Should I buy Tesla shares from Australia? Only if you’re going to hold for 5-10 years

![]() Nick Sundich, September 26, 2024

Nick Sundich, September 26, 2024

Should I buy Tesla shares from Australia?

The world’s largest and most famous electric vehicle maker may seem like a no-brainer for investors wanting a safe growth stock. After all, electric vehicle demand is only going to keep growing and there’s a very long way to go. They are still a single digit percentage of used car sales in many markets including Australia and the USA.

However, it has not been an entirely smooth journey for Tesla.

Introduction to Tesla (NDQ:TSLA)

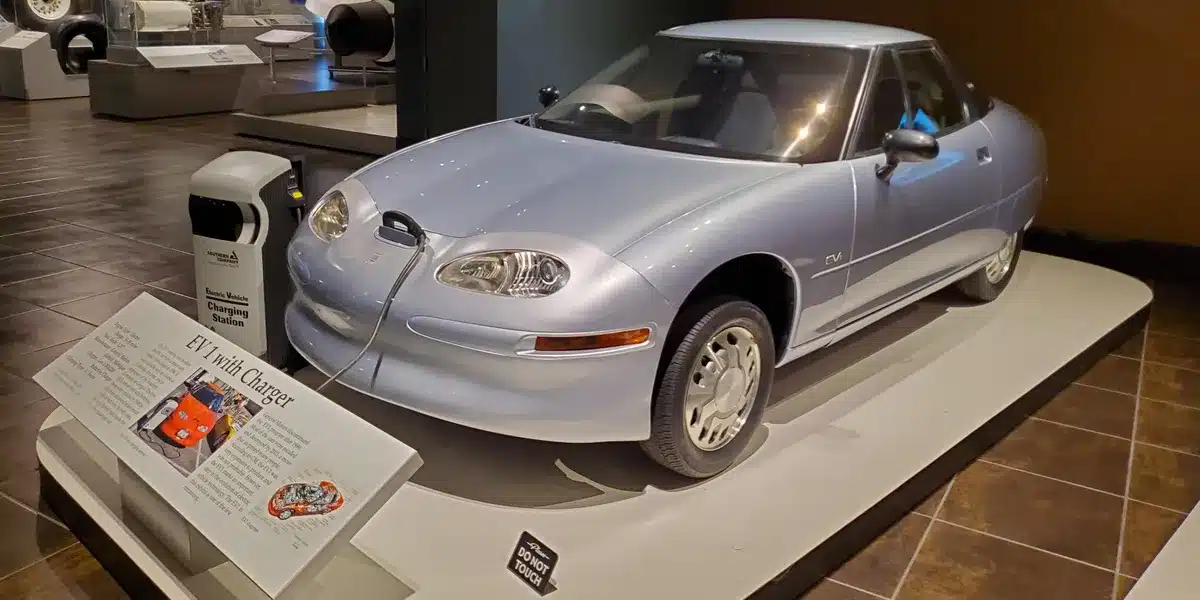

Tesla was founded in 2003 and was named after Serbian engineer Nikola Tesla. Elon Musk initially joined in 2004 as a strategic investor, but became CEO in 2008. There actually were electric vehicles before Tesla – just ask GM which produced the EV1 in the late 1990s. But it ended up ceasing the program because it could make it profitably.

Source: Hemmings

Tesla’s first car, the Roadster, was released in 2008 but it was discontinued in 2012 as Tesla released its Model S sedan and chose to focus on it. It released the Model X in 2015 (a mini SUV), the Model 3 sedan in 2017 and Model Y in 2020. It has also for several years focused on solar energy products (including storage systems and energy-generating tiles) and therefore changed its name to Tesla Inc. from Tesla Motors.

The company listed in 2010 at $17 per share. After two share splits (a 5-for-1 split in 2020 and a 3-for-1 split in 2022), these original shares are only worth $1.13.

