PEP11 has been cancelled, and that’s bad news for these stocks

![]() Nick Sundich, January 21, 2025

Nick Sundich, January 21, 2025

PEP11 (Petroleum Exploration Permit 11) has officially been cancelled by the federal government. Federal Industry and Science Minister Ed Husic officially announced the call in recent days. This is bad news for two ASX companies – MEC Resources (ASX:MMR) and BPH Energy (ASX:BPH) (not to be confused with mining giant BHP) – with a stake in Advent Energy which has 85% of the project, not to mention Bounty Oil and Gas (ASX:BUY) which has the remaining 15%.

All about PEP11

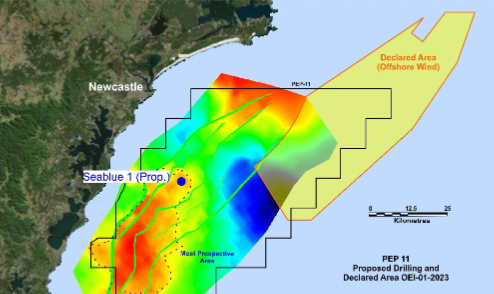

PEP 11 encompasses an area of 4,649 sq km in the basin that has multiple-cubic feet of gas and condensate-charged reservoirs, offering a substantial opportunity for commercial-scale gas exploration even with a single exploration well. The mapped prospects and leads are less than 50 km from the Sydney–Wollongong–Newcastle region and the existing gas pipeline network.

Advent has a total P50 prospective resource inventory (under the PEP 11 prospect) of 5.9tcf (trillion cubic feet). With an 85% share in the reserve, the firm will own an inventory of 5tcf. There are multiple prospect, but the best is 30km southeast of Newcastle that lies 2,150m below the ground surface.

There was hope that this new supply in the market could help with the gas shortages and subsequent high gas prices. Well, there was hope.

Source: BPH Energy

Morrison cancelled it, the court reinstated it, and Albanese has cancelled it again

Former Australian PM Scott Morrison opposed the extension of Advent’s PEP 11 license in December 2021, sighting opposition by local community; the suspension on exploration was being considered despite a recommendation from National Offshore Petroleum Titles Administrator (NOPTA) to renew Advent’s license in April 2020.

A few weeks after the change of government, in May 2022, Advent filed for a judicial review of the government’s decision in the Federal Court of Australia. On 14 February 2023, the Federal Court quashed the decision. A few days earlier, the new federal government and Advent had agreed informally to end that legal battle, but that still did not give it a formal approval.

Not helping matters was that the decision was delegated to Ed Husic rather than resources minister Madeline King – she excused herself after public comments she made in late 2021 opposing the project whilst in opposition came to light once more. Teal independents from the Northern beaches Sophie Scamps and Zali Steggall put pressure of their own on the government.

The government was taken to court in a legal action designed to force it to make a decision and issued a preliminary refusal. A final refusal was announced a few days ago.

Ed Husic released a public statement naming reasons why they were refused including ‘concerns about the applicants’ estimate of the cost of works and their ability to raise the necessary capital to fund the proposed works’ and also claiming Advent Energy (now called Asset Energy) was given an opportunity to respond to these concerns once a preliminary view was made and its response was considered.

So what now?

BPH and MEC have released identical announcements basically saying that suing was not off the table.

‘The Joint Venture has statutory legal rights to seek a review of the decisions referred to in the notice under the Offshore Petroleum and Greenhouse Gas Storage Act 2006 and is obtaining legal advice on such a review process,’ both statements said.

MEC shares fell 20% in the first hour and a half of trading on Monday whilst BPH shares fell by 18% in that same time frame.

Today’s decision does not rule out the prospect that there will ever be exploration and/or production in the PEP11 area ever again. But this would be contingent on Advent Energy successfully winning a new round of legal action which would take months to win at best, and come with no guarantee of success.

What are the Best ASX stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Top 3 AI Stocks to Invest in for Long-Term Growth

Artificial Intelligence is no longer a speculative technology of the future, it’s the defining driver of modern business. From predictive…

The Australian Federal Budget 2025: Which Sectors Will Win and Which Will Lose?

The 2025 Federal Budget has been released, sparking conversations across boardrooms, households, and political circles. Described as a “budget for…