OFX (ASX:OFX): After backflipping on its growth promises and spending months in the doldrums, maybe there’s light at the end of the tunnel?

OFX (ASX:OFX) shares shed more than two thirds of their value from October 2024 to June 2025 after a weak trading update. But its most recent trading update has shown there might be hope for shareholders.

OFX Share price chart, log scale (Source: Google)

Introduction to OFX

OFX was founded in 1998 by Matthew Gilmour and Gary Lord from the former’s house at Sydney’s Northern Beaches. The pair thought consumers needing foreign exchange services could get better service at a better price. From those humble beginnings, it was a slow and steady journey, but by the time it listed in 2013 at $2 per share, it generated $1bn in turnover and had a presence in several markets globally – in Australia, the UK, Canada, the United States, Europe and the Asia-Pacific. Unfortunately, there were tough times in the first few years with disappointing results, the loss of a partnership with Westpac and takeover interest from Western Union (at $3.70 a share) ultimately falling through.

What are the Best ASX Stocks to invest in right now?

Check our ASX stock buy/sell tips

But things have (overall) been better for OFX since it hired John Alexander (‘Skander’) Malcolm as CEO and pivoted from consumers to business – a segment that generates more recurring revenue. Typically, consumers only need forex services every now and again, but businesses that need forex services will need them regularly. Clients want competitive pricing, high standards of security, the ability to manage volatility risk of forex exposure and the ability to speak to a human being when things go wrong (not a chatbot) and OFX provides this enhanced service.

OFX’s business model is simple: Transferring money from one country to another. OFX will calculate the amount to be transferred to the account and transfer the funds, receiving them into its bank account in country A. Then its correspondent bank in country B will transfer those funds to the client’s bank account – minus its own fee.

Historically this was charged as a percentage of the transaction and was 0.5%, whereas larger institutions charged more. But now it’s a flat $15 fee if under A$10,000, but no fee if it’s above that amount. OFX also makes money by taking a forex spread on each acquisition – the difference between the rate quoted by OFX to its client and the cost for OFX to acquire the currency.

Clients can be consumers or businesses and the reasons for transfers are endless, from transferring money between family members or purchasing a vintage car or villa in another country. These can be one-off transfers, regular transfers or in some instances OFX’s software is integrated into a business’ own software to make transfers seamless. One of OFX’s most notable clients in the latter respect is logistics software giant WiseTech (ASX: WTC).

Will it deliver on its promises?

When OFX handed down its FY24 results (in May 2024, given the company uses an April to March financial year), it told investors that it would deliver at least 10 per cent NOI (Net Operating Income) growth per annum over the next 3 years. As well as an EBITDA margin of 28-30%.

Given its NOI was only up 6% (to $227.5m), its revenue and EBITDA were both up by smaller margins (plus its NPAT was down 10%), this may have been a tough ask to begin with. But investors have every right to hold you to account once you’ve made those promises as a company.

Five months later, in October 2024, OFX advised investors it would deliver NOI of $111m (down 3.5%) and EBITDA of $28m (down 8%). The company told investors that later then anticipated shifts in the interest rate cycle saw a slower rebound in consumer confidence. And this is not just in Australia, but even in the UK where Corporate transaction volumes were down 22% and Canada saw a 7% decline.

The company still expected NOI growth, but less than the 10 per cent promised, and for a 28% EBITDA margin which could be lower if there were unanticipated bad debts. Investors said it was still committed to those targets in the longer-term, but would provide an update on the medium term at its FY25 results due in May.

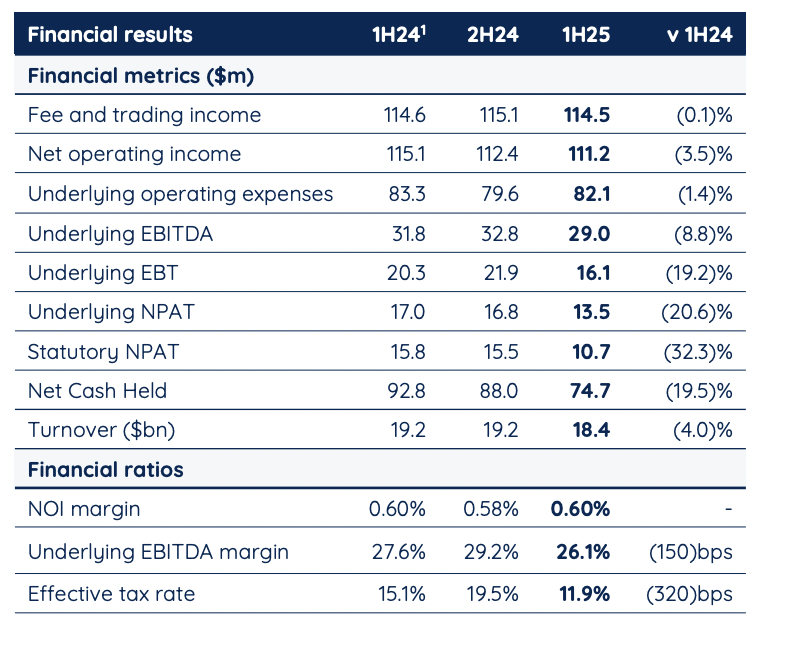

The company handed down its results a few weeks later and these were in line with is guidance. We would also note its underlying profit fell 20.6% and statutory profit fell 32%.

Source: Company

Good signs?

For the full FY25, the results of which came out in May 2025, it was not good. Its turnover only fell 1% to $38.1bn, but revenue fell 3% to $221.9m, EBITDA fell 11% to $57.7m and its profit fell 20.6% to $24.9m on a statutory basis. But the company said things would improve as it rolled out its New Client Platform. It also noted that the uncertainty in interest rates and tariffs caused problems, and presumably things would improve when there was certainty.

OFX reckons its NCP is a big deal because it transforms the company a FX/payment provider into an integrated financial operations platform tailored for CFOs and corporate treasury teams. Companies can manage currencies with local account details with many currencies, issue virtual and physical card, track and control expenditure, bulk invoice and do it all though dedicated business apps. On average holders spent over $11k per month.

In July 2025, the company issued a trading update which showed some good signs. Net Operating Income and revenue grew 11.3% quarter-on-quarter. The company claimed it reflected more stable conditions and momentum from the NCP roll out.

No guidance for FY26 was given, but consensus estimates expect a nuanced FY26 with modest $4m revenue growth and flat EPS. But FY27 will see growth to $242m (8% growth) but stagnant profit growth. The mean target price is $1.22, nearly 50% higher than the prior corresponding period. The company’s P/E if 16.5x and its EV/EBITDA is 3.1x – compelling, but analysts aren’t expecting the growth to justify either.

Conclusion

Would we buy this company? Probably not, at least until its 1H26 results, due in November 2025. You have to keep in mind that it is a l0w-margin business (with a <1 per cent NOI margin) with a small market share where banks and incumbents hold the majority stake. Yes, there’s potential for smaller providers that target SMEs rather than large corporates to do well, but it is difficult for companies to stand out other than branding and marketing.

We do take confidence in AEF’s major shareholding, and that it hasn’t been the most vulnerable to tough economic conditions, but we’d prefer to sit on the sidelines for now.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…