ReadyTech (ASX:RDY) has terrific prospects to fly on the wings of Digital Transformation

![]() Nick Sundich, January 8, 2025

Nick Sundich, January 8, 2025

ReadyTech (ASX: RDY) is one of the best tech stocks on the ASX, in our view. It has a track record of growth, serves inflation-proof end markets and is set for good growth in the years ahead.

Who is ReadyTech?

ReadyTech provides SaaS technology in Australia and operates in three segments: Education, Workforce Solutions and Government and Justice.

The Education segment offers cloud-based student and learning management systems for education and training providers to manage the student lifecycle, including student enrolment and course completion. This segment also provides platforms to help state governments manage vocational education and training programs.

The Workforce Solutions segment offers payroll software, outsourced payroll services and human resource management software solutions to assist employers with payroll and management of their employees in mid-sized companies.

The Government and Justice segment offers government and justice case management SaaS solutions to local and state governments as well as justice departments. It also provides asset management, property, licensing and compliance, finance, HR and payroll, and customer management products.

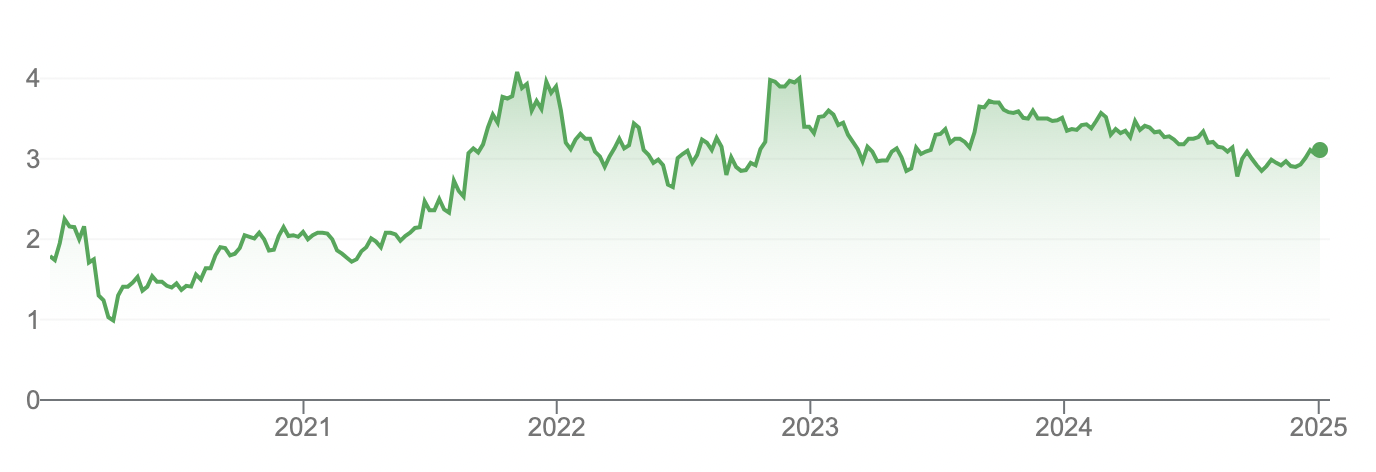

ReadyTech was founded in 1998 and listed on the ASX in 2019 at $1.50 per share. Although it is off its all time highs, it is still well ahead of its IPO price.

ReadyTech (ASX:RDY) share price chart, log scale (Source: Google)

COVID-19 has increased the demand for digital transformation – and the growth is not over

Organisations in all three segments of ReadyTech’s business – Education, Workforce and Government – are experiencing a growing and ongoing migration to cloud and SaaS. This digital transformation across all industries is nothing new, but what is news that this transformation has been accelerating in the wake of COVID-19 shutdowns as demand soared for technology-driven initiatives to enable remote work, distance learning, new customer experiences and new online sales channels.

But it is only just getting started. Goldman Sachs estimated last year that transition from on-premise systems to Cloud software is just 20% completed. It also estimated that annual revenues are US$235bn compared to enterprise IT revenues of US$1.4tn and the Cloud could easily grab that and even more from non-digital spending.

ReadyTech is well-positioned to benefit from the opportunities created by the accelerated digital transformation. The company is investing more than 30% of its revenue in research and development activities to align its products with different customers, including larger enterprises, where it can open up new market opportunities for its businesses. It has also engaged in M&A activity to make itself a ‘one-stop shop’ for its clients.

