Should I buy McDonalds shares (NYSE:MCD)? Here are 3 reasons why we’re McLoving it!

Nick Sundich, June 26, 2024

McDonalds (NYSE:MCD) really doesn’t need an introduction. It is the world’s largest and most famous restaurant chain. It typically benefits from difficult economic times, with the GFC proving a useful guide (it made higher sales in 2008 compared to 2007 and 2006). But it hasn’t been an easy 2024.

The company is facing increased competition in the fast food industry (especially amongst fast food chains targeting lower income customers), seeing slowing sales growth and has been entangled with the Israel-Hamas conflict. 1960s and 1970s executive Ray Kroc once said that ‘either you’re green and you’re growing or you are ripe and you are rotting’. McDonalds has always been trying to reinvent itself to stay green and growing, but is it now ripe and rotting?

Who is McDonalds?

McDonalds traces its origins back to the 1950s, founded by the McDonalds brothers who ended up selling it to Ray Kroc who took it to the next level. And he’s not the only one to have ever gotten rich from the franchise. Those who bought 100 shares at its 1965 IPO for US$2,250 would have over US$8m today after splits and stock dividends.

It is true that the fast food industry has fierce competition, low barriers to entry and non-existent switching costs from a consumer’s perspective. This makes the McDonalds’ success all the more remarkable, up there with the best of companies in the S&P 500. It has 40,000 restaurants worldwide that employ ~2m people as employees or franchisees and serve 65m people each day. Australia is the fourth largest market after the US, UK and France by revenue. It accounts for roughly a thousand stores and just over 100,000 employees – it is the largest youth employer in the country.

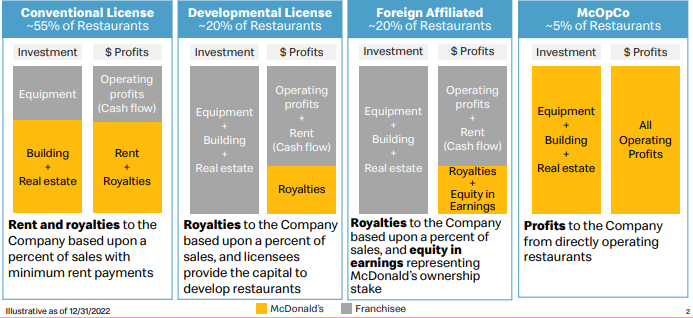

There are many things that make McDonalds unique including its franchising model that have led many to say it is really a real estate company than a fast food company. You see, its franchisees pay not just royalties on sales but rent for running ‘their’ business on a property – not to mention a whopping US$1.5m upfront charge that must be financed with the franchisees’ own money (yes, their own – not borrowed funds). And they have to deal with all the front-line issues that they’ll have to face being a franchisee.

But while it is hard work for the franchisees, it is easy for head office. McDonalds tends to buy cheap land that will inevitably grow over a 20-year period during which their franchisees are contracted with them. And it sets up its stores with a plain, simple and consistent layout meaning minimal upfront costs for them. Here’s another quote from Ray Kroc,’ We’re not in the hamburger business, we’re in the show business’. You know what you’re going to get from Maccas, no matter where you are.

Source: Company

McDonalds has big growth ambitions…

In the last 5 years, McDonalds has slightly trailed the S&P 500 but beaten the Dow Jones. US$100 invested in McDonalds at the end of 2018 would be worth US$187 5 years later, while the Dow Jones would be $180. Since 2019, McDonalds has grown sales by 30% and its operating margin from 43 to 47%. And the company is planning for a big future, both short and long-term. In particular it is targeting 50,000 global restaurants by 2027. This would equate to 2,000 a year and represent the fastest period of growth in the company’s history. McDonalds has 100 new restaurants in the pipeline in Australia alone, one third of which will be in regional areas. There is inevitably a far larger pipeline when the rest of the world is taken into account.

McDonalds has 150 million active loyalty users worldwide, and is aiming for 250m in the next 4 years. Currently, it only makes US$20bn from loyalty members but is aiming for US$45bn by 2027.

McDonalds has 3 growth pillars: Marketing, Core and the 4 Ds (Development, Digital, Delivery and Drive-Thru). Let’s look at these individually. The Marketing needs no explanation unless you’ve never seen one of the company’s advertisements before. The ‘Core’ alludes to its ‘core menu’, that includes favourites like the Big Mac, but also newer products. One thing investors may not know is that chicken products now generate just as high sales as beef, thanks to newer products such as McCrispy and McSpicy that complement long-term favourites like McNuggets and McChicken. As for the 4Ds (Development, Digital, Delivery and Drive-Through), they all relate to what the company believes customers like it for – convenience, value and personal connections. It offers delivery in 85% of restaurants and drive thru in 64% of restaurants worldwide (This proportion is 90% in the US).

