Sayona Mining and Piedmont Lithium are merging to create a A$900m lithium player

![]() Nick Sundich, November 21, 2024

Nick Sundich, November 21, 2024

Earlier this week, it was announced that Sayona Mining and Piedmont Lithium are merging. The two North America-focused lithium players will together create the largest hard rock lithium producer in the entire continent. Will this be enough to revive investors’ fortunes without a recovery in lithium prices?

Who are Sayona Mining and Piedmont Lithium

The companies, worth over $300m each have projects in North America. Sayona’s (ASX:SYA) flagship project is the North American Lithium (NAL) project in Quebec, which it has 75% of with Piedmont holding the remaining 25% stake. The NAL project has 87.9Mt at 1.13% lithium oxide and is North America’s largest operating spodumene asset.

There is a further 14.1Mt @ 1.01% lithium at the nearby Authier project and 93.1Mt @ 1.21% lithium at Sayona’s Moblan project at the James Bay Hub. Granted, none of those products were at a production stage except NAL.

Sayona had guided to 190-210,000 dmt of spodumene concentrate production and 200-230,000 dmt of sales. The problem is that it expected unit operating costs of A$1,150-1,300/dmt – far lower margins than the highs of 2022!

Source: Company

Piedmont, which was dual-listed on the NASDAQ as well a the ASX, has further projects in North Carolina, Tennessee and Ghana. On top of all this, Piedmont had a 12% stake in Sayona.

Source: Company

The investment cases for both companies were that the lithium cycle was about to turn as something would give on the supply side. Being positioned in the USA, they faced low corporate taxes and low royalties while being close to many battery and EV makers including Ford, LG, BMW and Hyundai.

Why Sayona Mining and Piedmont Lithium are merging

Essentially, the companies think they’ll be better off together. This new company, which will bear a new name that is yet to be determined, will be the largest lithium producer in North America. Heck, even larger than Rio Tinto and Albemarle!

The companies hope to achieve a reduction in costs through synergies, achieve brownfields exploration success to increase the resource, continue to grow the resources, achieve any remaining necessary permits to keep the project going.

This deal will come with individual A$40m placement to Piedmont and Sayona, with potential for a further A$22.5m raising once the deal is closed. The companies will boast a market cap of A$931m and have A$149m in cash.

Lithium is expected to turn

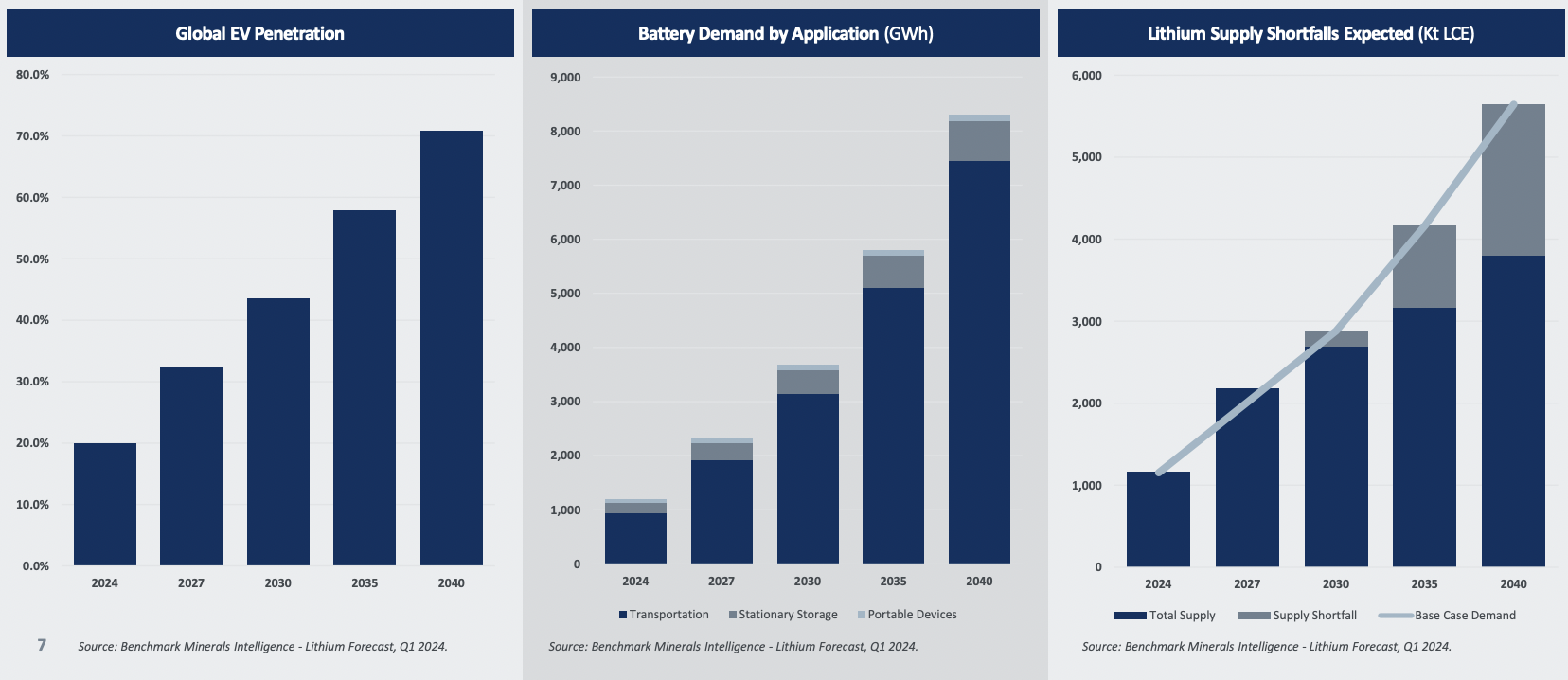

In case we forgot to mention it, lithium prices have been in a bear market for two years to the point where many projects are unprofitable. All companies (from explorers to producers) think prices will turn around. After all, demand for EVs keeps rising, and a supply crunch is expected to grow in the coming years.

Source: Company

But it isn’t a good luck when many companies have halted production – like Core Lithium (ASX:CXO) – and others are warning they may need to in 2025 if things don’t turn around, like Liontown Resources (ASX:LTR). Probably the most worrying sign was that even Australia’s most profitable lithium mine (Greenbushes) was not paying dividend to part-owner IGO.

Seemingly, Piedmont and Sayona believe the market is about to turn and are poising themselves to make hay when the sun shines again. They are not the only companies – Rio Tinto has bid $9.9bn for Arcadium Lithium.

Conclusion

This deal will take some months to close and is subject to regulatory approval. From there, we would like to see spodumene prices across US$1,000 before confidently declaring that lithium is turning around. If lithium can mount a comeback, there could be an opportunity in the merger of Sayona and Piedmont.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

4 Growing ASX Dividend Stocks to Buy and Hold for Steady Returns

Investing in dividend stocks remains a reliable strategy for Australians seeking steady income and long-term capital growth. But which ASX-listed…

3 ASX ETFs to Buy for Passive Income in May

Investing in exchange-traded funds (ETFs) on the Australian Securities Exchange (ASX) has become one of the most popular ways to…

The Alpha of a stock: Here’s why it is important for investors to know

The Alpha of a stock is another important investing metric that stock investors need to know about. In this article,…