WiseTech shares are way overvalued because of 1 thing investors are missing

![]() Nick Sundich, March 11, 2024

Nick Sundich, March 11, 2024

Ever since WiseTech shares were under pressure in 2019/20 after a short-seller report and the Corona Crash, there’s been practically no downward pressure on its share price. The demand for eCommerce was a boom to the company. And whilst many eCommerce companies suffered from supply chain issues and inflation in 2022 and 2023, WiseTech is part of the solution. In our view, this is a good company, but it is too overvalued at the moment, especially given one thing that investors are missing!

Introduction to WiseTech

WiseTech’s main product is CargoWise One, a Cloud-based end-to-end logistics execution platform that freight forwarders and other logistics companies can use to manage their businesses. The product is sold in a subscription model and is customisable to meet customer needs. It also has the Xtrade messaging solution, that lets suppliers and customers share information as well as transport management solutions for truckload shippers.

The company was founded in 1994 and operated privately for over two decades before its listing. CEO Richard White has been there all the while and is still the largest shareholders. It is truly a global company with less than a third of its revenues coming from Australia and its 17,000 customers hailing from 150 countries. These include all of the Top 5 Global Freight Forwarders and 45 of the Top 50 Global Third-Party Logistics Providers (3PLs).

The good

WiseTech delivered $816.8m in revenue in FY23, up 29% overall and 21% on an organic basis, $421.1m in EBITDA (excluding M&A costs) up 28%, and a net profit of $247.6m (up 30%). In 1HY24, it made $500.4m in revenue, putting it on track to surpass $1bn in revenue for the first time. EBITDA was up 16% and NPAT was up 8%. Indeed, the company had guided to over $1bn in revenue for FY24.

