The 4 Best ASX stocks for October!

![]() Nick Sundich, October 4, 2023

Nick Sundich, October 4, 2023

In this article, we look at the best ASX stocks for October.

This month we have four choices and underpinning them all are two opinions. First, interest rates will remain on hold for the foreseeable future as the RBA ponders how consumers are coping with the increased cost of living. And second, as consumers adjust to the new normal, they will return in their drove to spending priorities they have shunned for several months – at the expense of consumer discretionary stocks.

SIGN UP FOR THE STOCKS DOWN UNDER NEWSLETTER NOW!

The 4 best ASX stocks for October!

1. Domain (ASX:DHG)

Yes, this is an obvious one and we probably don’t need to explain why. It is spring selling season, so it should see an uplift in revenues as one of Australia’s top real estate classified sites.

In FY23, its revenues were flat but its profit (from continuing operations) declined by nearly 30%. Nonetheless, the company indicated that there were early signs of recovery in new ‘for sale’ listings in Sydney and Melbourne markets. And even with flat revenues in FY23, the company undertook substantial uplifts in user experience and developed new products that users have been paying a premium for.

Although the company won’t be releasing FY24 results for 12 months, the foundations could well be laid this month.

2. Dominos (ASX:DMP)

Dominos is fresh from its FY23 result. Although the result was a stinker (with a 61% fall in its NPAT), it appears FY24 might be a better result. The company has indicated sales are returning to growth and unveiled a restructuring plan that would eliminate unprofitable stores and the unprofitable Danish market. However, the stock is still well behind where it was 2 years ago and think it can make up at least some of the ground it lost over the last couple of years.

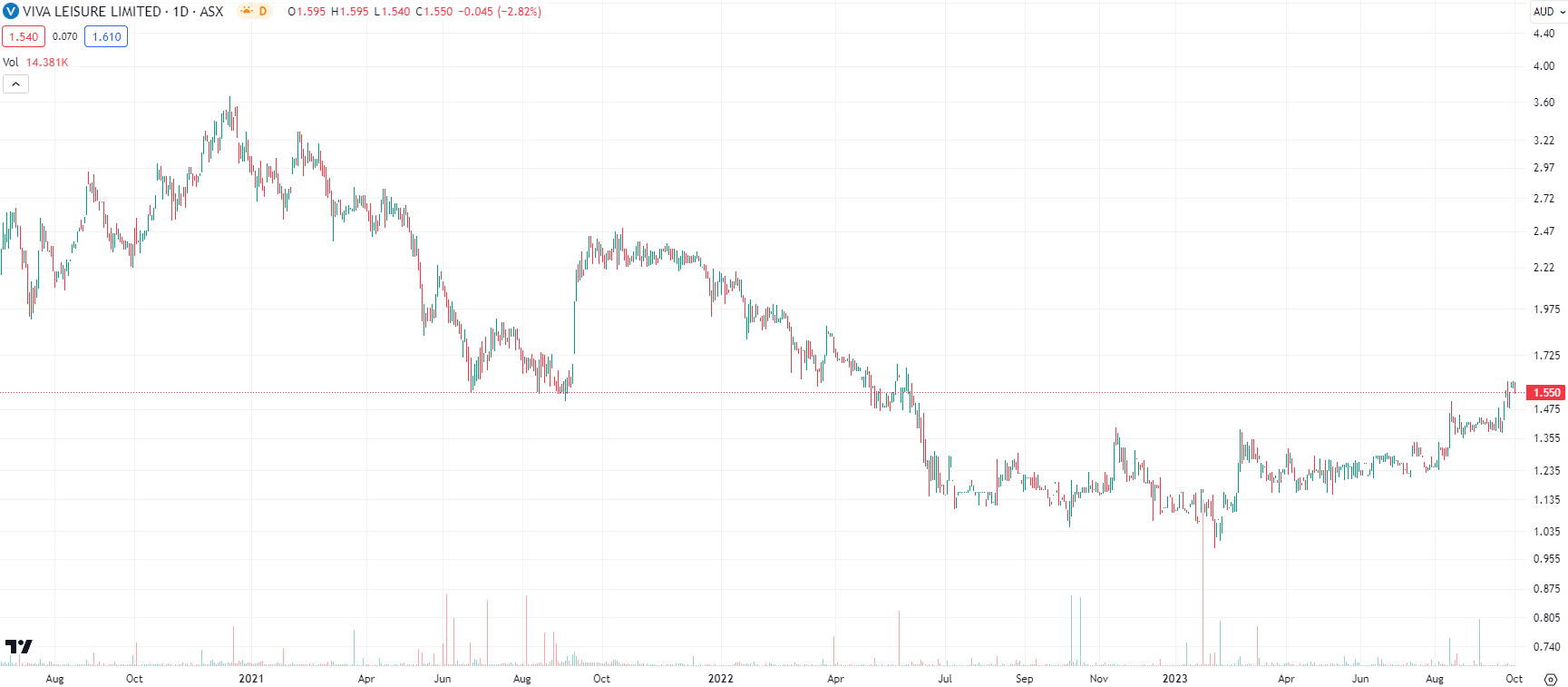

Dominos (ASX:DMP) share price chart, log scale (Source: TradingView)

Even though margins may not return to pre-COVID levels, the company appears to have reversed the trend of flatlining sales through initiatives such as its meal boxes and new marketing campaigns.

