Nvidia … Is June 2024 a Good Time to Buy the Stock?

Have you been keeping tabs on Nvidia lately? It’s been quite a show. With all this buzz, you might be wondering if now is the perfect moment to invest in this stock. So, let’s take a closer look at what’s currently happening in the company.

The Rapid Ascent of Nvidia

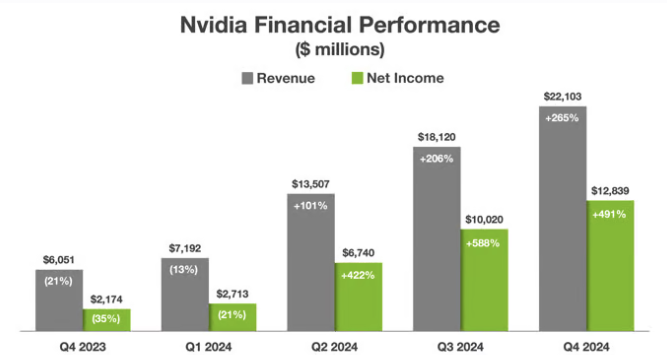

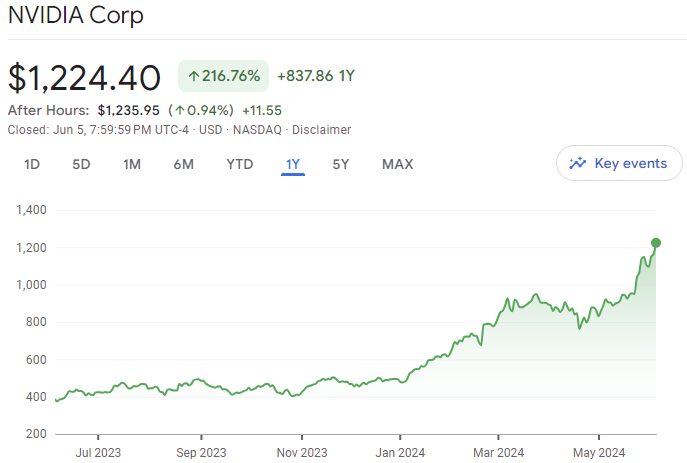

Nvidia’s performance over the past year has been nothing short of spectacular. The stock has rocketed up by 217%. Just this year, it’s up by 154%, and in the past month alone, it’s climbed an additional 33%. The company is the 3rd largest company in the world – it only trails Microsoft and Apple, and the gap continues to narrow.

This isn’t just market momentum, it’s backed by solid results. In the first quarter of FY25, which ended in April 2024, Nvidia’s revenue shot up by an astonishing 262% compared to last year. Operating income? That soared by 690%, largely thanks to its AI-driven data centre segment, which itself saw revenue increase by 427%. These figures prove the company’s commanding presence in the AI space and its ability to capitalise on the increasing demand for AI technologies.

Nvidia has long been a leader in the graphics processing unit (GPU) market, which remains a core part of its business. However, its strategic shift towards AI makes it stand out. The company’s GPUs are essential for AI applications, positioning the company at the heart of the booming AI industry. But is it just all AI?

The Diverse Growth Engines

Nvidia’s growth stretches well beyond AI. In its gaming division, which includes sales of GPUs to gamers and specialised chips for gaming consoles, revenue has risen by 18%. This is especially noteworthy considering the gaming industry’s size and trajectory. Valued at $217 billion in 2022, the video game market is expected to grow at a compound annual rate of 12% until the end of the decade. The company’s strong foothold in this sector ensures it remains a key beneficiary of the industry’s robust expansion.

Outside of gaming, the company’s professional visualisation and automotive segments have also shown impressive growth, with revenue increases of 45% and 11%, respectively. The professional visualisation sector catles to designers and engineers, providing them with powerful tools for complex tasks. Meanwhile, the automotive division is making wonders in self-driving technology.

Although it’s a smaller slice of Nvidia’s revenue, the automotive sector holds substantial promise. Advances in self-driving technology are moving swiftly and Nvidia’s DRIVE platform is already in use by major automakers and Tech giants. CFO Colette Kress has even highlighted the automotive sector as a potential multibillion-dollar area for the company in the future. But can there be a threat from competitors?

Nvidia vs. AMD

When stacking Nvidia against its main competitor, Advanced Micro Devices (AMD), which holds the second-largest share of the GPU market, the former appears to have an edge. While AMD’s stock has risen by 33% since last June, Nvidia presents a more compelling value on several fronts.

By examining forward price-to-earnings, price-to-free cash flow and price/earnings-to-growth ratios, Nvidia consistently emerges as better value. These metrics help investors understand a stock’s price relative to its financial performance, with lower numbers generally indicating better value. Given its dominance in AI and its strong overall market performance, it might be the more solid bet for investors looking for reliability in their Tech investments.

