Liontown Resources (ASX:LTR): Have collapsed lithium prices sent the one-time market darling from spectacular riches to rags?

![]() Nick Sundich, March 25, 2024

Nick Sundich, March 25, 2024

We’ve all heard the saying ‘rags to riches’ and when Liontown Resources (ASX:LTR) found Kathleen Valley, it was the perfect illustration of what it means. Liontown was just another small cap explorer, hoping to stumble across a major deposit and turning it into a mine – but of course, with little hope.

Unfortunately, the last 6 months just might be the opposite – riches to rags. It shed roughly half of its market value from $6bn to $3bn, had a takeover deal fall through, not to mention a major financing deal that would’ve helped it bring Kathleen Valley into production also falling through. The latter deal was signed on the dotted line, but lenders walked away. Why? Falling lithium prices. But does this mean the long-term story is no longer in tact? In our view, not necessarily, but there’ll be little hope of achieving its dreams without a big lithium price recovery.

Who is Liontown Resources (ASX:LTR)?

Liontown Resources is an ASX resources company responsible for the Kathleen Valley lithium project. The project, which Liontown made the Final Investment Decision on in 2022, is one of the most significant new, long-life lithium projects being constructed anywhere in the world.

Liontown Resources was founded in 2011 and for several years was just another small cap explorer. Initially focused on gold exploration in Western Australia, the company shifted its focus to lithium exploration by 2014, and picked up Kathleen Valley project in 2016. The rest is history.

