How much longer will Dexus (ASX:DXS) be down in the doldrums?

![]() Ujjwal Maheshwari, November 7, 2023

Ujjwal Maheshwari, November 7, 2023

Dexus (ASX:DXS) is one of the most prominent ASX-listed property companies, with a highly diverse and high quality portfolio worth A$61bn and led by CEO Darren Steinberg for an impressive 11-year tenure.

But it has been a difficult few years. Dexus remains well below its pre-COVID highs. And less than a fortnight ago, the company announced Steinberg’s departure in 2024 as part of a larger generational transition within the property sector. What does the future hold for the company?

Who is Dexus and how did it get where it is now?

Dexus has a $61bn portfolio with $17.4bn of owned property and $43.6bn of investments in its funds management business. It has a further $17bn of assets in the pipeline. Dexus has 182 assets in total, the majority of which are actually industrial properties. The most high profile of its industrial peoperties is Perth Jandakot Airport, the airport itself and highly valuable industrial estate surrounding it. However, the company’s office properties are more prominent because it owns so many high-profile offices in major Australian CBDs.

According to the company,’ Dexus’s strategy is to deliver superior risk-adjusted returns for investors from high-quality real estate and infrastructure assets’. Whether or not that is the case, it certainly hasn’t delivered a share price return for investors in its stock.

Investor confidence in the commercial property space has been shot because of all that’s happened in the last few years and how no one has any idea if things will ever be the same again. Just when the tide should have turned, in early 2022 as people returned to the office, interest rates started rising.

Dexus ended up recording a $1.6bn profit in FY22 but a $752m loss in FY23, directly as a consequence of $1.6bn in devaluations – both properties the company sold at a loss and those it wrote down due to rising interest rates.

