Microsoft (NDQ:MSFT): There’s still a lot more growth left in this one

![]() Nick Sundich, November 7, 2023

Nick Sundich, November 7, 2023

Microsoft (NDQ:MSFT) is our International Stock of the Week, but it really needs no introduction. We all use its products in our everyday lives; it successfully transitioned from a hardware to a software company and then to a cloud company; is worth over US$2.5tn today and has managed a 50%+ return in 2023.

Sounds great, doesn’t it? But, how can a $2.5tn company get any bigger? We will tell.

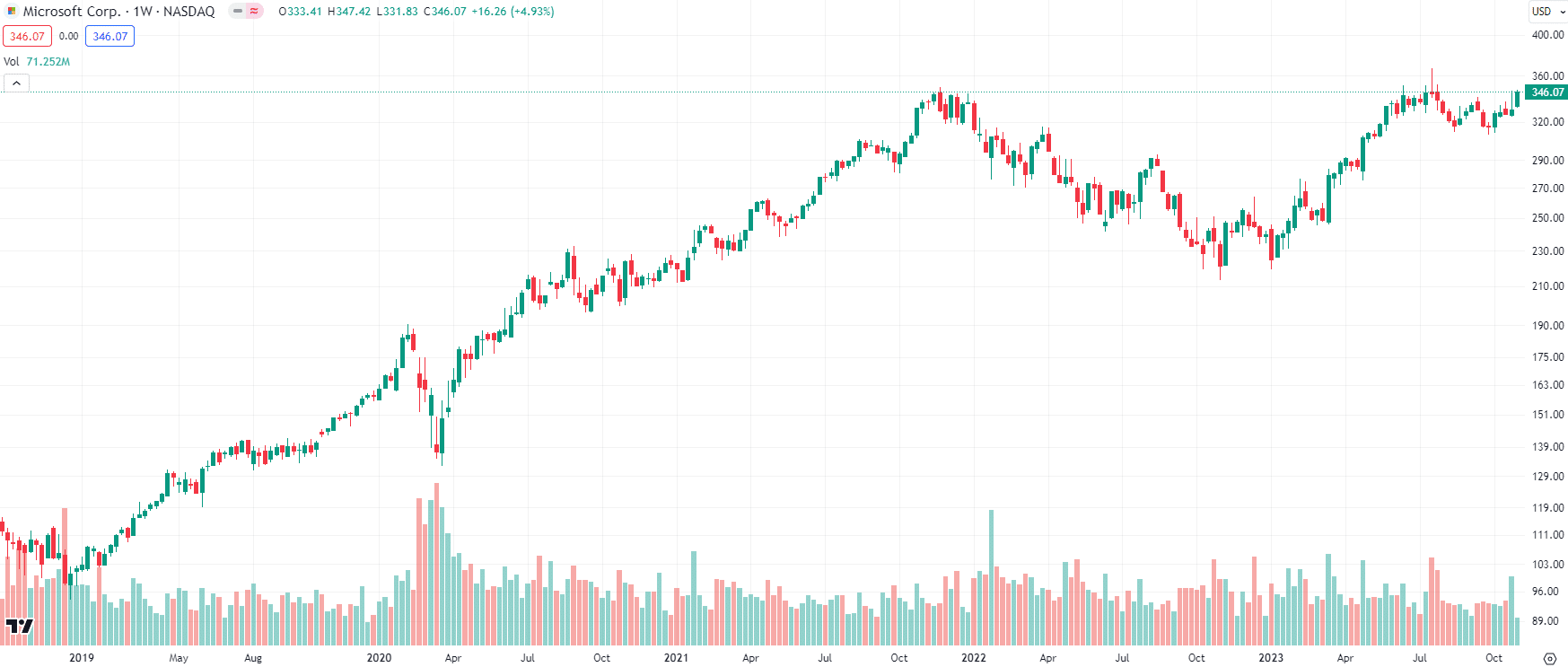

Microsoft (NDQ:MSFT) share price chart, log scale (Source: TradingView)

Introduction to Microsoft (NDQ:MSFT)

Look at Microsoft’s annual report and you’ll see it has several different segments – 10 to be exact. But 61% of revenue comes from 2 segments – Server products & Cloud services and Office products & Cloud services. Another 10% comes from Windows products. LinkedIn accounts for ~7%.

As you can see, it is a highly diversified business. It began in 1975 and went public in 1986, led by Bill Gates until he handed the reins over to Steve Ballmer. Ballmer was succeeded in 2014 by Satya Nadella who has held he role ever since. Over time, Microsoft rose to dominance of the tech world, then had to share power after missing out on the ascendance of smartphones even in spite of growing its sales and profits.

Under Nadella’s tenure, the company has sought to become Cloud focused. Microsoft revised its mission statement to ’empower every person and every organization on the planet to achieve more’. And its cloud ambitions are a big part of that – its products serve everyone from small business to the US Department of Defence.

Still growing and set to continue to grow

Take a look at its FY23 results (the company uses July 1-June 30 despite being a US company). It made $211.9bn in sales (up 7%) and a profit of $73.4bn. Although the latter figure was down 1%, it represented a 34% net profit margin.

And in the first quarter of FY24, Microsoft increased revenues 13% to $56.5bn and its profit (or net income) to $22.3bn, up 27%). Looking a decade ahead, consensus estimates (from 50 analysts mind you) call for nearly US$600bn in revenue. Yes, we know inflation is high, but not that high.

It is going to come from growth in the Cloud, that Microsoft is in a box seat to capture a huge share of with it an AWS holding up to 70% of all Cloud spending according to Ofcom. We have noted in a few article before some research from Goldman Sachs estimating that the transition to the Cloud is just 20% complete.

Goldman also estimated that annual revenues are US$235bn compared to enterprise IT revenues of US$1.4tn and the Cloud could easily grab that and even more from non-digital spending.

But just focusing on the near-term, good growth is expected in the next couple of years. Consensus estimates for FY24 call for US$242.3bn in revenue and $11.13 EPS, both up 14% from the year before, again roughly up 14% each.

So while it will be a long wait for all the expected growth to materialise, you won’t be waiting too long to see some of it come to fruition.

Our valuation

The 50 analysts covering Microsoft derive a mean target price of $402.97, a share price premium of ~15%.

We have valued Microsoft at $541.32 per share using a blended DCF/RV methodology, representing a 60% premium. Our relative valuation uses a 53x P/E, the average among all its peers, while our DCF uses consensus estimates, a 8.9% WACC and a 3% terminal growth rate. While Microsoft is trading at less than 30x P/E, many of its peers are higher. Amazon is at 41x, Snowflake is 190.8x, Adobe is 31x and Workday is 36x.

We think it is more than reasonable to expect that the

Short-term risks include high capex, the company has warned it will have to invest to keep up with demand. There have also been fears about big clients doing ‘cost-cutting’. Microsoft had denied this and instead called it a ‘cloud optimisation phase’ having spent so much during the pandemic and not gotten the return you should. But it is far from cutting back spending.

What are the Best ASX Stocks to invest in right now?

Check our ASX stock buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…