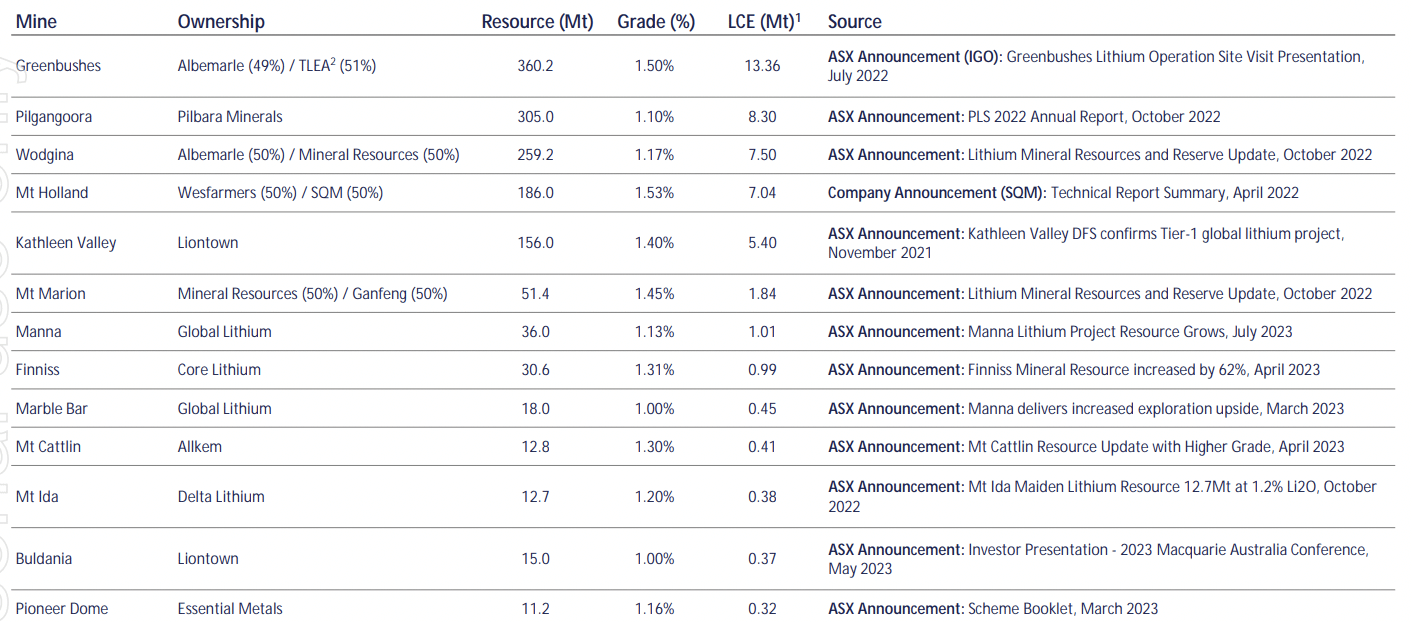

Source: 2023 Diggers & Dealers presentation

Great project metrics

Kathleen Valley has a current Mineral Resource Estimate of 156Mt at 1.4% lithium and could produce over 500ktpa over a 23-year life of mine. Over 80% of this is Measured or Indicated. The project’s economics, outlined in the 2021 DFS include an NPV of A$4.2bn and a 57% IRR after tax. There is also a tantalum by product that will generate further revenues, and a strong ESG focus with significant renewable energy use at the project – >60% at the project start up.