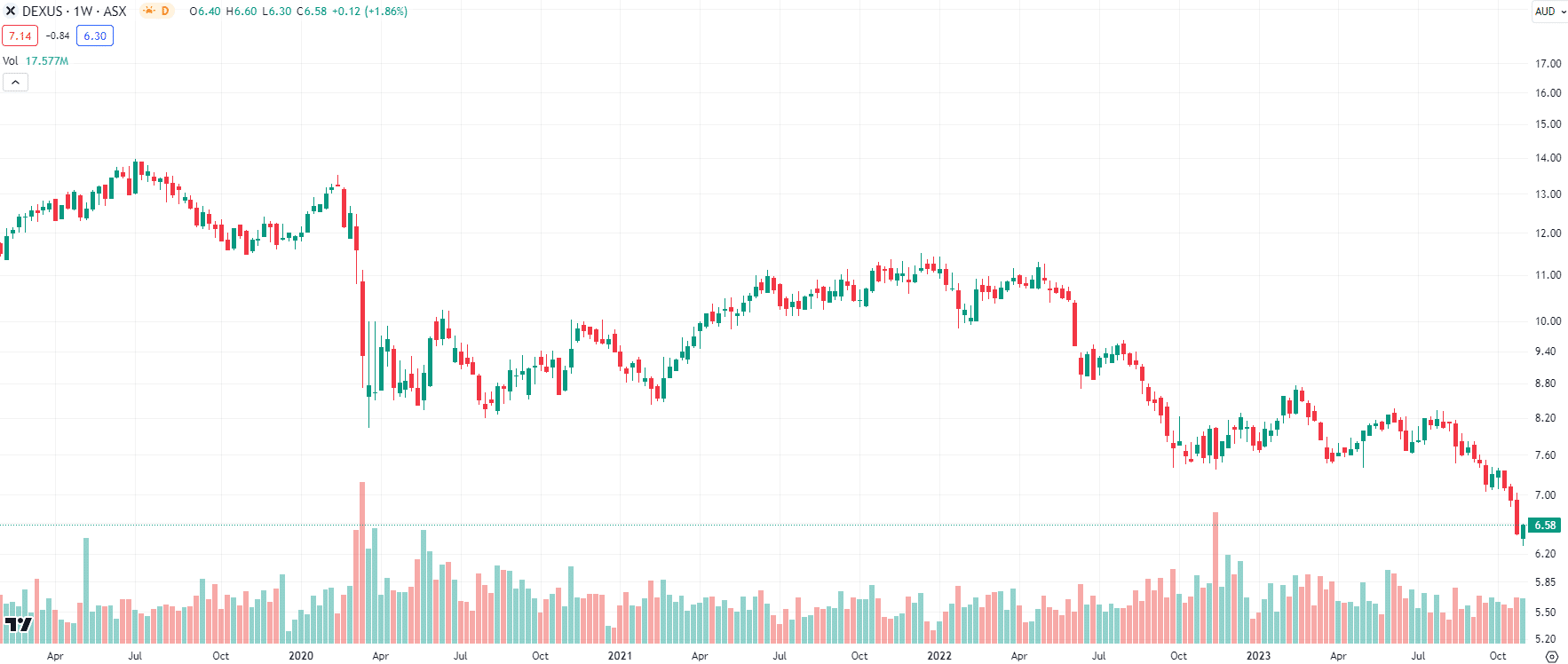

Dexus (ASX:DXS) share price chart, log scale (Source: TradingView)

A new era?

But let’s cut the doom and gloom and see if there is hope on the horizon.

Steinberg’s exit represents a significant leadership shift. The stock is down 3.3% During his tenure, he implemented crucial strategic changes in Dexus, including diversification of the company’s portfolio, reducing reliance on office assets, and expanding into the management of various real assets, including infrastructure. This forward-thinking approach has positioned Dexus to adapt to changing market situations.

Steinberg is actually one of several long-term executives to have stood down in recent months – GPT’s Bob Johnston, Mirvac’s Susan Lloyd-Hurwitz and Lendlease’s Steve McCann have also departed in the last two years. Steinberg will nonetheless stay on until a permanent replacement is found.

Dexus maintains a strong financial position, as demonstrated by its low gearing of 27.9%, which is below the target range of 30-40%. The company actively manages its debt, securing $2.6 billion in new and refinanced facilities, including a notable $500 million exchangeable note issue. The debt is well-hedged, with 86% of it protected against interest rate movements over the medium term.

Dexus has achieved high occupancy rates of 95.9% for office spaces and an impressive 99.4% for industrial properties. Additionally, the company has demonstrated strong rent collection, collecting 99.6% of rent.

Dexus’ acquisitions, including the buy-out of Perth’s Jandakot Airport and control of a significant portion of AMP Capital’s platform, significantly demonstrate its growth-oriented strategy. The company’s diversification efforts, especially in response to the COVID-19 pandemic, have proven timely and effective.

Investor Concerns and Valuation:

Investors have expressed concerns about valuations, leading Dexus’ stock, along with others in the sector, to trade at a significant discount compared to their estimated portfolio values. This could present an opportunity for investors seeking undervalued assets.

After all, the majority of its properties are industrial properties that are not facing as bleak an outlook. And while there may be more writedowns with its office portfolio, it is difficult to envision anything near the magnitude of what occurred in FY23.

Considering Dexus’ strong financial position and timely diversification efforts, the company appears well-prepared to navigate the challenges in the property sector. However, being mindful of the broader economic conditions, including interest rate movements and geopolitical risks is extremely important in the current volatile market.

Dexus presents a compelling opportunity for investors with a long-term perspective. The company’s diversified portfolio and strong financial position provide a solid foundation for future growth. However, we think a more appropriate entry point might be next year at its 1HY24 results.

This is because it is difficult to see any other catalysts before then and we might see an improving picture. We recommend waiting because we don’t know for sure how it will come out but we do know that if it is good, there could be more upside left, because it will be a slow and steady journey.

What are the Best ASX Stocks to invest in right now?

Check our ASX stock buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…