Should I buy McDonalds shares (NYSE:MCD)? Here are 3 reasons why we’re McLoving it!

McDonalds (NYSE:MCD) really doesn’t need an introduction. It is the world’s largest and most famous restaurant chain. It typically benefits from difficult economic times, with the GFC proving a useful guide (it made higher sales in 2008 compared to 2007 and 2006). But it hasn’t been the easiest couple of years.

The company is facing increased competition in the fast food industry (especially amongst fast food chains targeting lower income customers), seeing slowing sales growth and has been entangled with the Israel-Hamas conflict. Trump’s tariffs have hit the markets and the company (both directly in having to pay them and indirectly through anti-American sentiment and hits to consumers’ incomes).

1960s and 1970s executive Ray Kroc once said that ‘either you’re green and you’re growing or you are ripe and you are rotting’. McDonalds has always been trying to reinvent itself to stay green and growing, but is it now ripe and rotting?

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Who is McDonalds?

McDonalds traces its origins back to the 1950s, founded by the McDonalds brothers who ended up selling it to Ray Kroc who took it to the next level. And he’s not the only one to have ever gotten rich from the franchise. Those who bought 100 shares at its 1965 IPO for US$2,250 would have over US$8m today after splits and stock dividends.

It is true that the fast food industry has fierce competition, low barriers to entry and non-existent switching costs from a consumer’s perspective. This makes the McDonalds’ success all the more remarkable, up there with the best of companies in the S&P 500. It has 40,000 restaurants worldwide that employ ~2m people as employees or franchisees and serve 65m people each day. Australia is its fourth largest market after the US, UK and France by revenue. It accounts for roughly a thousand stores and just over 100,000 employees – it is the largest youth employer in the country.

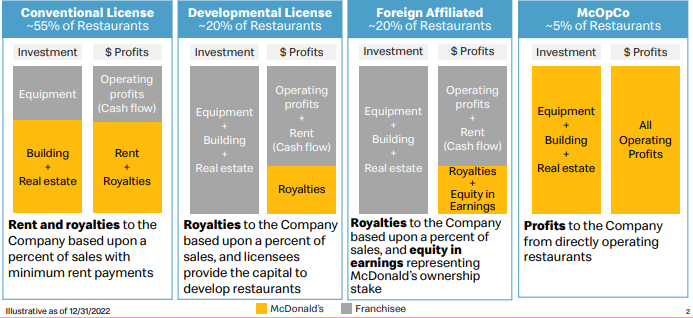

There are many things that make McDonalds unique including its franchising model that have led many to say it is really a real estate company than a fast food company. You see, its franchisees pay not just royalties on sales but rent for running ‘their’ business on a property – not to mention a whopping US$1.5m upfront charge that must be financed with the franchisees’ own money (yes, their own – not borrowed funds). And they have to deal with all the front-line issues that they’ll have to face being a franchisee.

But while it is hard work for the franchisees, it is easy for head office. McDonalds tends to buy cheap land that will inevitably grow over a 20-year period during which their franchisees are contracted with them. And it sets up its stores with a plain, simple and consistent layout meaning minimal upfront costs for them. Here’s another quote from Ray Kroc,’ We’re not in the hamburger business, we’re in the show business’. You know what you’re going to get from Maccas, no matter where you are.

Source: Company

McDonalds has big growth ambitions…

In the last 5 years, McDonalds has gained 49% but the S&P 500 is up nearly 90%. Nonetheless, it can boast of having higher margins than pre-COVID, which is something not many other fast food companies can say. In 2024, Global sales were over US$130bn with full year growth over US$1bn – US$30bn of which was to its 175 million loyalty members.

2025 has had more good than bad with a 3.8% increase in sales during Q2 and international markets growing faster than the US after a few quarters of it being the other way around.

The company is planning for a big future, both short and long-term. In particular it is targeting 50,000 global restaurants by 2027. This would equate to 2,000 a year and represent the fastest period of growth in the company’s history. Moreover, it is aspiring to grow 90-day active users from 150m to 250m. McDonalds has 100 new restaurants in the pipeline in Australia alone, one third of which will be in regional areas. There is inevitably a far larger pipeline when the rest of the world is taken into account.