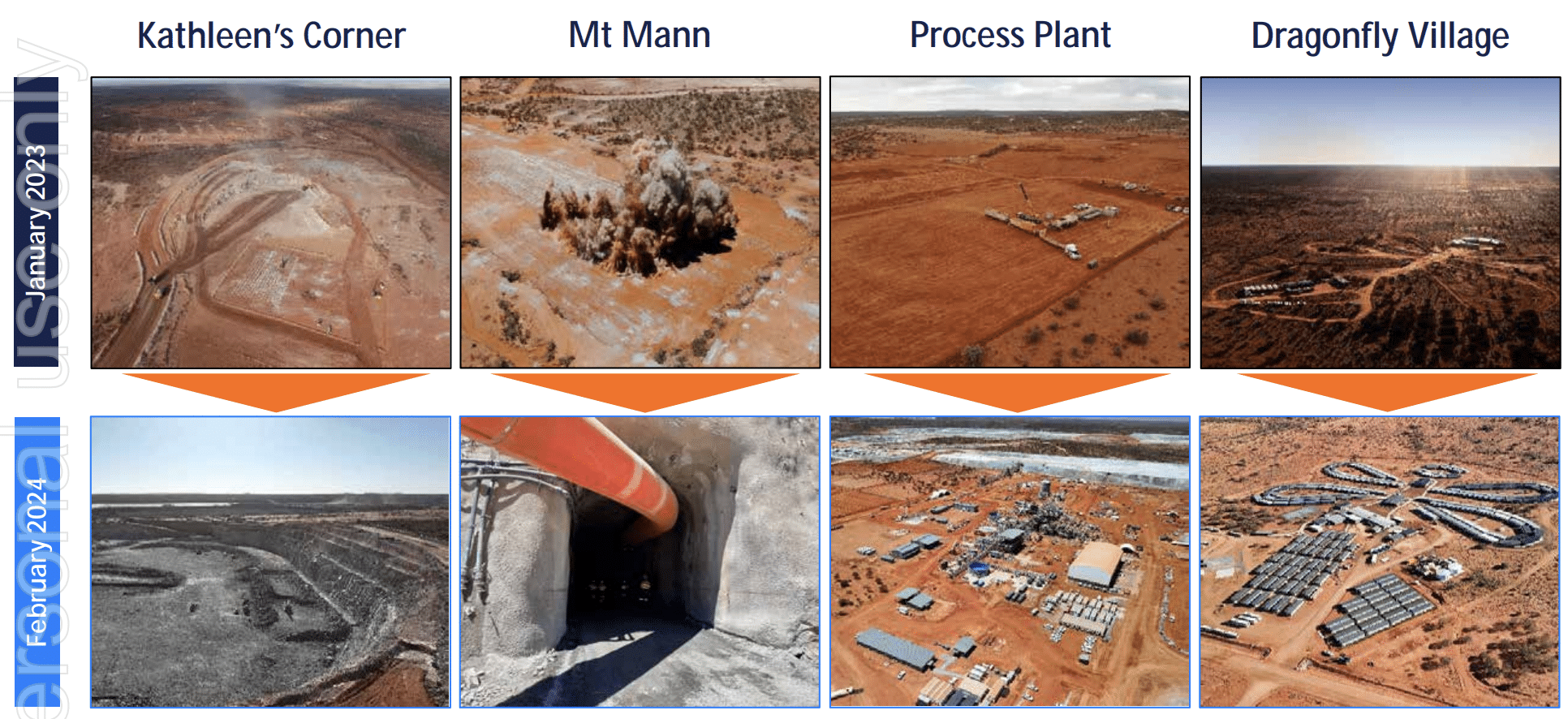

The company’s shares have never looked back as it unveiled the deposit, defined the resource and commenced construction on the project, putting it on track for first production in the second half of 2024, as well as securing the initial offtake agreements. And it remains on track for this goal, having made significant progress in the last year.

Source: Company

From rags to riches, to rags again?

Obviously, it is all well and good to have a big lithium deposit, but pointless if it cannot be extracted economically and if there are no customers. Liontown has customers including Tesla, Ford and LG and total offtake commitments of up to 450,000 dmt (dry metric tonnes) per annum. The 2021 DFS had low operating costs of US$314/dmt. And it was ideally located in Western Australia, a jurisdiction with practically zero sovereign risk. All the boxes seemed ticked.

Unfortunately, it has been a poor run for lithium prices. The growth in electric vehicles has slowed throughout the last 18 months and demand for lithium has followed suit. In China for instance, EV sales grew 84% in 2022 but only 25% in 2023. In January 2024, spodumene concentrate was US$955, down 90% from 12 months earlier. Ouch. All companies developing mines would make contingencies for scenarios where prices fall 20-30% from their base case, but typically not where it falls below their cost curves. And for many lithium (and other battery metal) miners and developers, this is just what has happened. Morgan Stanley has estimated that 6% of global lithium production has been removed from the market since the start of 2024.

More victims of lithium crash

Liontown is not the only battery metals stock to be impacted by falling prices. Core Lithium has halted production at its mine, Albemarle cancelled the proposal to build a 4th processing facility at its own project and Panoramic Resources went into administration, sending the shutters slamming shut on its flagship nickel mine. Liontown has been hit.

As a result of these events, a $6.6bn takeover bid from Albemarle fell through and rumours Gina Rinehart would make a move of her own came to nothing. The rumours were legitimate because she was buying shares in the company but stopped right at 19.9%. And barely 3 months after signing a commitment letter and credit approved term sheet for a $760m debt financing package, the company was sent back to the drawing board and eventually negotiated a smaller A$550m facility. This syndicate includes CBA, NAB, Societie Generale, Export Finance Australia and the Clean Energy Finance Corporation. HSBC, Westpac and ANZ were originally part of the syndicate but withdrew.

Cost blowouts

For the record, this facility matures in October 2025. So, even if the company gets the money, it’ll need to pay it back by then, presumably through another debt or equity deal. Keep in mind that even this facility won’t totally go to the project, $300m is to repay an existing debt facility plus capitalised interest. CEO Tony Ottaviano has openly called for government support in the form of royalty relief. We can’t imagine the company won’t have its fingers crossed that the situation will have improved enough by then to secure a longer-term financing deal – i.e. 5-10 years.

Liontown has also been impacted by rising inflation. A shortage of contractors and input shortages led to the capital costs blowing out. Kathleen Valley had been estimated to cost $240.5m in late 2019. This rose to $325m in 2020, $473m in November 2021 and then $545m in mid-2022. The final ‘upgrade’ was to $895m in January 2023. At the time, investors didn’t care that much because they believed it would pay for itself quickly given lithium prices at the time. Not so much now.

