Dominos Pizza Enterprises (ASX:DMP): Still in the doldrums in FY24

Nick Sundich, January 31, 2024

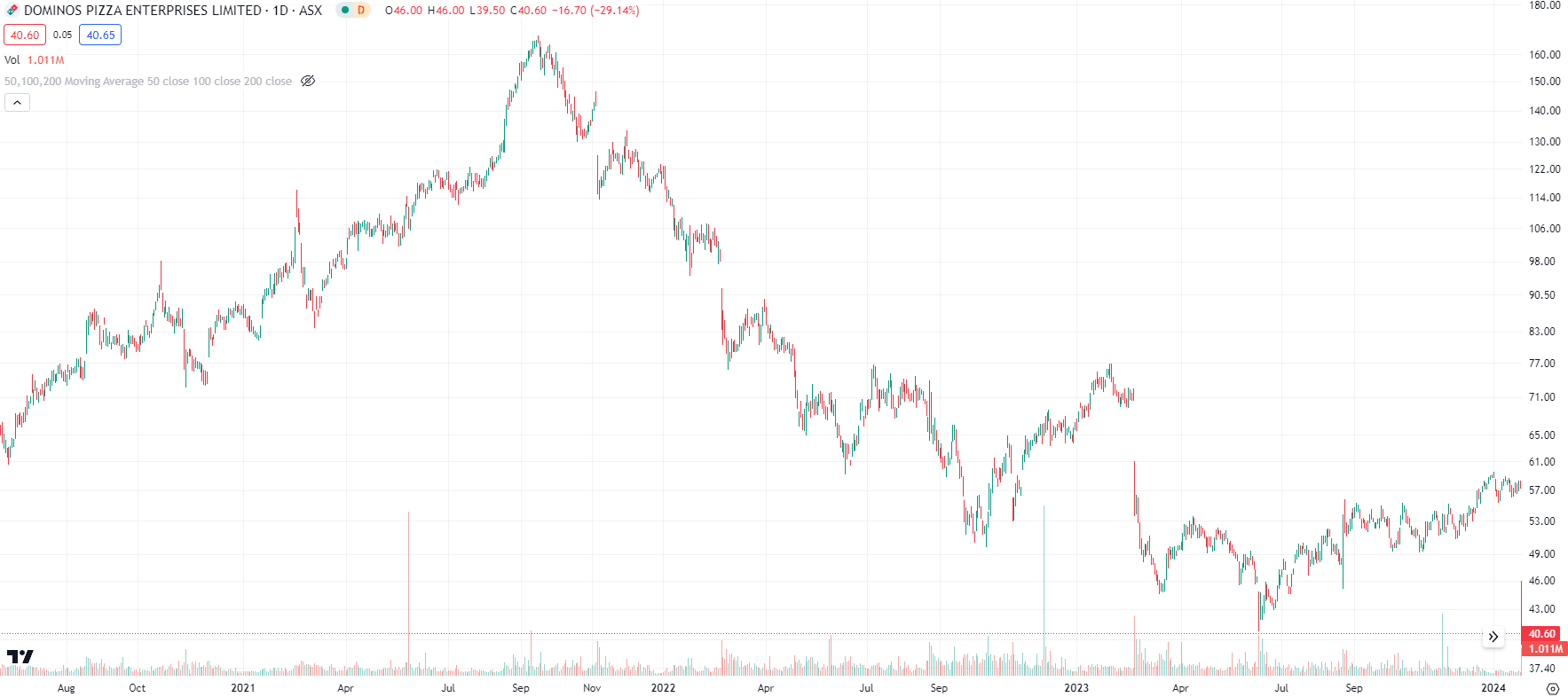

Dominos Pizza Enterprises (ASX:DMP) is back to Square one – at least it seems that way after investor reaction to last week’s trading update. Its recent results have shown that sales are recovering in some markets, but some are still lagging and investors fear margins are being sacrificed. And ultimately, its share price is barely a third of its 2021 levels.

Despite investor acknowledgement that the group is in better shape than 12 months ago, its sales in Asia have been weak and its ‘value initiatives’ aren’t exactly designed to grow margins.

Meet Dominos Pizza Enterprises

The Dominos Pizza Enterprises listed on the ASX is not the Domino’s parent company, but the master franchisor of Dominos in roughly a dozen countries: Australia, New Zealand, France, Germany, the Netherlands, Belgium, Luxembourg, Taiwan, Japan, Malaysia, Singapore and Cambodia.

Dominos franchises its stores to franchisees who run the stores and pay the day-to-day costs. Dominos earns 7% of gross sales in royalties and a further percentage (of up to 6%) towards national advertising. Dominos pays a royalty to the parent company in the USA of 2-3% of sales, subject to market conditions.

We like Dominos, and not just its pizzas

Our long-term readers would know we have a soft spot for this company. There are many things to like about it: Its long-term leadership, established market position in many jurisdictions, the propensity of fast food stocks generally to be good performers during tough economic times and the growth potential ahead of the company.

