Modi Stocks: Here are the best stocks to buy after the Indian election in 2024

Let’s take a look at so-called Modi stocks; in other words, stocks to buy after the Indian election. India may appear an attractive investment options to investors. Maybe you missed out on China and like the idea of another economy with a 1bn+ population but with a younger population and a democratic system (at least in theory). What’s not to like?

Well, it isn’t that simple. And even if it was, there’s not too many options on the ASX. All this being said, we thought we’d have a look at stocks that may benefit now that Modi has won the election. It is fair to observe as a general comment that stocks which have benefited from his regime will continue to, as it is tough to imagine any substantial changes.

Modi stocks provide the opportunity to invest in India, but how to invest?

The best way to invest in India on the ASX is via ETFs with a focus on the subcontinent. And there’s not that many. For those who do not know, an ETF is an Exchange Traded Fund. You can buy them just like ordinary shares in an individual company, but instead of owning one company you own a portfolio of companies.

One ASX ETF enabling ASX investors to invest in India is the BetaShares India Quality ETF (ASX:IIND). It purports to select the 30 highest-quality Indian companies based on a combined ranking of several factors such as existing profitability and earnings outlook.

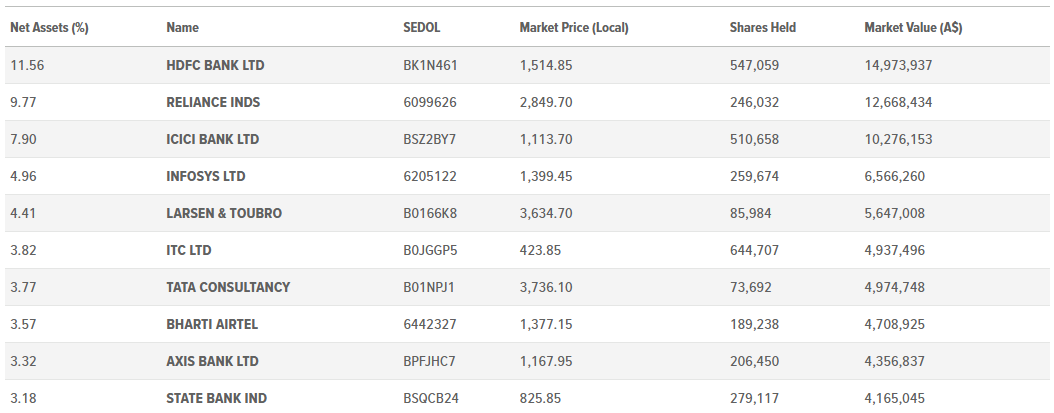

Another is the Global X India Nifty 50 ETF (ASX:NDIA) that tracks the Nifty 50 index, the key indice of the Indian stock exchange. Unfortunately, there’s not many individual companies that offer significant exposure to India, making it difficult to invest in India from Australia. Here are its top holdings.

Source: GlobalXETFs, as at May 31, 2024.

Specific stocks with exposure to India

One of the most notable examples was Buy Now Pay Later stock Zip (ASX:ZIP) that invested US$50m into local player ZestMoney. But we’ve heard little from Zip about this investment ever since as it focuses on the more established US market. Perhaps also because ZestMoney winded down at the end of CY23.

Findi (ASX:FND) is one company with exposure right now. This fintech company, which offers digital payments and banking solutions, won a 7-year contract to supply the State Bank of India with over 4,000 ATMs last year that will possess its own branding. The contract will offer $500-620m in revenue over the life of the contract. Findi was previously known as Vortiv and focused on cybersecurity, but pivoted in 2020.

Local fund managers

Investors seriously keen to invest in India, may wish to look for a India-focused fund manager or maybe even invest in local companies themselves, whether on local stock exchanges or perhaps even in private companies. But of course, international shares come with their own unique considerations and challenges that won’t need to be considered in respect of local companies. And that is before you even consider the unique complications of Indian stocks.

Although we will stop short of designation specific Indian stocks as ‘Modi stocks’, we would observe that infrastructure stocks should be winners so long as he doesn’t hose down the pace at which infrastructure is being built.

Why isn’t there more exposure to India on the ASX?

Despite the growth potential of investing in India there are a number of reasons why there are not that many individual companies with exposure to India, or even ETFs. You could argue companies do not want to be over-exposed to the market in the same way several companies (particularly infant formula stocks) became too exposed to China.

Furthermore, although the Indian economy is growing, most companies have little exposure to the global economies – they are essentially domestic only plays. And despite progress made by the Modi administration, infrastructure bottlenecks and red tape remain.

Finally, India is holding national elections next month. It may well be a fait accompli that Modi will win another term if he runs again, but perhaps some investors may wish to wait and see that he will get another 5 years.

Because there’ll be significant uncertainty for investors if he does not continue for another term. Even if he wins, investors may wish to look for clues as to what may change in the next 5 years, or indeed if anything will.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

Electro Optic Systems (ASX:EOS) US$42m Slinger Order Lands as Defence Demand Heats Up

New Highs, New Contract, But Valuation Is Now the Debate Electro Optic Systems has pushed to new highs on the…

Immutep’s Phase 3 trial for Efti has gotten the chop and shares plunge >90%! What now for investors?

After nearly a week in suspense, Immutep (ASX:IMM) confirmed news about Efti that its investors did not want to hear,…