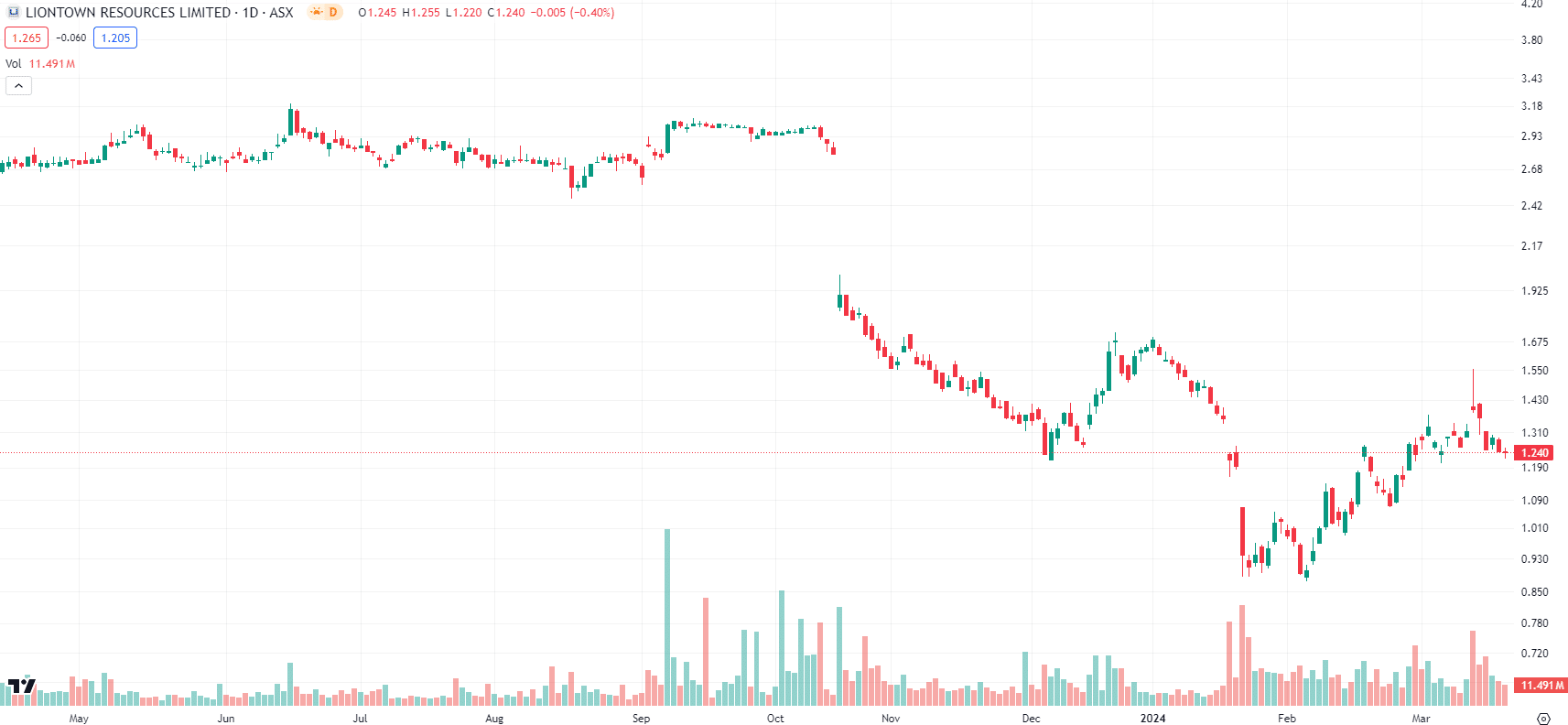

Liontown Resources (ASX:LTR) share price chart, log scale (Source: TradingView)

So, is there hope of the company making it to riches again?

That will all depend on where lithium prices go. The company is still on track to start production in the middle of this year and it has not downgraded its resource. In did secure that syndicate and also has $517m in cash at bank. Evidently, the company believes price will improve.