Dominos is aspiring to have 7,100 stores by 2033, more than double the current number. The bulk of this will come from Asia – particularly Japan. But the company has been through difficult times. It benefited during the pandemic as locked down consumers ordered pizza at home. The company was in perfect position to capitalise given its store network and in-house delivery system.

Inflation killed momentum

But as people remerged form their cocoons, inflation skyrocketed and Dominos saw sales flatline as people pivoted to cheaper options. High inflation on ingredients and unfavourable forex movements compounded the hit to the company’s bottom line. To say it has been an ugly couple of years for the share price is an understatement.

Dominos Pizza Enterprises (ASX:DMP) share price chart, log scale (Source: TradingView)

DMP was not the only fast food stock to experience this. But its position as a ‘premium’ product meant it suffered more than peers, such as Collins Foods (ASX:CKF) that operates KFC outlets in Australia and Europe.

The pivot to value was not just seen amongst consumers, but investors too. Investors became weary of companies with big expansion plans and turned to value stocks.

In FY23, the company grew food sales by 2% (to $4bn), but its EBIT fell by 23% ($201.7m) and its pre-tax and post-tax profits fell by over 60% ($100.6m and $69m respectively).

A better future?

Dominos took some steps to turn things around. In June 2023, the company announced it would be exiting the loss-making Danish business and closing dozens of underperforming stores. Also in the first half of CY23, it unveiled new products and ‘value options’. In particular, it launched the My Domino’s Box that offers a pizza and 2 sides for A$10 each. And after such a long time of resisting partnering with third party delivery apps, head office decided to give in and embrace them.

Amidst the poor FY23 results, the company reported network sales were 12.6% higher than 12 months ago (2.8% on a same store sales basis). Investors liked the news. However, this growth came mostly from Europe and ANZ (Australia and New Zealand). Asian sales retreated nearly 8% and the company could only say it was ‘cautiously optimistic’ about Asia returning to growth and margins recovering there.

Headwinds in Asia

On January 24, 2024, Dominos released a trading update in advance of its results for the first half of FY24 (1HY24). Overall, its Same-Store sales grew 1.3% while Network Sales grew 8.8% compared to 1HY23 and 4.9% compared to 1HY24. The bulk of this growth was in Australia where same store sales grew 9% – a result the company claims to be the best in 6 years. The company credited it to new products including the Meltzz snacking option, the Smokehouse range and the My Dominos Box. It purports to be the fastest growing pizza company in Australia given these initiatives, as well as its partnership with Uber.

Europe was flat, but Asia declined 8.9%. As a result of Asia, its pre-tax profit is forecast to be $87-90m, above 1HY23 but below 1HY24. Japan and Malaysia were flat, although Singapore recorded strong sales growth and Taiwan saw improved sales momentum.

The company told investors it was operating with a comfortable margin below its banking covenant thresholds and saw its net debt decrease by $68.7m to $770.0m. However, investors are mostly concerned about falling margins and intense competition in the fast food sector generally.

What is next?

There are 14 analysts covering the stock and they expect a 12-month target price of $56 – a discount to January 23’s price although a reasonable premium to the price right now.

For the full FY24, $2.55bn in revenue and a $128m profit, up 8%. For FY25, $2.74bn in revenue and a $190.4m profit, up 7% and 48% respectively. For FY26, $2.97bn in revenue and a $225.4m profit, up 8% and 18% respectively. Presumably analysts expect inflation to moderate from FY25 and Dominos may improve its margins form them.

Still upside, but a lot less than before

We think Dominos can recover some of the ground it lost in the last couple of years – although the A$160 per share price level it reached in 2021 won’t be seen anytime soon. At its FY23 result, we built a model show Dominos being worth A$90.50, assuming consensus estimates held up and using an 8.9% WACC. Adjusting our model for a virtually flat FY24, leaving other projected growth figures the same, cuts it back to $70.55 – still a premium, but lower than before.

We congratulate investors who made a profit off the recent share price spike and sold before the current decline, but we would urge caution against getting in at this point in time. We would like to see it surpass $60 before concluding that it is in a long-term uptrend as opposed to a short-term one.

What are the Best stocks to invest in right now?

Check our buy/sell stock tips

Blog Categories

Recent Posts

You need to keep an eye on the ex-dividend date if you want a solid payout! Here’s why

If you’re wondering what is the last day can you buy/sell a stock and still get/keep a declared dividend –…

Here are 4 of the worst red flags for stocks that you need to watch out for

Investors should always be on the look out for red flags for stocks. We’re talking about subtle signs that may appear…

ResMed (ASX:RMD): Investors who bought the dip would be satisfied, but is there any growth left in this one?

ResMed (ASX:RMD) is one of the few ASX healthcare stocks that has successfully made it in the USA. In this…