Should I buy Air New Zealand shares given they’re still down over 65% from pre-COVID levels?

![]() Nick Sundich, April 11, 2024

Nick Sundich, April 11, 2024

The question ‘Should I buy Air New Zealand shares?’ has been one many investors have asked, but any who thought the answer was yes and acted on it have not seen the returns they may have expected.

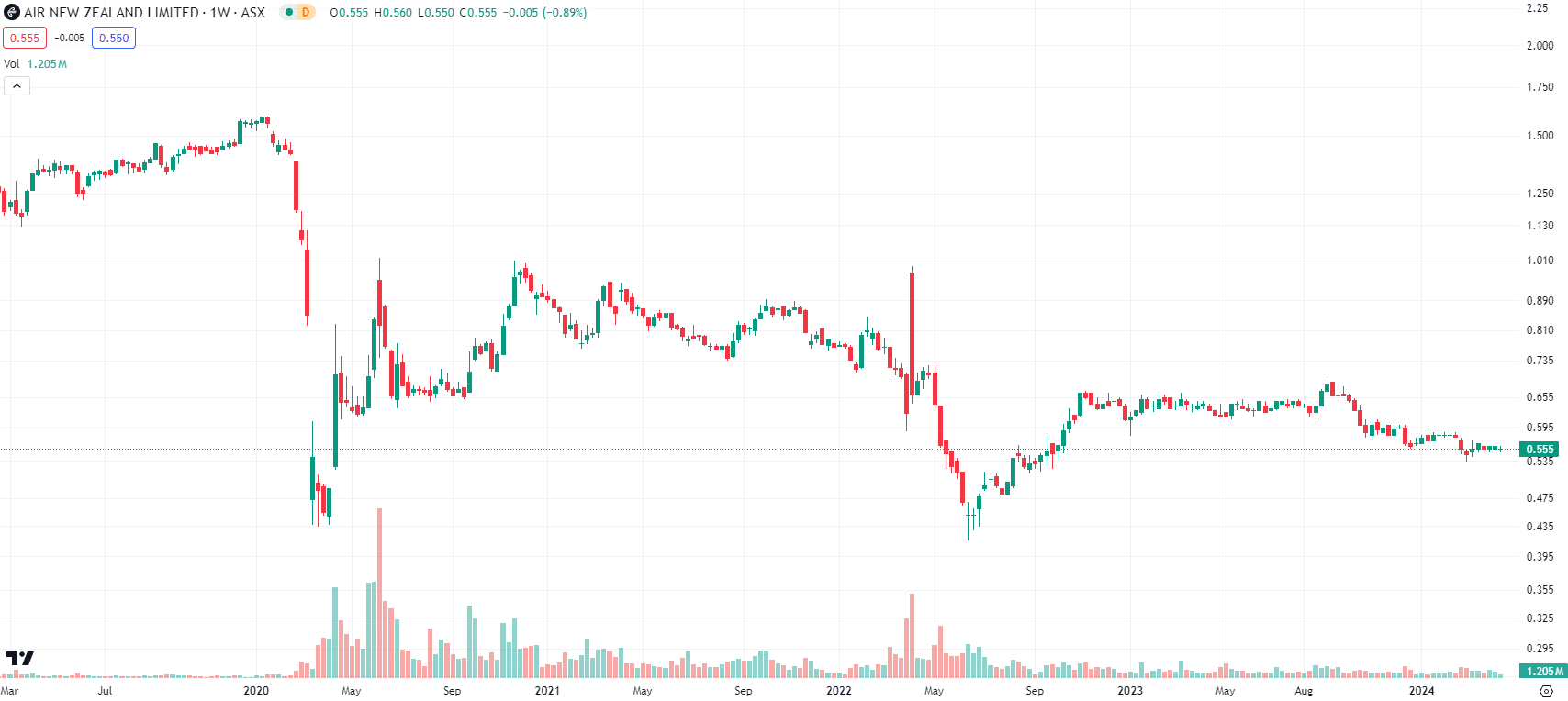

Air New Zealand share price chart, log scale (Source: TradingView)

The company has some structural advantages compared to Qantas, but some disadvantages too – and the latter has been coming to light in the past few months.