Industry experts aren’t so optimistic. Back in January Wood MacKenzie tipped lithium prices would stay at current levels until 2029. The initial package was withdrawn not long after this prediction was made. Coincidence? Maybe…but maybe not. Tony Ottaviano argued Wood Mackenzie hadn’t accounted for lithium projects that would fall through. Goldman Sachs is not as bearish, but still predicts prices will bottom out in FY26 (between July 2025 and June 2026) before recovering over the next 2 years.

In our view, that’s evidently a better scenario than prices remaining stagnant for 5 years, but not the ideal scenario in light of its debt facility maturing. While we wouldn’t rule out prices remaining stagnant for 5 years, we would all but rule out EV sales growth suddenly jumping from 25% to 84% again.

Our view

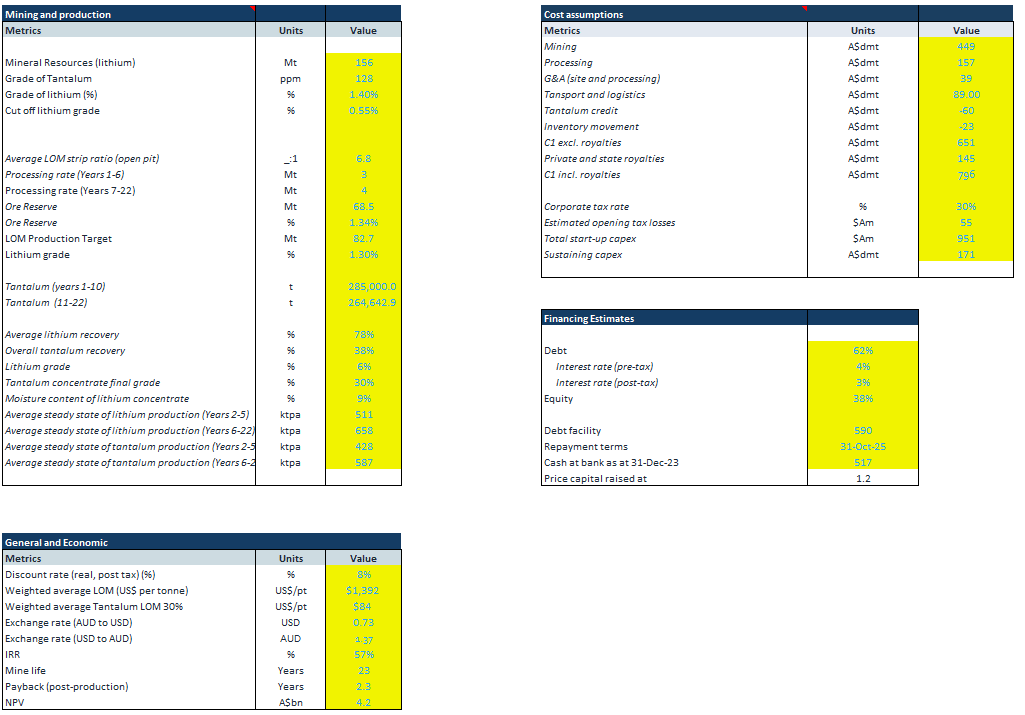

We’ve done our own modelling on Liontown, the assumptions are below. You’ll notice the lithium price was US$1,392/t, a heavy discount to the current price and an NPV of A$4.2bn.

Source: Stocks Down Under derived from 2021 DFS and 2023 cost updates

The cost increases take it down to $3.2bn, using an 8% discount rate. Considering the company is just below $3bn in market capitalisation right now, that doesn’t make it as compelling as before. Evidently, Ablemarle assumed prices would remain high. Adjusting the price to US$1,800 derives the $6.5bn+ bid that it had made. But cut it to US$950/t and our NPV becomes negative. Take out the discount rate and it is just $332m – certainly not worth investing $500m into.

Anyone investing into Liontown is obviously assuming lithium prices will rebound – except the debt financiers who obviously assume the company will be able to raise further equity in the next 18 months or so.

Should I buy Liontown shares?

Not until there’s evidence that prices turnaround. Not even the company entering production could be a catalyst so long as prices remain as depressed as they are now.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…