There have been plenty of controversies over the years including Elon Musk promising to take Tesla private, claiming (wrongly) that he secured funding and then getting fined by the SEC. It had a horror year in 2022 from a share price perspective as countries began cutting EV subsidies and competition ramped up, especially in China. True, legacy car markets lost Round 1 of the battle to Tesla – but it was only Round 1. And will consumers keep taking on debt to buy vehicles in a slowing economy?

Ultimately, with a current share price of over US$260, those who have held for several years would be sitting on some good returns.

Tesla (NDQ:TSLA) share price chart, log scale (Source: TradingView)

And even in spite of a horror year from a share price perspective in 2022, it grew its sales volume by 40% from 936,458 to 1,313,851. Even though electric vehicles are getting cheaper, the average price per car still was 9% higher than the year before. And overall automotive sales rose 52% from US$44bn to US$67.2bn.

2023 has proven to be even more of the same with 1.8m sales, and another 830,000 in the first half of 2024. You can see sales have slowed down recently as inflation bites consumers as well as Tesla’s bottom line.

How much growth is expected?

This does beg the question of how much growth will come in the years ahead, not just for electric vehicles but for Tesla specifically. Because competition is indeed heating up, particularly in the Asia-Pacific.

There are varying estimates of how much the EV market will grow. But one view comes from BloombergNEF. Total electric vehicle sales will increase from 10.5m in 2022 to almost 27m in 2026. And as a percentage of total sales, they will grow from 14% to 30% in 2026. It is important to note that this is a global figure – some markets will see higher growth.

Bloomberg estimates that EVs will be more than half of all vehicle sales in China by 2026, 42% in Europe and 28% in the USA.

What about for Tesla? Consensus estimates expect 2024 will be a year of slower growth on the top line and a retreat on the bottom line. Specifically for US$99.6bn in revenue and a US$6.2bn profit, down from US$99.8bn and US$15bn the year before. CY25 is expected to be better with US$116.4bn in revenue and a US$9.2bn profit. In CY26, $136.5bn in revenue and a $13.7bn profit.

Keep in mind that this is mostly driven by estimates of vehicle sales. And there are varying estimates as to just how many vehicles it would sell. Tesla aims for 20m annually by 2030, double what Toyota (the world’s top car market) sold last year and several times ahead of what Tesla sells right now.

But is it worth it?

The target price among the 36 analysts that cover it is US$208.94, a discount to the current price. It is at a P/E multiple of 77.7x and a PEG of 5.2x for CY25. For our part, we have tried to value Tesla and it appears over-priced. Our DCF valuation is US$161.45, a discount of over 35% to the current share price. We have used consensus estimates and a WACC of 10.8%.

A relative valuation does little better. The average P/E among its peers is just 6.7x. And this generates a target price 85% discounted – just US$38 per share. Even just using the highest trading peer (BYD which trades at 21.7x), then our target price comes in at US$123.

All this evidence would suggest Tesla is overvalued right now, even with the forecasted growth.

However…there is no doubt that electric vehicles are not going anywhere and neither is Tesla. So shares still might still soar to greater heights. Of course, just as its growth to date has been achieved in the long-term, so will be its future growth. It could well retreat in the months ahead, yet be several times larger by 2030 than it is now.

So should I buy Tesla shares from Australia?

To answer the question in this article’s title: Only if you’re comfortable with short-term volatility as well as everything additionally you need to take account of when investing in international shares that you don’t when sticking with domestic shares.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips on the top ASX stocks

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

The $3m super tax is coming! If you’re invested in equities, here is how it might impact you

It seems during the next 3 years, the $3m super tax will be officially a thing. Itwas blocked by the…

Northern Star Resources (ASX:NST): The $28bn gold miner that stands above them all

Northern Star Resources (ASX:NST) is by far the largest gold company on the ASX, capped at $28bn as of May…

6 ASX stocks you forgot were listed

Here are 6 ASX stocks you forgot were listed Brisbane Broncos (ASX:BBL) No it is not a mistake. This…