Introduction to Air New Zealand

Air New Zealand is New Zealand’s flag carrier. It is dual-listed on the ASX and NZX and is 51%-government owned. Similar to Qantas it is an end-of-line carrier rather then a hub-and-spoke carrier, meaning its business model is about getting people to their home country instead of just taking people through one or multiple hubs as is the case with the Middle Eastern 3 carriers and the American legacy carriers.

It began in 1965, succeeding Tasman Empire Airways as New Zealand’s international airline. It merged with the then domestic airline in 1978, was privatised in 1989, but then went government-owned after nearly collapsing in 2001.

The airline operates an all-Boeing long-haul fleet with 787s and 777s while operating A320s on domestic capital city and short-haul international routes along with ATR and Dash-8 turboprops on regional routes. In FY19, it made $5.8bn in revenue and a $270m profit.

Air New Zealand still feeling the impacts of COVID-19

The pandemic wiped out demand for Air travel and all airlines were affected. Nonetheless, Air New Zealand was worse impacted than other airlines given the border was closed far longer than other jurisdictions (i.e. from March 2020 until mid-2022). The airline prematurely retired some of its 777 jets, thinking that demand would lag for years, and had to take out a NZ$2.2bn recapitalisation package.

The massive capital raise increased the number of shares on issue by 50% and the dilution put downwards pressure on the share price, which was further accelerated by the bear market following Russia’s invasion of Ukraine and kept the share price depressed.

By September 2022, bookings on the domestic network were at around 105% of pre-pandemic levels with the international network around 75%. So why hasn’t the share price recovered Because its financial results lagged for some time. It made NZ$2.7bn in revenue and an $810m loss in FY22.

A false dawn

In FY23, things got better with $6.3bn in revenue and a $412m profit. But in 1HY24, even though operating improvement was up 13%, its net profit was down 39%. Furthermore, the company warned that the performance in the second half would be lower than the first half.

The company has been hit by several factors. One of this is that the company has been impacted by inflation, especially jet fuel prices. Demand, particularly amongst corporate travellers and on international routes remains subdued. Indeed, raw passenger numbers internationally are down 37% from pre-COVID levels and revenue passenger kilometres is down 35%.

Engine problems

We noted that Air New Zealand retired its old 777s. It has now been impacted by the Airbus Pratt & Whitney engine troubles impacting the deliveries of its new A320s, not to mention Boeing’s Dreamliner Rolls-Royce engine issues. It has had to lease planes and cut routes right as lease prices are sky high and competition is intense.

And Air New Zealand’s frequent flyer is no match for Qantas’. Compared to the program run by the Red Roo, Air New Zealand’s Airpoints program is essentially still stuck in the 1970s where frequent flyer programs were essentially ‘buy however many flights and get _ free’. It is consequently not the cash cow that it otherwise might be.

So should I buy Air New Zealand shares?

To put it bluntly, no. Consensus estimates for future years aren’t rosy. Analysts call for $6.1bn in revenue and a $135m profit for FY24. The former figure is 5% higher than the year before, but the latter is less than half what it was in FY23. Turning to FY25, and revenues are expected to be flat whilst the company’s profit is only estimated to be slightly higher, at $168m. In FY26, more of the same with $6.3bn revenue and $203m profit.

The mean target price on the New Zealand exchange is NZ$0.59 per share, a slight premium to the NZ$0.55 per share it is trading at right now. The company’s multiples, at just 3.2x EV/EBITDA and 12x P/E for FY25 may look compelling, but not when you consider the lacklustre growth.

There are better travel stocks out there

We think there are better ways to gain exposure to the travel thematic that might even be safe if there is a downturn – Corporate Travel Management (ASX:CTD) is one of them. The only catalyst that could spark a surge in the share price is unexpectedly good FY24 results. However, if the company isn’t optimistic, there’s little reason why investors should be.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…