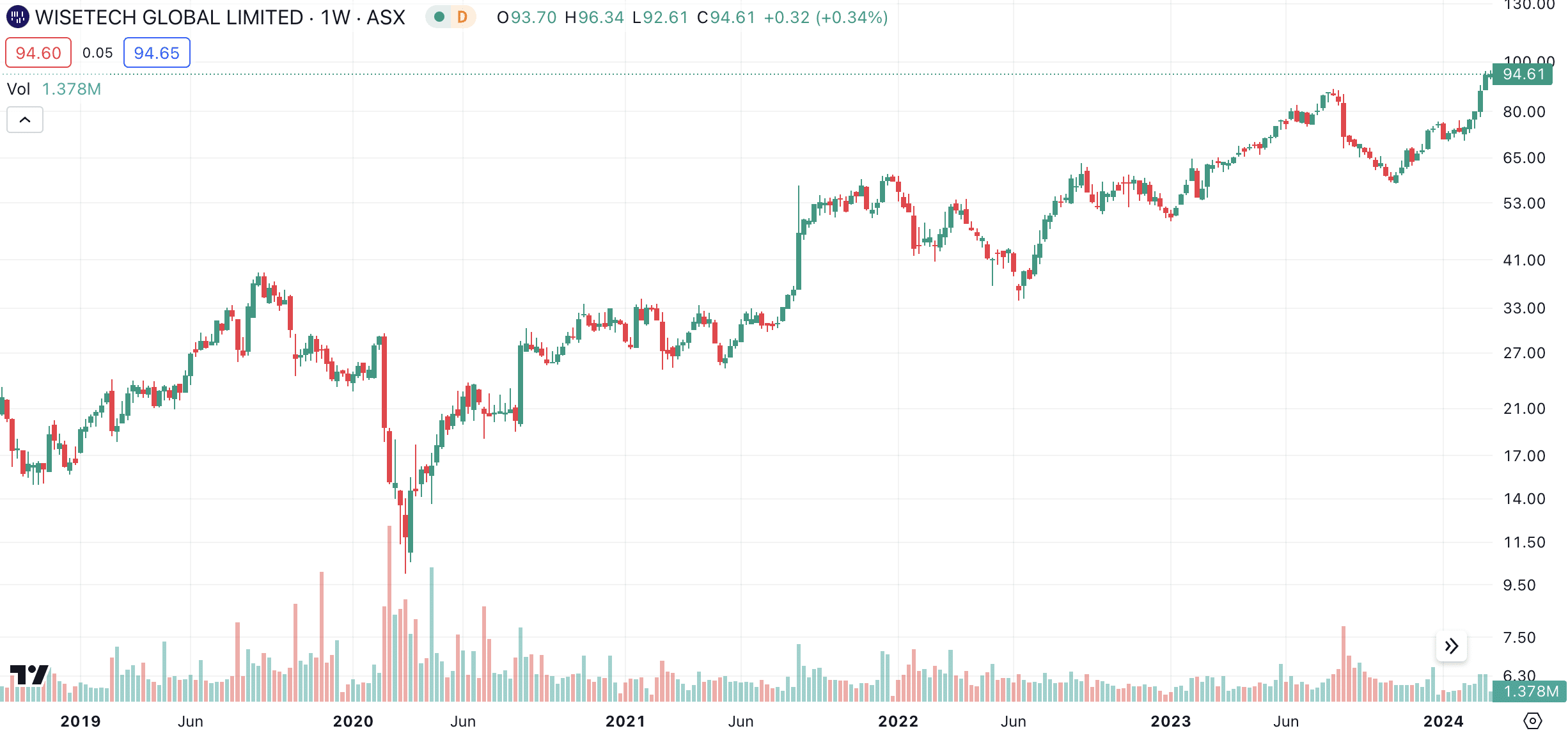

WiseTech listed in 2016 at $3.35 per share, so investors who’ve been in for the long term have been sitting on some pretty good gains.

WiseTech (ASX:WTC) share price chart, log scale (Source: TradingView)

The bad

We’re not going to accuse the company of irregular accounting practices as J Capital did. But we think investors are missing something blatantly obvious in WTC’s recent financial reports…that its costs are growing nearly as fast as its sales. The company needs to either control it more, or else any drop in sales could be bad for the company. Just look at Appen (ASX:APX) as an example as to what can happen to a high-growth darling when it stops being high-growth.

We also won’t accuse the company of being completely blind to this issue. It told investors it was undertaking a cost-cutting program that would see $15m net savings in FY24. And of course a big part of expenses has been product design and development, not to mention acquisitions. Also in its defence is its decent margins, high for a software stock – 26% NPAT margin by our estimations in FY23.

The ugly

But its operating expenses (including cost of sales, product design & development, sales & marketing and general & administrative) grew by 37% from $377m to $517m and from 59.7% to 63.2% of revenues. In 1HY24, expenses were up 40% from $171.2m to $239.5m.

You might argue, this is just the case with Tech stocks – that there’ll always be high expenses and they are worth it if there’s high revenue growth. But let’s look at a couple of WTC’s WAAAX peers. Xero’s expenses grew only 15% in 1HY23 and it went from a NZ$16m loss to a NZ$54m profit. Altium’s expenses in 1HY23 grew from US$80.9m to $97.9m, growth of 21%. These two peers kept costs in check as opposed to WiseTech!

What might happen

We have built a model that exactly meets consensus estimates for revenue and has no less than 24% growth over the next 4 years. If you assume WTC’s profit is slightly ahead of consensus estimates, its expenses would grow significantly, by 37% in FY24, 20% in FY25, 17% in FY26 and 18% in FY27. This may not be an issue if the company’s revenues grow, but obviously it will be if there’s slower top line growth. Our model generates a valuation of $54.66 per share, 40% below the current share price. The 17 analysts covering the company aren’t as bearish. but the median share price target is still below the current price, at $87.90. WTC is trading at a whopping 82x P/E for FY25 and a PEG of 2.8x!

Even putting this issue to the side, dividend investors wouldn’t like this stock because it has a policy of paying out just 20% of underlying NPAT. This is not unheard of amongst global stocks and you could argue investors should be grateful for anything. Not to mention it invests a lot in R&D. At the same time, there are other companies out there that could generate better returns for income-oriented investors.

Buying WiseTech shares is a gamble

If you’re buying WiseTech shares, you’re betting that revenues will keep growing enough to offset the high growth in costs. This isn’t too unreasonable to assume, although it would be naive to think nothing can go wrong for the company. For instance, a slowdown in revenue growth that isn’t matched by at least an equally large slowdown in operating costs. Again, we point to Appen that lost Google as a customer and wasn’t able to cut costs nearly enough to match the drop in revenues.

So, at these valuations… WTC buyer beware!

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…