What could be the Impact of Nvidia’s Stock Split?

Nvidia recently announced a 10-for-1 stock split set to take effect on June 7. It’s important to understand that while a stock split doesn’t change a company’s market capitalisation, it does make the shares more affordable, opening the door for a wider range of investors to get involved. Historically, Nvidia’s stock has seen significant gains following its splits. For instance, after a 4-for-1 split in July 2021, its stock price increased by nearly 12% within a month and by 58% by the end of that year.

The current stock split could draw more retail investors, boosting trading volume and potentially elevating the stock price further. However, it’s crucial to remember that stock splits do not alter the fundamental value of the company. What drives Nvidia’s stock price are its earnings and ongoing growth prospects.

Stock splits are generally perceived positively and can indicate that a company anticipates continued stock appreciation. For Nvidia, this move aims to make its stock more accessible to a broader range of investors and employees, democratising ownership and allowing more individuals to invest in a stock that might have been too pricey for them previously.

What’s Ahead for Nvidia?

Nvidia’s financial track record suggests strong potential for future growth. The company’s earnings per share (EPS) have consistently beaten analysts’ predictions. For example, EPS jumped from 88 cents in the first quarter of 2023 to $6.12 in the second quarter of 2024—a 595% increase. Analysts expect EPS to reach $6.38 in the third quarter of calendar 2024.

The company’s data centre segment, driven by AI demand, continues to report strong revenue growth. With Nvidia’s technological edge and pricing power, the company consistently expands its margins and profitability.

Additionally, a 281% surge in free cash flow enables the company to invest in new technologies, broaden its product lineup and consider strategic acquisitions. It also provides a cushion against market fluctuations and economic downturns, securing its position as a solid investment choice in the tech sector.

Tech Partnerships

Nvidia’s strategic partnerships are key to its strong market position. The company has joined hands with Hewlett Packard Enterprise to supply AI servers equipped with Nvidia’s H100 chips. Additionally, Foxconn plans to establish an advanced computing centre in Taiwan utilising Nvidia’s Blackwell chips. These alliances help Nvidia’s leadership in AI and its capability to meet the surging demand for AI technologies.

Nvidia’s collaborations with major tech giants like Microsoft and Google further cement its dominance in the AI space. Also, its partnership with Foxconn aims to expand into new areas like data centres, autonomous driving, and electric vehicles.

Is Nvidia correctly priced?

Nvidia’s current price-to-free-cash-flow ratio stands at 66x, which might seem very steep. However, this figure is lower than its average over the past three to five years. In contrast, AMD’s ratio is at 230x, despite not experiencing similar growth rates. As a consequence, Nvidia’s valuation seems more reasonable when factoring in its performance and growth prospects.

Investors should take into account the company’s consistent track record and future growth opportunities. While the upcoming stock split might generate short-term momentum, the long-term investment prospects for the company are robust. Its leadership in AI, diverse growth drivers, strategic partnerships and solid financials present a strong investment case.

Nvidia’s market cap is around US$3 trillion, reflecting the high confidence investors have in its growth path and strategic placements in rapidly expanding markets. However, it’s crucial to consider the competition. Competitors like AMD, Intel, and other emerging entities in AI continue to innovate, potentially affecting its market share.

Is It the Right Time to Buy the stock?

For long-term investors, purchasing Nvidia stock now could be a wise strategic decision. The company’s premier position in AI, its broad growth across tech sectors and its robust financial health suggest a trajectory of sustained growth. The impending stock split may also draw more investors, likely boosting the stock price further.

However, investors need to be aware of the inherent risks, such as competition, pricing pressures and market fluctuations. While Nvidia is a standout in the AI trend, it’s not the only player in the highly competitive Tech landscape. Yet, with its powerful growth drivers and strategic positioning, it stands out as a solid investment choice for those aiming to invest in a leading technology firm.

What are the Best ASX Semiconductor Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

WiseTech Global (ASX:WTC) CEO Buys $1m of Shares, Here’s What It Signals

WiseTech $1m Insider Buy, The Synergy Curve Is the Thesis WiseTech Global (ASX: WTC) has just given investors a simple…

Block (ASX:XYZ) Up 28% as a 40% Headcount Cut Rewrites the Earnings Outlook

Jack Dorsey Goes Lean, The Market Pays Up Block shares surged 28% following the announcement that the company intends to…

AML3D (ASX:AL3): Order Book at $16.5m, The Growth Runway Stays Intact

A $150m to $200m Navy Opportunity, But Execution Comes First AML3D has reported its interim half-year results, and while revenue…