Mineral Resources (ASX:MIN): Its the most diversified ASX 50 mining stock, but it is highly undervalued!

![]() Ujjwal Maheshwari, January 23, 2024

Ujjwal Maheshwari, January 23, 2024

Mineral Resources (ASX: MIN) is turning heads on the ASX as a mining powerhouse. Beyond being the reason why Chris Ellison from Perth is one of Australia’s richest people, it is a Jack (or Jill) or all trades in the mining industry.

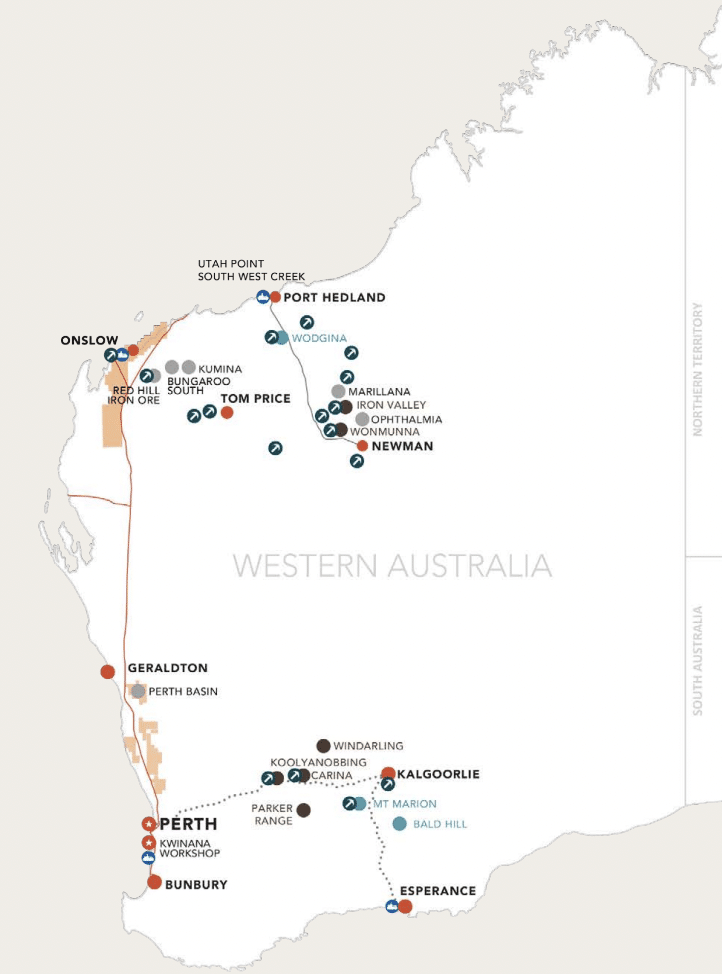

The ASX 50 company provides mining services, but also owns its own mines, including lithium, gold and iron ore mines. It is even an investor in micro-cap explorers, with one example being lithium newcomer Kali Metals (ASX: KM1) and another Delta Lithium (ASX:DLI). It may not be held in the same regard as BHP, Rio Tinto and Fortescue, but perhaps it should.

Mineral Resources’ latest endeavour – an investor in junior explorers

We thought we’d take a close look at the company’s move to purchase a 10% stake in Kali Metals. It is rare to see a large cap resources company take a big stake in a junior explorer. Rarer still, is to see it buy on market in the first couple of days of trading – the AFR reported it was actually blocked from participating in the pre-IPO meetings the company held with would-be investors. Chris Ellison has a near 5% stake held in his own name.

But of all explorers it could’ve bought, why Kali Metals? Because Kali Metals has exploration ground near Mineral Resources’ Mt Marion and Bald Hill mines. Kali has other projects too, including a joint venture in the Pilbara with SQM.

This isn’t the only junior Mineral Resources is doing any sort of business with. Last November, it struck a deal with Pantoro (ASX:PTR) to pay up to $60m plus royalties to secure lithium rights to its project. And Mineral Resources has a near 25% stake in Delta Lithium, which has the Mt Ida project that has a JORC Resource of 12.7Mt @ 1.2% lithium. Finally, it bought a 10% plus stake in takeover target Azure Metals (ASX:AZS), although the jury is still out in regard to what it is hoping to achieve there.

The core business is still going strong

Investors at Mineral Resources who attended the company’s AGM would’ve been greeted with a PowerPoint slide with Chris Ellison declaring ‘The past 12 months have been the most productive in MinRes’ history’. That statement may be up for debate, although there’s no doubt that the 12 months that were FY23 were successful.

The company increased revenues by 40% to $4.8bn and its operating cash flow by 383% to $1.4bn. It spent $1.8bn in capex and managed to generate a 6.7% Return on Invested Capital and close the year with $1.4bn in cash. It paid $1.90 per share.

We are more impressed with its track record over 5 years. It has quadrupled its EV, grown its ROIC by 22% on average and made 44% in Total Shareholder Returns (TSR) per annum.

Source: Company 2023 AGM presentation

There may be more upside – even if lithium prices stay in the toilet for a while

Mineral Resources is on track for increased profits with higher production levels on the horizon. Currently, its stock is quite affordable, trading at less than 22.6x P/E for FY24 and just 12.3c P/E for FY25. Its PEG multiples for those years are just 0.53x and 0.29x times. It is covered by 16 analysts and they expect $5bn in revenue, $1.5bn in EBITDA for FY24 (up ~10% and down 15%) respectively, followed by $6.3bn in revenue and $2.2bn in EBITDA for FY25 (up 26% and 44%). The 16 analysts covering the stock have a mean target price of $69.20, an 18% premium to the current price.

Hang on – you might say – what about falling lithium prices? Many lithium companies (such as Pilbara Minerals (ASX:PLS) and IGO (ASX:IGO)) are forecasted to have falling revenue and earnings for at least a couple of years, all because of falling lithium prices. Why should Mineral Resources buck the trend? Because it is not just a one-trick pony, it has exposure to other commodities, both through its direct mining operations and its mining services business.

Conclusion

Investing in Mineral Resources is a safer way to tap into the lithium market’s opportunities, minimising the short-term fluctuations. Its strategy of investing in smaller companies like Kali Metals adds further intrigue, opening up chances for considerable gains. And its core businesses have proven their ability to perform through multiple commodity cycles.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…

Here’s why drug reimbursement is so important for ASX healthcare stocks

Let’s take a look at the concept of drug reimbursement, something that is crucial for ASX healthcare stocks looking to…