of both worlds being a digital-first lender but with a legacy in the financial services industry. It has a high-quality book with just over 50% of settlements with a LVR of 70% or less and only 2% of loans over 80%.

Losing some of its steam?

It has not been as easy in recent months. Being so exposed to industrial assets around the world, Macquarie Group is overly sensitive to rising interest rates and slowing economic activity. High interest rates are hitting infrastructure and real estate more vehemently than other sectors.

Its net profit in 1HY24 (which is April 1-September 30 2023) was $1.4bn, down 39% on 1HY23 and down 51% on 2HY23. Its Return on Equity was only 8.7% compared with 16.9% across FY23. And last week, it told investors its Net Profit After Tax for the first three quarters of FY23 (April 1 to December 31 2023) was ‘substantially down’. This has worried investors, although the result is more complicated than that.

Asset management stable

The Bank’s Asset Management Business saw stable AUM overall, at $882.5bn. Its Public Investments fell 2% to $535.1bn due to net flows and unfavourable foreign exchange movements, although its Private investments rose 1% to $347.4bn, driven by increases in asset valuations. It told investors it has $35.4bn of equity to deploy. Its Banking Business had total deposits of $135.6bn, up 3%, and a home loan portfolio of $117.9bn (up 3%). Car loans fell 8% to $4.8bn. Its Commodities contribution was not specifically outlined, although reported as down due to decreased inventory management and trading revenues in North American Gas, Power and Emissions. As for Macquarie Capital, investment banking fees have been depressed for several months as the IPO market has slowed.

What does the next 12 months hold?

Macquarie Bank follows an April 1-March 31 financial year and will report FY24 results during May. Investors shouldn’t expect too much to change in the coming few months. The good news is that base asset management fees will remain stable and its loan portfolio will grow. The bad news is expenses supporting loan growth will be higher and net operating income for Asset Management will be down subject to market conditions.

‘We continue to maintain a cautious stance, with a conservative approach to capital, funding and liquidity that positions us well to respond to the current environment,’ the bank told investors.

What the market things

12 analysts cover Macquarie and their mean target price is $188.80, roughly in line with the current share price. Consensus estimates for FY24 expect $16.9bn in revenue and $9.27 in EPS (up ~12% and ~30% respectively), the latter figure equating to a ~$3.8b profit assuming the same number of diluted shares on issue – 406.6m. For FY25, $18.5bn in revenue and $11.24 EPS (up 9% and 21% respectively from FY24 but still down from FY23), or a profit of $4.6bn. For FY26, $19.43bn in revenue and $12.99 EPS (or a profit of $5.3bn), figures that would surpass FY23.

Its P/E multiple appears cheap at 16.4x for FY25 when you consider it is below the ASX 200 average and the Big Four Banks. Its PEG looks good too at under 0.8x.

You could argue Macquarie is undervalued just because it is only A$70bn, a figure behind all of the Big Four banks despite all of the Big Four being predominantly focused on mortgages as a profit source and having (for the most part) failed in their offshore expansion strategies.

Time to buy Macquarie Group?

In our view, not at this exact point in time given the FY24 result may be received with some disappointment. However, Macquarie Group is a solid business without a shadow of a doubt and will bounce back in the years ahead, so it is always one to keep an eye on, and perhaps get into after its FY24 result is released.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…