We also think the company’s embracing of delivery platforms will be a good thing. Customers have shown a willingness to pay a premium for Dominos’ Pizza compared to competing items. And it will also enable Dominos to deliver more pizzas per hour with the same labour – thereby helping margins.

3. Breville (ASX:BRG)

Breville is a premium kitchen appliances business. It is discretionary, but arguably less than others. Think about it: If you drink coffee and use a coffee machine and it beaks, you’re not going to wait to get a new one. It has a terrific long term record of sales growth and revenue expansion, it has terrific supply chains and has successfully unwound excess inventory it had during the pandemic.

It grew its revenue and profit by 4% during FY23, meeting the top end of its guidance. Granted, it has not yet given guidance for FY24 but consensus estimates expect 8% growth to $1.6bn as well as for 10% profit growth.

4. Viva Leisure (ASX:VVA)

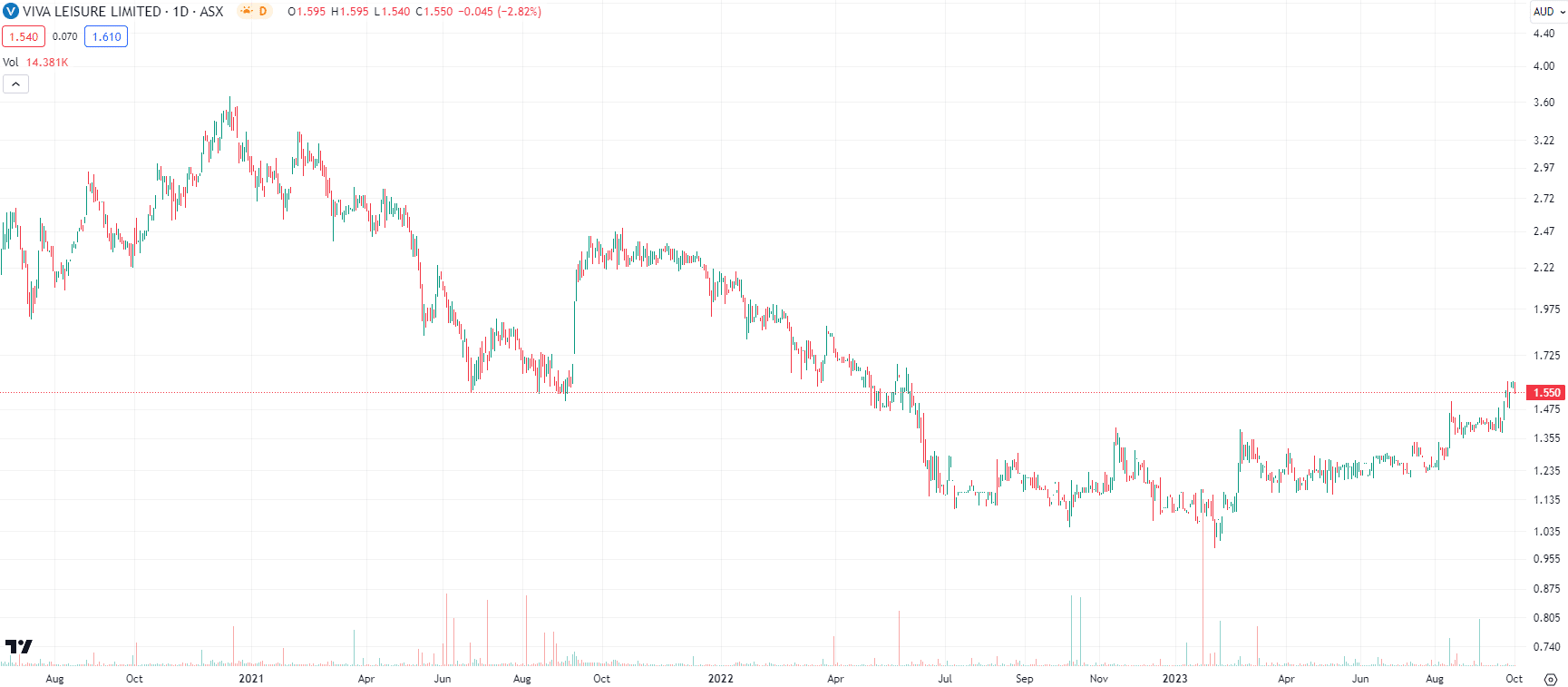

This company operates fitness centres and is the market leader in Australia. It has been an extremely unlucky company with (brief) pandemic shutdowns and a slow and steady trek back to pre-COVID levels. But technically, shares might finally be headed in the right direction. And its results were very strong with its revenue increasing 44% to $141m and its bottom line turning from a $12.1m loss to a $3.4m profit.

It also grew its membership to over 340,000 in 12 months. We’ve long liked this company but have been hesitant to declare it a top stock because it has not looked technically attractive due to weak sentiment. But we think the darkest days of the pandemic and cost of living crisis are behind it and it is set for good things going forward.

Viva Leisure (ASX:VVA) share price chart, log scale (Source: TradingView)

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips on the top ASX stocks

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

The $3m super tax is coming! If you’re invested in equities, here is how it might impact you

It seems during the next 3 years, the $3m super tax will be officially a thing. Itwas blocked by the…

Northern Star Resources (ASX:NST): The $28bn gold miner that stands above them all

Northern Star Resources (ASX:NST) is by far the largest gold company on the ASX, capped at $28bn as of May…

6 ASX stocks you forgot were listed

Here are 6 ASX stocks you forgot were listed Brisbane Broncos (ASX:BBL) No it is not a mistake. This…