McDonalds has 3 growth pillars: Marketing, Core and the 4 Ds (Development, Digital, Delivery and Drive-Thru). Let’s look at these individually. The Marketing needs no explanation unless you’ve never seen one of the company’s advertisements before.

The ‘Core’ alludes to its ‘core menu’, that includes favourites like the Big Mac, but also newer products. One thing investors may not know is that chicken products now generate just as high sales as beef, thanks to newer products such as McCrispy and McSpicy that complement long-term favourites like McNuggets and McChicken.

Looking collectively at the 4Ds (Development, Digital, Delivery and Drive-Through), they all relate to what the company believes customers like it for – convenience, value and personal connections. It offers delivery in 85% of restaurants and drive thru in 64% of restaurants worldwide (This proportion is 90% in the US).

…but the shorter term may not be easy.

For most of the post-COVID period, McDonalds avoided the fate that hit other companies such as Dominos (ASX:DMP) in having to either cut prices to keep consumer demand and face margin decline, or maintain prices and risk losing customers and likely seeing margins fall anyway.

2024 was the year this fate hit McDonalds. From 2019 to 2024, according to the company’s own figures, salaries rose up 40% and food/paper costs rose 35%. It initially opted to raise menu prices to counter demand and has claimed to have maintained margins, although some products rose by less than inflation. In its most recent quarterly results, the company announced it would reduce the price of its combo meals to restore its reputation for affordability.

Still, it has introduced some cheap items such as $5 value meals. And there is the risk of competition, not just from other fast food franchises (like Burger King/Hungry Jacks that are unveiling their own ‘meal deal’ options), but even companies like Walmart (NYSE:WMT). American lender Lending Tree claims that nearly 80% of its surveyed consumers think fast food is now a luxury and two-thirds say they are dining out less because of prices.

Ultimately, franchises are allowed to set their own prices, and so prices can vary from location to location. And so there is the occasional controversy from customers – in 2024, some customers in Connecticut complained of a nearly $18 price tag for a Big Mac combo meal. This led to a rare PR response from head office. While denying the claims that prices were raised ahead of inflation, it did not shy away from the fact that average prices had risen.

Signs from the company are a mixed bag

Again, McDonalds saw nearly 4% sales growth in the most recent quarter, but this does not tell the full story. This was after sales fell 3.6% in Q1 of 2025. The wars in Ukraine and the Middle East have continued to impact the company forcing it to close stores there and keep them closed. Did you know that in Israel, one franchisor offered free deals to Israeli soldiers after October 7, and then sales in some Arab countries fell 50-90% month on month?

Beyond the impact Trump’s tariffs will have on local consumers, they have also impacted American sentiment, especially in important markets. One is India, the country with the largest population but also one with amongst the highest tariffs (50%).

The company has remained firm on its CY 2025 plans: opening approximately 2,200 new restaurants globally, with capital expenditures of US $3–3.2bn, and aiming for systemwide sales growth of around 2%.

Consensus estimates, drawn from a grand total of 30 analysts, call for US$26.7bn in revenue (up 3%) and $12.33 EPS (up 7%). In CY26, $28.2bn in revenue (up 6%) and $13.36 EPS (up 10%). In CY27, $29.8bn in revenue (up 6%) and $14.42 EPS (up 8%).

The company is trading at a P/E of 23.4x for CY26 and the consensus price is $334.30 per share, a 7% premium to the current price. This may not appear cheap, but it is slightly below the 24x that its peers trade at – and some trade higher. Starbucks is 35x, Dominos is 25x (DPZ not DMP) and Chipotle is 32x.

Our view

Ultimately, we think there is growth left in this business. While we cannot shy away from the capex, competitive and consumer demand challenges, we think McDonalds is well positioned to benefit because of its scale, reputation and healthy balance sheet.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…