Good FY24 results and more results to come

In FY24, the 12 months to June 30 2024, ReadyTech recorded $113.8m in revenue ($95.4m of which was subscription revenue), a figure up 10% from the year before. The company boasted 22 major enterprise contract wins across all segments worth $12.5m. Average revenue per new customer was $119.1k.

ReadyTech’s underlying EBITDA was $38.8m, up 11.5% and representing a 34% margin. Its profit was $5.5m, up 9%. The company has advised shareholders to expect organic revenue growth to be in the low to mid double digits and a 34-35% EBITDA margin. It is aiming to achieve over $170m in organic revenue in ‘the medium term’ and a cash EBITDA margin of over 20%.

ReadyTech’s valuation is attractive

There are 8 analysts covering the stock and their mean target price is $4.01 – a near 30% premium to its $3.10 price on the first trading day of 2025. Consensus estimates for FY25 call for $126.8m revenue and $42.9m EBITDA (both up 11%). In FY26, $143.8m revenue and $50.5m EBITDA (up 13% and 18% respectively). In FY27, $162.1m revenue and $58.2m EBITDA (up 13% and 16%).

RDY trades at a P/E of 20.6x, EV/EBITDA of 9.3x and PEG of 0.35x for FY25. Looking to FY26 estimates, these translate into multiples of 15.9x P/E. 7.9x EV/EBITDA and an 0.28x PEG.

We expect ReadyTech to continue this notable rate of growth for the next few years as it is heavily investing in R&D and is opening doors to new customers and markets. Although the company is profitable, we don’t expect it to pay dividends for the foreseeable future as it has many growth opportunities and the company also states that it will remain focused on growth.

We think ReadyTech can double

We have constructed a model for ReadyTech and we think it is worth $6.14, nearly double its current price. We have used modelled with consensus estimates up to FY27 then assumed 10% growth thereafter. Its NPAT margin was 9.4% in FY23 and we assume it can maintain a similar margin for the years ahead. Our WACC is 11.07% derived from a 1.5 beta, a 5% equity risk premium and a 3.6% risk free rate of return.

So why is ReadyTech down?

Obviously the sentiment towards tech stocks has not been positive in the last 12 months. Although ReadyTech is profitable, it is only just so given M&A activity. And a $4.50 per share takeover bid ultimately came to nothing as a couple of substantial shareholders opposed the bid, considering it not reflective of the company’s long-term potential.

Microequities Asset Management told the AFR that ‘ReadyTech is a TechnologyOne in the making’. For comparison’s sake, TechnologyOne (ASX:TNE) has a $10bn market cap. So with RDY’s $377m market cap, that would be more than 10-fold growth if it was to reach those levels.

Nonetheless, it did take TNE about a decade to reach the levels it is at today – implying that ReadyTech has some way and time to go before reaching this valuation. The rejection of a takeover for upfront cash was hard for other shareholders to stomach.

ReadyTech will rerate

We are not optimistic that ReadyTech can become a $4bn company anytime in the short to medium term. But we do think the company has significant upside in the short to medium term. We would point to the example of Infomedia (ASX:IFM) which was sold off after a takeover bid ultimately came to nothing.

In IFM’s instance, there were 3 suitors that all did due diligence but IFM opted to end talks after a few months. Although the stock was punished in the short-term, it re-rated after IFM’s 1HY23 results that depicted that it really was a quality business. We expect a similar scenario to play out with ReadyTech come the next reporting season.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Frequently Asked Questions about ReadyTech

- Is ReadyTech Holdings an Australian company?

Yes, RDY is based in Pyrmont, NSW.

- Does ReadyTech Holdings pay a dividend?

No, the company uses its funds to grow its business for the foreseeable future.

- Is ReadyTech Holdings a BUY right now?

We think prices below $3.30 are attractive with a stop loss at $3.00.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Car Group (ASX:CAR): Successful in Australia, but now going for global growth

For most of the listed life of Car Group (ASX:CAR), it has been known after carsales.com.au; its original car classifieds…

Here are 6 ASX 200 stocks with low PE multiples – are they bargain buys?

Here are 6 ASX 200 stocks with low PE multiples Helia (ASX:HLA): 5.7x for FY25 Helia is a mortgage…

Top 3 AI Stocks to Invest in for Long-Term Growth

Artificial Intelligence is no longer a speculative technology of the future, it’s the defining driver of modern business. From predictive…