…but the shorter term may not be easy

For most of the post-COVID period, McDonalds avoided the fate that hit other companies such as Dominos (ASX:DMP) in having to either cut prices to keep consumer demand and face margin decline, or maintain prices and risk losing customers and likely seeing margins fall anyway.

But so far in 2024, this fate has hit McDonalds. Since 2019, according to the company’s own figures, salaries are up 40% and food/paper costs are up 35%. It has raised menu prices to counter demand and has claimed to have maintained margins, although some products have risen by less than inflation. Still, it has introduced some cheap items such as $5 value meals. And there is the risk of competition, not just from other fast food franchises (like Burger King/Hungry Jacks that are unveiling their own ‘meal deal’ options), but even companies like Walmart (NYSE:WMT). American lender Lending Tree claims that nearly 80% of its surveyed consumers think fast food is now a luxury and two-thirds say they are dining out less because of prices.

Ultimately, franchises are allowed to set their own prices, and so prices can vary from location to location. And so there is the occasional controversy from customers – earlier this year, some customers in Connecticut complained of a nearly $18 price tag for a Big Mac combo meal. This led to a rare PR response from head office. While denying the claims that prices were raised ahead of inflation, it did not shy away from the fact that average prices had risen.

Signs from the company are a mixed bag

In the first quarter, it appeared to be a good one for the first glance. It grew sales by 2% – marking 13 straight quarters of growth; made US$6bn in revenues and increased its EPS by 9%. However, it missed its bottomline consensus for the first time since the December quarter of 2021, albeit slightly. And on the earnings call, the company admitted it was impacted by two factors.

First, the war in the Middle East which saw it have to buy all restaurants that comprise its Israeli franchise due to a pro-Palestinian boycott action. This ensued after the then franchisor offered free deals to Israeli soldiers after October 7, impacting not just demand in Israel but in the broader Middle East. Sales in some Arab countries fell 50-90% month on month even in spite of local franchisors disassociating themselves from Israel and pledging funds and aids to Palestine. Second, it saw a sales dip in the wake of increased menu prices, especially amongst consumers on less than US$45k annually.

For the full CY24, McDonalds expects:

- SG&A expenses to be 2.2% of systemwide sales,

- A mid to high 40% range operating margin

- A 9-11% hike in interest expense

- 20-22% effective income tax rate

- $2.5-$2.7bn in capex, half of which will be to new restaurant expansion, and;

- FCF conversion rate over 90%.

We think the capex might concern some investors as is well ahead of the $2.4bn in 2023. It is important to note that capex is not just in new restaurants, but reinvestment in existing restaurants, although the growth ambitions form a large part of the increased capex.

Consensus estimates, derived from a grand total of 30 analysts, call for US$26.6bn in revenue (up 5%) and $12.14 EPS, equating to an $8.7bn profit (up 5%). In CY25, $28.2bn in revenue (up 6%) and a $9.6bn profit (up 10%). In CY26, $29.8bn in revenue (up 6%) and a $10.5bn profit (up 9%).

The company is trading at a P/E of just 18.9x for FY25 and the consensus price is $310 per share, a near 25% premium to the current price.

Our view

We think McDonalds is worth US$331.91 using a blended DCF/relative valuation. Our DCF valuation is $349.85, using consensus estimates and a WACC of 8.2%.

Our relative valuation is $313.97 per share, using a 23.4x FY25 P/E – the average of its peers, including Starbucks, Dominos, Restaurant Brands and Yum. Again, we note current share price is just 18.7x P/E for FY24. We also observe that certain fast food stocks trade higher, recent listed Cava Group is 215x P/E for FY25 following runaway share price growth following its listing. The more established Chipotle attracts a premium too, at 51.2x. Including these in the peer basket would boost the implied price to McDonalds above US$400.

Ultimately, we think there is growth left in this business. While we cannot shy away from the capex, competitive and consumer demand challenges, we think McDonalds is well positioned to benefit because of its scale, reputation and healthy balance sheet.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Here’s why Rich Lister WiseTech boss Richard White ‘stood down’, and how the A$30bn+ cargo software giant may be affected

WiseTech boss Richard White has been viewed as a key reason for his company’s success over its 30-year history and…

Is the S&P 500 Really Doomed to a ‘Lost Decade’? Goldman Sachs thinks so, but will it eventuate?

The term ‘Lost Decade’ gets thrown about a lot, but most recently to the next decade to the S&P 500.…

Halloween Stocks: Here are 5 ASX Stocks that Will Benefit from Halloween

Here are 5 ASX Halloween Stocks! The Reject Shop (ASX:TRS) The Reject Shop is one of Australia’s most notable…